The private real estate market is facing a triple threat: persistently high inflation, rising interest rates, and a potential economic slowdown. These factors have raised concerns about the near-term attractiveness of private real estate investments. Recent sell-offs in public real estate investment trusts (REITs) and doubts about redemption limits at non-traded REITs have added to the unease surrounding the sector.

Private real estate had a stellar performance in 2021, with near-zero interest rates and an influx of capital driving growth. Real estate managers raised $214 billion in closed-end funds and $36 billion in unlisted REITs that year. However, transactions and fund flows are now slowing as market participants reassess the implications of the changing landscape.

In this article, we aim to provide financial advisors with valuable insights into the current state of private real estate. Whether advisors oversee existing exposures or are looking to allocate client assets to this asset class, understanding the fundamentals, potential catalysts, risks, and opportunities is crucial. Let's delve into what may be causing the slowdown in private real estate activity and explore potential catalysts that could drive the market towards a new equilibrium.

Private Real Estate Valuations: Frozen in Price Discovery

While publicly traded REITs have experienced a 27% decline in the year-to-date, private real estate markets have not yet repriced to the same extent. Unlike publicly traded REITs that trade at a premium or discount to their net asset value, the values of non-traded REITs and closed-end real estate funds are determined solely by appraisals of the underlying assets. However, these appraisals are conducted less frequently than daily trades on exchanges. The lack of comparable sales and current economic uncertainty makes valuations challenging.

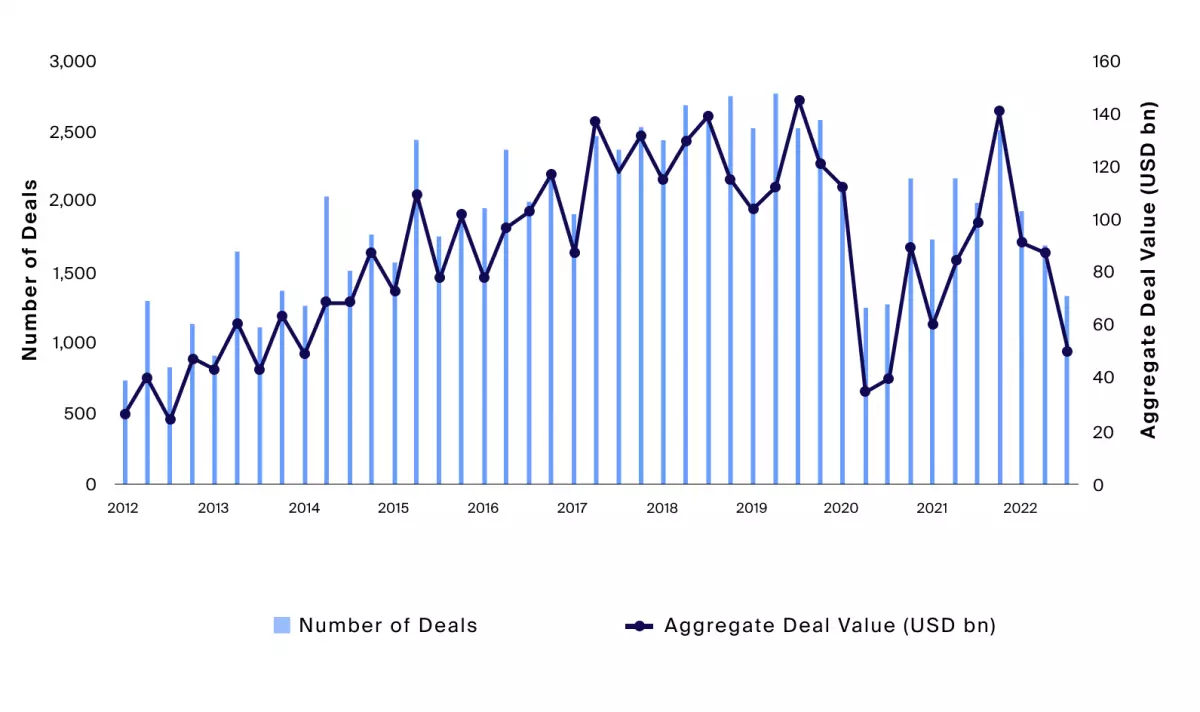

Private real estate transactions, by value and deal count, have fallen, nearing COVID-era lows as of Q3 2022.

Private real estate transactions, by value and deal count, have fallen, nearing COVID-era lows as of Q3 2022.

The private real estate market has entered a phase of price discovery due to the regime of higher interest rates and economic uncertainty. Transactions have declined to levels similar to the COVID-era lows. Sellers are hesitant to lower valuations, awaiting greater economic certainty and better pricing in the future. On the other hand, buyers are reluctant to accept stale valuations that may not account for higher debt-financing costs or potential income declines in a slower-growth or recessionary scenario. As a result, a wide bid-ask spread has gripped the market, causing global transactions to drop by 30% YoY in Q3 2022.

A lack of attractive financing options has also hindered transaction activity. The cost of debt financing has exceeded the capitalization rate in some instances, deteriorating short-term levered internal rates of return. Negative leverage tends to drive bid prices lower, widening the bid-ask spread and further stalling the market.

A broad measure across real estate sectors indicates a near-zero to negative spread between cap rates and debt costs in the latter half of 2022.

A broad measure across real estate sectors indicates a near-zero to negative spread between cap rates and debt costs in the latter half of 2022.

The lack of transaction activity makes it challenging to predict the extent of price corrections. Negative leverage may persist until interest rates decrease, which is not expected in the near future.

Potential Catalyst 1: Liquidity Needs, Negative Sentiment, and the Denominator Effect

Asian investors seeking liquidity reportedly drove initial waves of redemption requests from non-listed REITs. With margin calls in their domestic equity markets, these investors turned to the private real estate portion of their portfolios. The concern over redemptions could further erode investors' confidence in certain funds and the broader market.

To meet redemption requests, open-end private real estate funds may be forced to sell assets in an illiquid market, pushing down valuations across the asset class. This could trigger more selling, leading to a ripple effect. The denominator effect, caused by overallocation to private real estate, may also contribute to redemptions and slow fund flows.

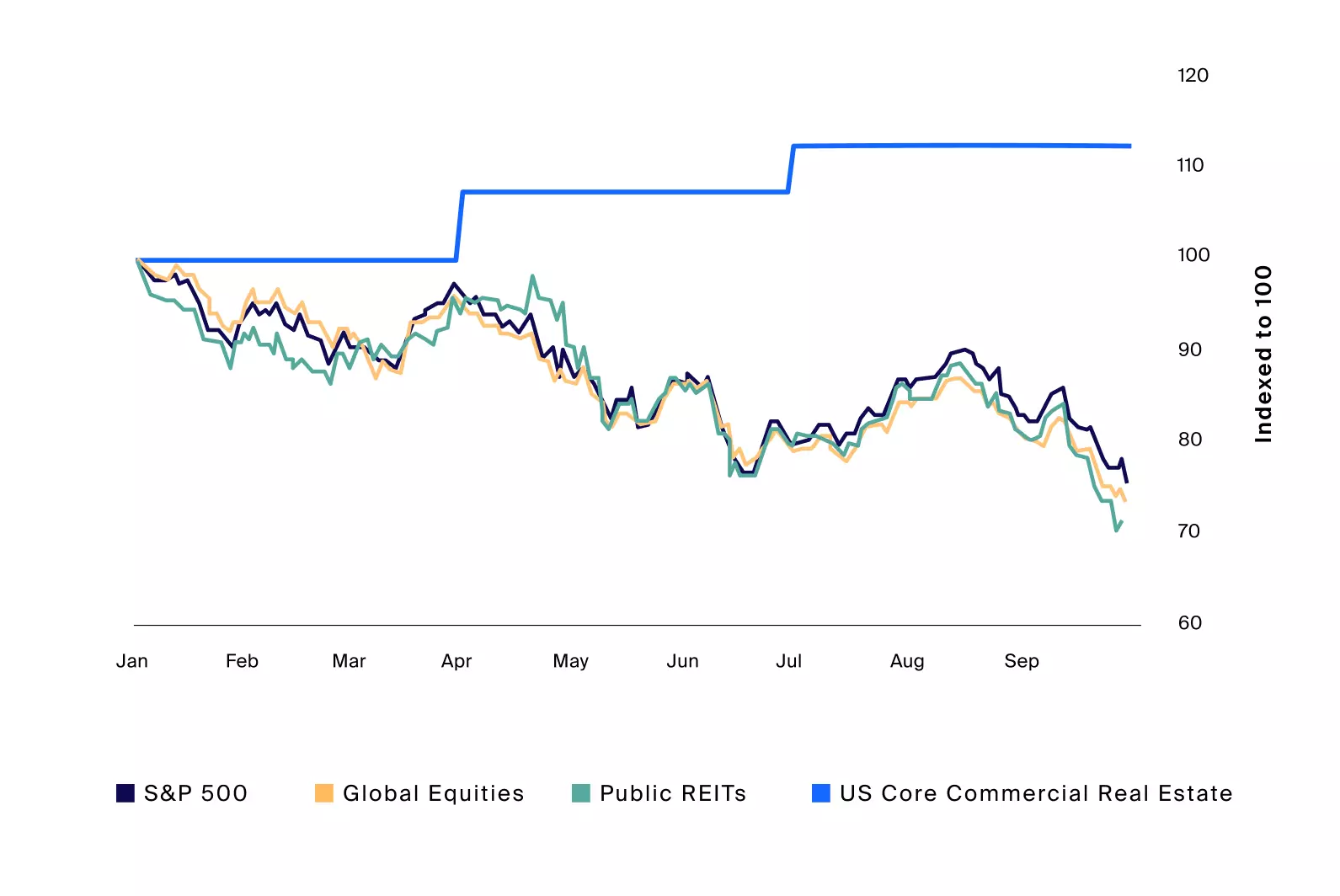

Private real estate outperformance YTD contributed to overallocation in the asset class, which may spur redemptions, slow fund flows, and commitments.

Private real estate outperformance YTD contributed to overallocation in the asset class, which may spur redemptions, slow fund flows, and commitments.

Semi-liquid private real estate vehicles may become a desired source of cash for investors seeking to rebalance their portfolios. However, redemptions in these investments may not provide the same level of liquidity as in the past.

Restrictions on redemptions protect the broader investor base and prevent fire-selling in illiquid assets. Well-capitalized funds like BREIT and SREIT are equipped to meet redemptions without selling assets well into 2024.

Potential Catalyst 2: Impending Debt Maturities and Negative Leverage

Upcoming commercial real estate debt maturities may force property owners to sell their assets. Refinancing options have become less attractive, and liquidity issues may lead to increased loan delinquencies. However, the volume of maturities is not comparable to the "wall of maturities" that contributed to the Global Financial Crisis. Borrowers generally believe that property values will not fall below their loan balances, and most maturing loans are post-crisis with lower leverage.

Property owners struggling with costs may choose to sell rather than take on higher-priced debt. Lenders are tightening their leverage and coverage ratio protections, making it harder to secure financing.

Potential Catalyst 3: Macroeconomic Factors and Operating Fundamentals

Fundamentals in private real estate assets have remained relatively strong across sectors. Industrial real estate vacancies remain at all-time lows, and newly built properties are leasing quickly. Following federal stimulus, personal consumption is at record levels, supporting the retail sector. Office leasing has returned to nearly 80% of long-term averages, and vacancies have decreased. While rent growth in multi-family properties has slowed, certain property types still offer long-term growth potential.

Where Risk and Opportunity Lie in Private Real Estate

While an immediate sharp downturn in valuations seems unlikely, advisors should exercise caution and be selective when seeking exposure to private real estate. It's essential to consider the manager's track record, access to properties, and resources for managing and improving portfolios. Concentration risks, liquidity considerations, and the illiquid nature of real estate investments should also be taken into account.

Opportunities may arise in private real estate debt, where private credit funds can step in as debt capital providers. The scarcity of debt financing may allow lenders to negotiate more favorable terms. Drawdown funds with available capital may offer lower entry points, while properties in core strategies with inflation adjustments or shorter-term leases could provide attractive yield opportunities. Advisors with longer time horizons may choose to maintain existing exposures to benefit from potential long-term growth drivers.

Private real estate investments continue to serve as an important part of a long-term strategic asset allocation. These investments offer diversification, lower volatility, and potential tax benefits. However, a long-term view is necessary given the illiquid nature of the asset class.

In conclusion, private real estate valuations are in transition due to various catalysts and economic factors. Financial advisors should carefully assess the risks and opportunities to guide their clients in navigating the evolving market. While challenges lie ahead, well-informed investment decisions can lead to long-term success in private real estate.