Image Source: Luis Alvarez

Image Source: Luis Alvarez

Dear subscribers,

In recent months, I've been vocal about my investment in Office REITs, particularly Highwoods (HIW), Kilroy (KRC), and Boston Properties (BXP). Today, I am thrilled to share that these investments have yielded positive returns, reflecting the changing landscape of these REITs. Many investors have taken notice and believe that now is the opportune time to invest in office REITs. But is it really?

Office REITs - The Undervalued Opportunity

I have written extensively about these companies throughout 2023, emphasizing their worthiness as investments. Despite the downturn in office spaces, it would be a mistake to dismiss all office property companies as unfavorable. Recent market developments have shown that the perceived undervaluation of these companies was largely due to rate risk concerns.

However, it is important to note that the fundamental risk to these companies remains largely unchanged. Their company fundamentals, credit ratings, dividends, and management have not undergone any significant alterations. The only thing that has changed is the market perception. As a result, many of these office REITs, where I have achieved yields of over 7.5% on cost, are now yielding less than 5.5-6%.

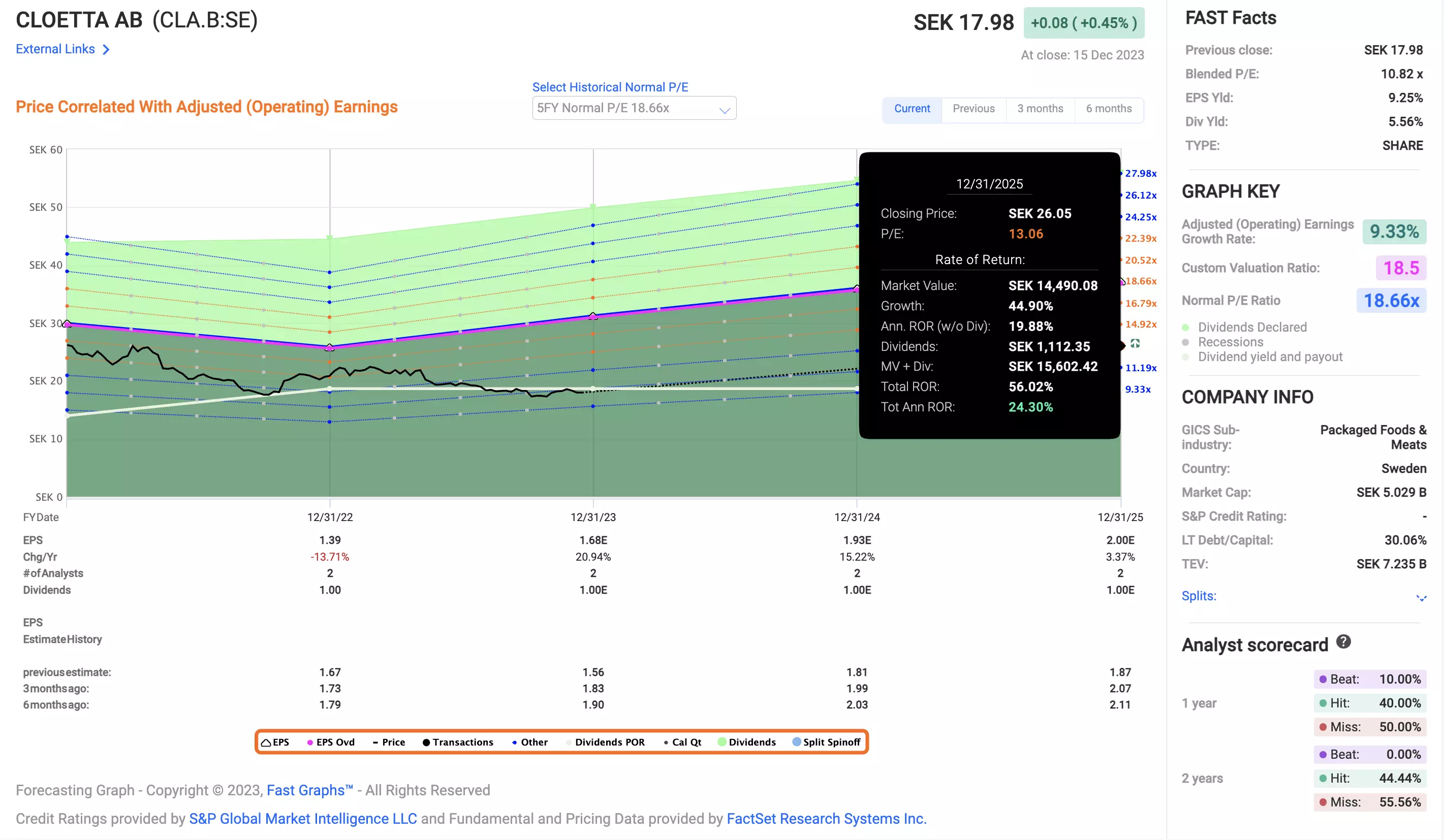

While this may still be appealing, there are other companies with even better upside potential. Take, for example, Cloetta, a Swedish candy and food company with a higher yield. When considering investment options, valuation is the key factor to consider. The recent surge in office REITs has pushed their valuations to levels where the potential returns are no longer as lucrative as before.

Valuation for Office REITs - A Time for Caution

While I still believe there is appeal in investing in these office REITs, it is essential to exercise caution when evaluating their valuations. The rates of return they once offered have significantly diminished in a matter of weeks. For instance, Boston Properties, the office REIT I cover here, is expected to grow its FFO, albeit at a modest rate of 0.5% per year. This has pushed its valuation to close to 10x P/FFO, requiring an estimate of 12.5x to achieve a 17% annual return.

The key takeaway here is that these returns, although still favorable, are nowhere near as enticing as they were just a few weeks ago. As an investor, it is crucial to recognize when sectors or subsectors trade down irrationally for extended periods, presenting opportune moments to invest. This is why I am always on the lookout for fundamentally sound businesses that offer attractive valuations.

Be Mindful of Valuation

As we approach 2024, it is important to approach investments with a realistic mindset. While we may continue to witness positive market developments, it is prudent to exercise caution and anticipate a more sobering investment landscape. My focus for 2024 will revolve around identifying the most qualitative and undervalued equities, which have the potential to outperform even in sub-par market conditions.

If you missed the opportunity to invest in these four office REITs during their trough valuations, I hope that my future articles in 2023 and beyond will provide you with quality investment ideas for the short, medium, or long term. I always provide honest assessments and make it clear where I see the risk-reward ratio.

For now, I still consider these office REITs as "BUY" options. However, it is crucial to acknowledge that their appeal has significantly shifted in recent weeks. Exercise caution and evaluate their valuations carefully to make informed investment decisions.

Image Source: F.A.S:T Graphs

Image Source: F.A.S:T Graphs