Finding Your Place in the Bayou City

Thinking about making Houston your new home? You're not alone! Houston's booming population is a testament to its affordability, job market, and vibrant culture. But before you jump into the exciting world of Houston real estate, let's talk about a crucial step: title searches.

This guide breaks down the ins and outs of property title searches in Texas, ensuring a smooth and confident homebuying experience. We'll demystify complex topics like tax jurisdictions, assignments, HOA liens, and tax mortgages. Think of this as your cheat sheet to understanding the legal side of Houston real estate.

What Does a Texas Title Search Actually Tell You?

A title search in Texas, particularly in a bustling city like Houston, is like a background check for a property. It uncovers the property's history and reveals any hidden issues that could impact your ownership. Here's a breakdown:

Tax Information:

- Multiple Taxing Entities: Houston has various taxing authorities, including the county, city, school districts, and utility districts. A thorough title search ensures all these taxes are accounted for, preventing any surprise bills down the line.

Ownership History:

- Deeds and More: The search delves into the property's past owners, uncovering any title transfers, open mortgages (deeds of trust), judgments, and liens recorded against the property.

Navigating the Maze: Understanding Title Search Costs

Here's a quick look at typical title search fees in Texas:

| Type of Search | Cost |

|---|---|

| O&E Search (Residential) | $95.95 |

| Two Owner Search (Residential) | $149.95 |

| Update Search (Residential) | $50.00 |

Important Note: These prices can change, so it's always best to confirm with a title company.

Unraveling the Complexities: Assignments, Liens, and Tax Mortgages

Assignments:

- Following the Paper Trail: When mortgages are sold or transferred between lenders, it creates an assignment. Tracking these assignments in Houston requires a keen eye, as they're often only indexed by the lender's name, making it tricky to find the relevant documents within a sea of bank names.

HOA Liens: The Power of Super Liens

-

HOAs and Your Ownership: Homeowners' Associations (HOAs) can place liens on properties for unpaid dues. The catch? In Texas, these liens can sometimes be "super liens," meaning they take priority over even pre-existing mortgages.

-

CCRs: Your HOA Guidebook: To determine if an HOA lien has super lien status, you need to carefully review the Covenants, Conditions, and Restrictions (CCRs) associated with the property.

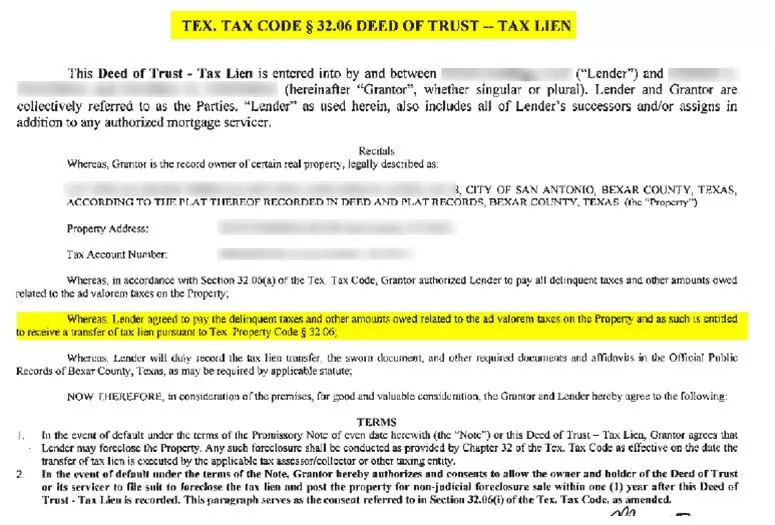

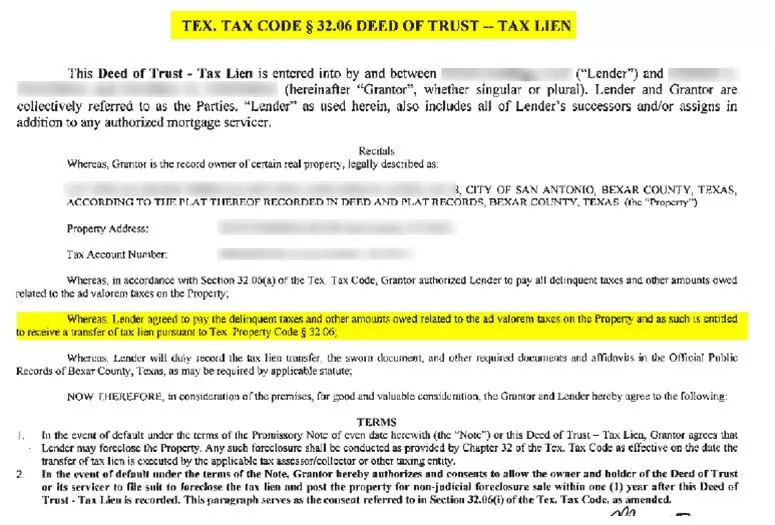

Tax Mortgages: When Taxes Take Priority

-

Understanding the Pecking Order: Generally, liens are prioritized by their recording date – the oldest lien gets paid first. However, tax mortgages in Texas throw a wrench in this system. They supersede all other liens, regardless of when they were recorded.

-

Breaking Down Tax Mortgages: A tax mortgage comes into play when a homeowner falls behind on property taxes and strikes an agreement with a third-party lender to settle the debt. This lender then gains a priority lien on the property.

Why a Pro Makes All the Difference

As you can see, Texas title searches involve a lot more than meets the eye. That's why partnering with a seasoned title company is paramount. Their expertise ensures a comprehensive search, uncovering any potential red flags and giving you peace of mind as you embark on your Houston homeownership journey.