The Portland housing market is a topic of great interest for both homebuyers and real estate professionals. In August 2023, the Portland Metropolitan Association of Realtors® (PMAR) released its comprehensive housing market report, revealing notable changes in key indicators compared to the previous year. Let's delve into the details and gain a deeper understanding of the market dynamics.

Portland Housing Market Update

Portland, known for its stunning landscapes, vibrant culture, and booming real estate market, experienced several shifts in supply, demand, and pricing. Here are some key findings from the PMAR report:

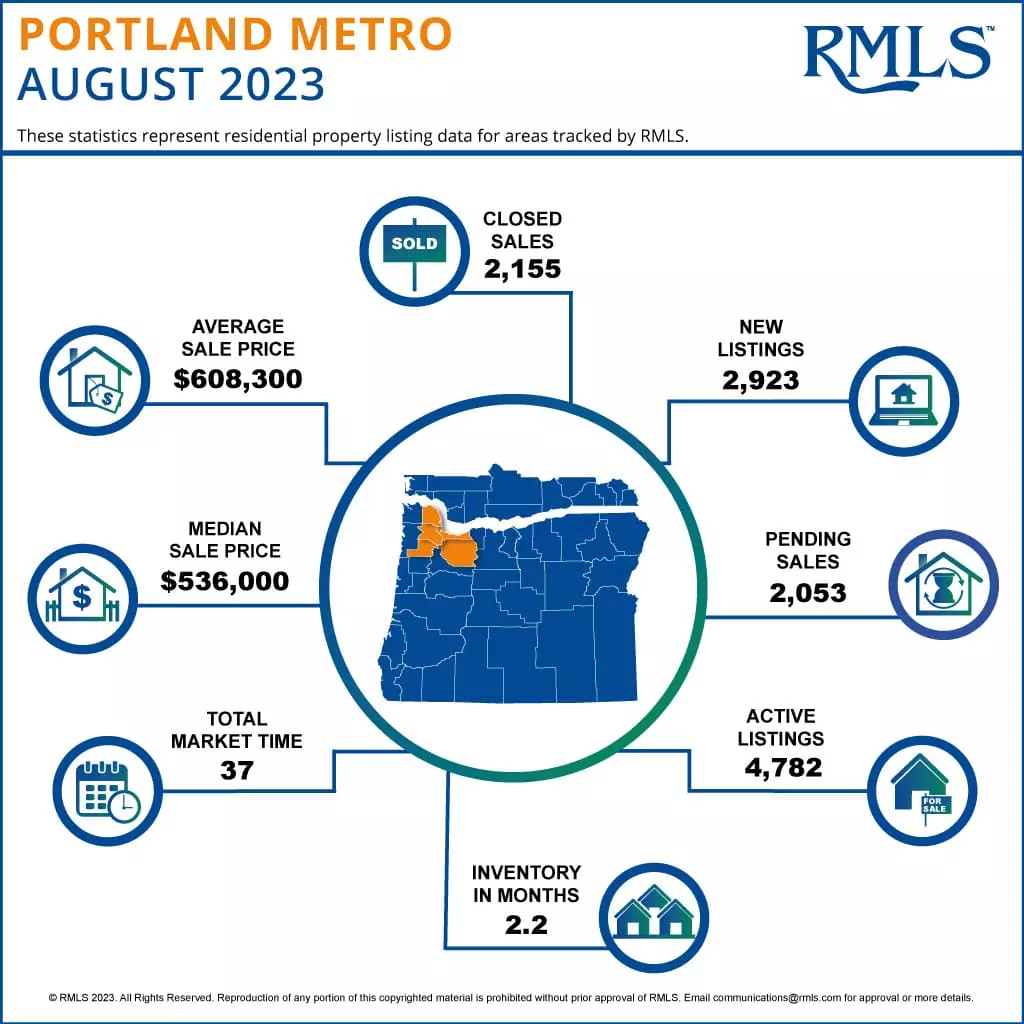

- The median sales price decreased to $536,000 from the previous year's $548,500.

- The average sales price also saw a decrease from $607,700 to $608,300.

- Closed sales dropped from 2,581 to 2,155.

- Pending sales decreased from 2,530 to 2,053.

- New listings declined from 3,209 to 2,923.

- Months of inventory increased from 1.8 to 2.2, indicating a shift towards a more favorable position for buyers.

- The average number of days on the market increased from 28 to 37.

Sales Prices

In August 2023, the median sales price in Portland was $536,000, showing a decrease from the previous year. Similarly, the average sales price decreased slightly to $608,300.

Sales and Pending Transactions

The number of closed sales in August 2023 dropped to 2,155 from 2,581 in the previous year. Additionally, pending sales decreased to 2,053 from 2,530, indicating a shift in buyer activity.

New Listings and Inventory

August 2023 saw a decrease in new listings, with 2,923 listings compared to 3,209 in the previous year. The months of inventory increased to 2.2 from 1.8, suggesting a more balanced market that favors buyers.

Days on the Market

Properties in Portland spent an average of 37 days on the market in August 2023, compared to 28 days in the previous year. This indicates a slightly longer selling period for properties.

Is it a good time to buy a house in Portland, Oregon?

Given the price drops observed in August 2023, it could be considered a relatively good time to buy a house in Portland. The lower prices compared to the previous year present opportunities for buyers to make purchases at a more favorable cost. However, individual circumstances, financial considerations, and market dynamics should be carefully evaluated before making a decision.

Market Dynamics: Buyer vs. Seller

With the increase in months of inventory to 2.2, the market is leaning slightly towards a more balanced or buyer-friendly situation compared to before. A lower months of inventory suggests a seller's market, where demand exceeds supply, potentially leading to higher prices. However, the increase in inventory might indicate a shift towards a more neutral market, giving buyers more options and potentially less pressure to compete.

Courtesy of Pmar.org

Courtesy of Pmar.org

Portland Housing Market Forecast 2023-2024

To gain insights into the current state and potential future of the Portland housing market, we turn to the latest data provided by Zillow. Here are the key takeaways and the 1-year forecast for the Portland-Vancouver-Hillsboro area:

Current Market Snapshot

As of July 31, 2023, the average home value in the Portland-Vancouver-Hillsboro area stands at $545,990, representing a 3.3% decrease over the past year. Homes in this area are going pending in approximately 9 days, indicating a fast-paced market with high demand.

Market Forecast

Zillow provides a 1-year market forecast for July 31, 2023, suggesting a growth rate of 3.5%. This forecast indicates optimism for the Portland housing market in the coming year, with the potential for home values to appreciate.

Market Metrics

Several key market metrics offer further insights into the current dynamics of the Portland housing market:

- Median Sale to List Ratio: The median sale to list ratio is reported as 1.000, suggesting that, on average, homes are selling very close to their list prices.

- Percent of Sales Over List Price: Approximately 47.8% of sales are going over the list price, indicating strong competition among buyers and potentially competitive bidding.

- Percent of Sales Under List Price: About 31.8% of sales are occurring under the list price, offering opportunities for buyers to find properties at a potentially lower cost.

- Median Days to Pending: The median time for a property to go pending is 9 days, highlighting the quick pace of the market and the high demand for homes.

Addressing the Question: Are Home Prices Dropping in Portland, Oregon?

While there has been a recent decline of 3.3% in average home values, the market forecast suggests a 3.5% growth rate in the coming year. These figures indicate that while there may have been a recent decline, the market is anticipated to rebound and show positive growth in the near future.

It's important to remember that real estate markets often experience fluctuations, and a single year's data may not provide a complete picture of long-term trends. The 1-year forecast offers a more optimistic outlook for the Portland housing market.

The Portland housing market is dynamic and competitive, with metrics suggesting both opportunities and challenges for buyers and sellers. Staying informed and consulting with a local real estate expert who understands the nuances of the Portland market can help individuals make well-informed decisions. The market forecast indicates that while there may have been recent declines, positive growth is on the horizon, making it an intriguing time to engage with the Portland real estate market.

Source: Zillow

Source: Zillow

Portland Real Estate Investment: Should You Invest in Portland?

Should you consider Portland real estate investment? The city offers a promising real estate investment landscape, with its strong economy, population growth, and rental market making it an attractive option for investors looking for potential long-term appreciation and cash flow. Here's why investing in Portland real estate can be lucrative:

Steady Population Growth

Portland's population has been consistently increasing, driving demand for housing and rental properties. This demand creates opportunities for investors to generate rental income and capitalize on appreciation.

Thriving Job Market

Portland is home to a diverse range of industries, including technology, healthcare, education, and manufacturing. The presence of major employers and a growing entrepreneurial ecosystem contribute to a stable economy, ensuring a steady stream of potential tenants and buyers for investment properties.

Strong Rental Market

With a high percentage of renters in the city, there is a constant demand for rental properties in Portland. Rental rates have been steadily increasing, providing investors with the potential for consistent cash flow and attractive returns on their investments.

Sustainability and Green Initiatives

Portland's commitment to sustainability and green initiatives has attracted environmentally conscious tenants and buyers, enhancing the long-term value of real estate investments in the city.

However, like any investment, there are considerations and risks to keep in mind. The Portland real estate market has experienced price fluctuations and can be competitive, especially in desirable neighborhoods. Conducting thorough market research, analyzing property values, and working with experienced local professionals are essential steps to mitigate risks and make informed investment decisions.

Portland's Attractiveness to Millennials

The Portland real estate market is particularly attractive to millennials, not just students, but also young adults looking to start families. The city's family-friendly and cultural environment, combined with relatively affordable housing compared to places like California, make it an appealing choice.

Limited Room for Growth

While the lack of room for growth in Portland may limit development opportunities, it also contributes to higher rental rates and property values. The scarcity of land drives demand and presents potential investment opportunities.

Relatively Affordable Housing Market

Compared to other major cities on the West Coast, Portland offers a more accessible and affordable housing market. Lower median home prices combined with a strong job market make it an attractive destination for both homeowners and investors.

Massive Student Market

The presence of numerous universities in the Portland area creates a significant rental market for students. The student population and demand for rental properties contribute to the overall growth and stability of the housing market.

Business Friendliness

Oregon's business-friendly environment, lower cost of living, and favorable tax rates make it an attractive destination for businesses and employees. As more companies choose Portland as their base, it drives economic growth and creates additional opportunities for real estate investors.

Relatively Landlord-Friendly for Small Landlords

While Portland has tenant-friendly regulations for large apartment buildings, small landlords who own a single property face fewer restrictions. This flexibility allows smaller landlords to adjust rental rates according to market demand.

Portland Investment Properties: Where to Invest?

When considering investment properties in Portland, it's essential to focus on neighborhoods with high population density, employment growth, and a strong demand for housing. Some popular neighborhoods in Portland include Bethany, Multnomah Village, St. Johns, and Laurelhurst.

Additionally, it is important to consider factors such as overall cost of living, rent-to-income ratio, and median home value to income ratio to identify neighborhoods that offer good investment potential.

Investing wisely in Portland's real estate market can provide positive cash flow and potential profits. It's recommended to consult with local real estate agents who can provide insights into neighborhoods with affordable entry prices, high appreciation forecasts, and growing rent prices.

Conclusion

The Portland housing market offers opportunities and challenges for buyers and investors alike. With its steady population growth, thriving job market, and strong rental demand, Portland presents an attractive investment landscape. However, careful research, analysis, and working with experienced professionals are essential to mitigate risks and make informed decisions.

Note: This article is for informational purposes only and does not constitute financial or real estate advice. It is always recommended to seek professional guidance when making investment decisions.

References: PMAR, OregonLive, Realestateagentpdx, RentCafe, Realtor, Neighborhoodscout, Tax-Rates, Entrepreneur, CNBC, Forbes, RealtyTrac