All sources have been thoroughly verified for credibility. Furthermore, an industry specialist has reviewed and approved the final article.

Everything you need to know is included in our Costa Rica Property Pack.

Are you considering buying real estate in the land of Pura Vida? Are you pondering if it's the right time to buy or if you should wait until next year?

Market timing is a subject where everyone has their own take. Your friend who is from San José might advise you to buy property now, whereas your relative who actually lives in Costa Rica may suggest waiting for more favorable market conditions.

At TheLatinvestor, when we create articles or update our pack of documents related to the real estate market in Costa Rica, we base our analyses on factual data and statistics rather than opinions, minimizing biases and uncertainties.

After thoroughly analyzing official reports and statistics available on government websites, we have gathered solid information in a database. Here are our findings that can assist you in determining whether it's the right time to invest in real estate in Costa Rica.

Enjoy the article!

How is the Property Market in Costa Rica Now?

Costa Rica Remains, Today, a Very Stable Country

Positive

If you want to invest in real estate, prioritize stability as it fosters steady rental income and potential capital gains. It is an information you need as a foreigner looking to buy real estate in Costa Rica.

You most likely already know that Costa Rica is widely known for its remarkable stability. The last Fragile State Index reported for this country is 41, which is an impressive number.

Costa Rica has a strong democratic government, and the country has been able to maintain strong economic growth and low levels of poverty and inequality. This has enabled Costa Rica to remain a very stable country despite its small size and geographic location.

Stability check done. Now, it's time to review the economic forecast.

Costa Rica is Poised for Strong Growth

Positive

Before diving into real estate investment, the initial step is to assess the economic strength of the country.

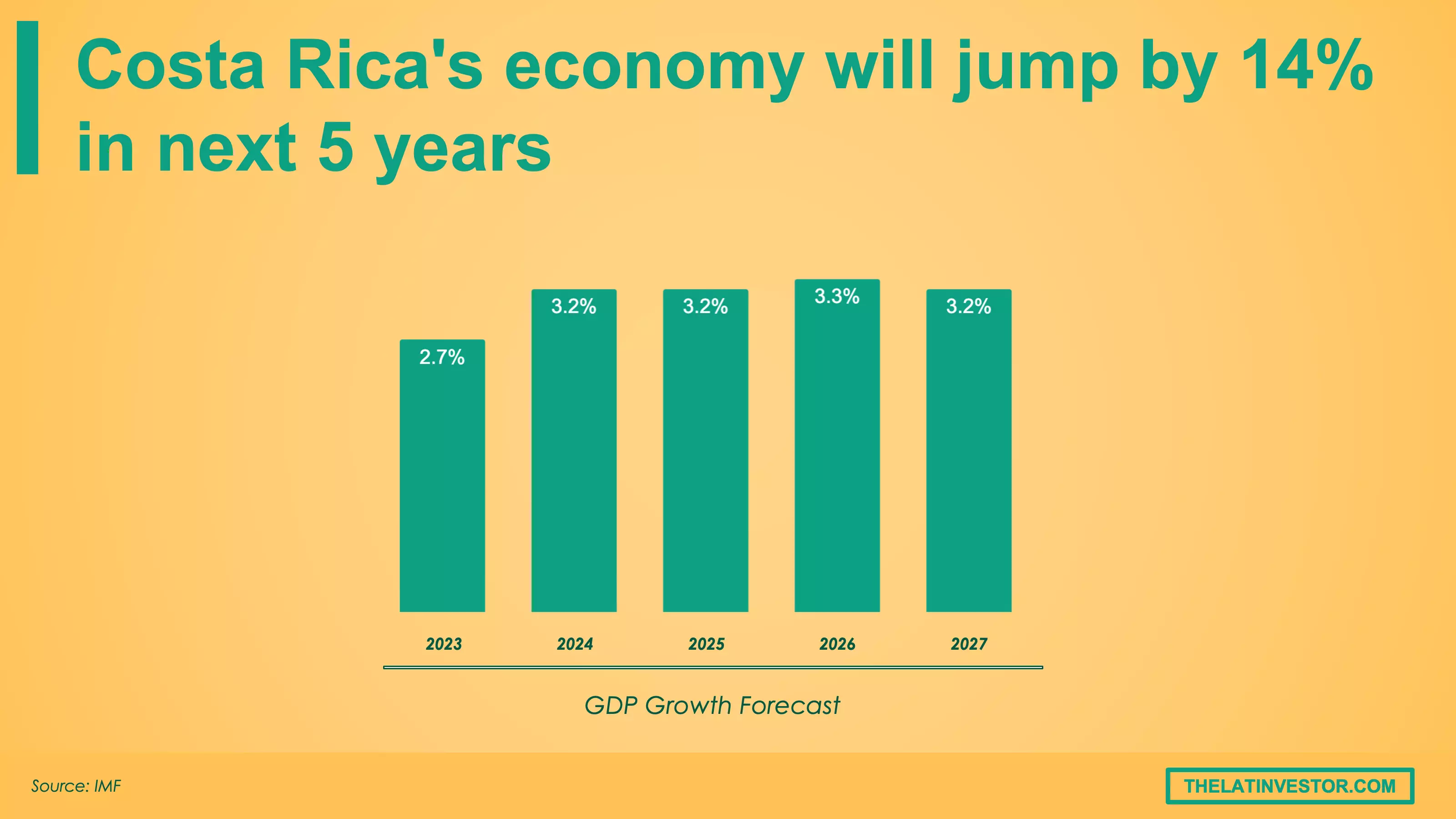

As indicated by IMF projections, Costa Rica will, in 2023, grow by 2.7%, which indicates the country is heading in the right direction. Regarding 2024, the consensus estimate is 3.2%.

Besides that, the economy will keep growing since Costa Rica's economy is expected to increase by 14.1% during the next 5 years, resulting in an average GDP growth rate of 2.8%.

The expected sustainable growth rate in Costa Rica is a good thing for someone who wants to invest in real estate because it indicates that the country has a stable and growing economy, which makes it a good place to invest in real estate and other investments. Additionally, it suggests that the value of real estate investments in Costa Rica is likely to increase over time.

That said, GDP growth is just one piece of the puzzle!

Costa Rica's Population is Getting Richer

Positive

Population growth and GDP per capita are crucial factors to think about when buying real estate because:

- A growing population means more people needing homes.

- A higher GDP per person means people have more money to spend on housing (which can lead to increased property value over time).

In Costa Rica, the average GDP per capita has changed by 7.2% over the last 5 years. It's a solid number.

This means that, if you purchase a tropical retreat in Manuel Antonio and rent it out, you will find that each year, you'll attract more tenants with sufficient funds to cover the rent.

If you're considering purchasing and renting it out, this trend is a good thing. Then, the demand for rentals is likely to go up in Costa Rican cities, such as San José, Jacó, or Tamarindo in 2024.

Rental Yields are Really Attractive in Costa Rica

Positive

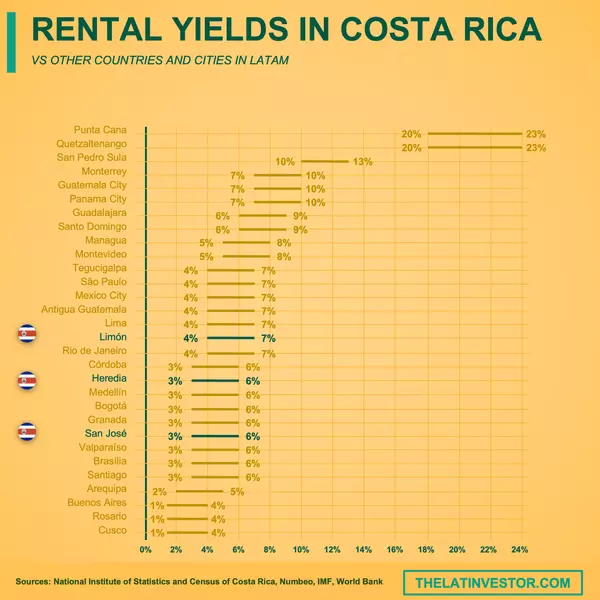

If you want to know if a property investment can be a wise financial decision, look at the expected rental yields.

Rental yield is the amount of money you can make from renting out a property, relative to the property's value.

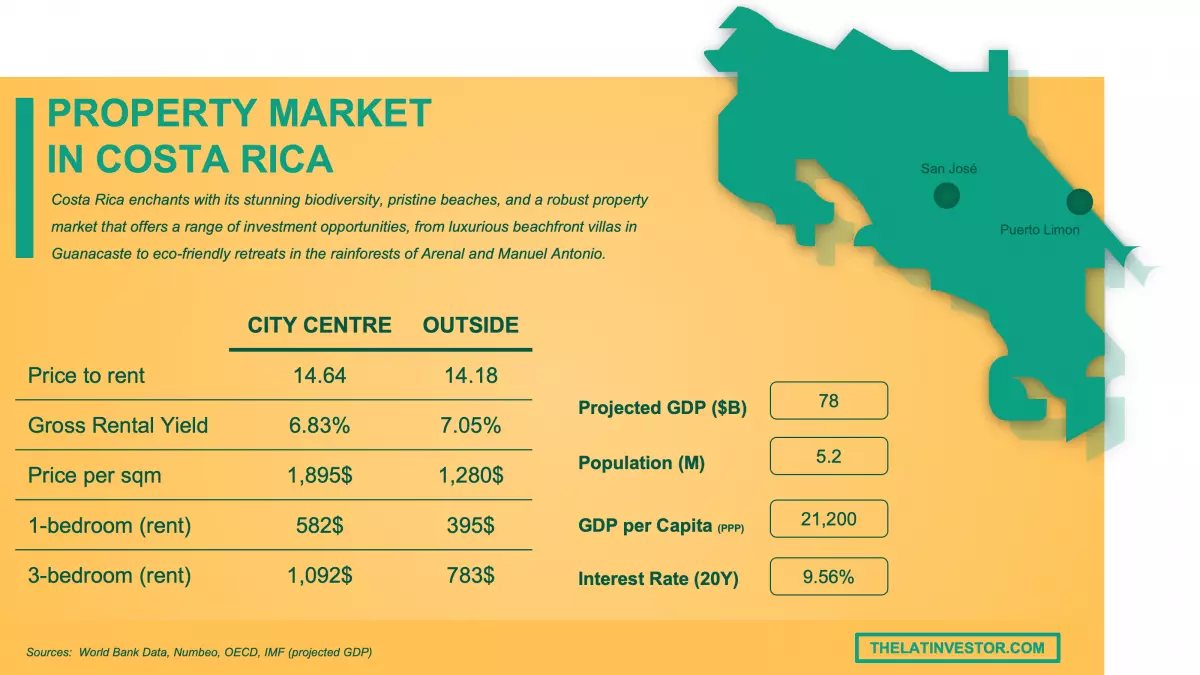

According to Numbeo, rental properties in Costa Rica offer gross rental yields ranging from 5.3% and 8.0%. You can find a more detailed analysis (by property and areas) in our pack of documents related to the real estate market in Costa Rica.

Yields like these are rare to come by.

In Costa Rica, Inflation is Projected to Remain Moderate

Neutral

Inflation is the persistent devaluation of money.

It's when your favorite cup of Costa Rican coffee costs 2,500 Costa Rican colones instead of 2,000 Costa Rican colones a couple of years ago.

If you're considering investing in a property, high inflation can bring you several advantages:

- Property values tend to increase over time, leading to potential capital appreciation.

- Inflation can result in higher rental rates, thereby increasing the cash flow from the property.

- Inflation reduces the real value of debt, making mortgage payments more affordable.

- Real estate can act as a hedge against inflation, preserving the value of the investment.

- Diversifying into real estate provides stability during inflationary periods.

In line with IMF predictions, over the next 5 years, Costa Rica will have an inflation rate of 14.7%, which gives us an average yearly increase of 2.9%.

It means that Costa Rica might experience inflation soon, so it's worth thinking about buying property now.

Costa Rica's Currency is Currently High

Negative

If you're a foreign investor, this is for you.

The Costa Rican Colon (CRC) is significantly valued: the currency is currently 11-15% over the past five years.

As a foreign investor, it is important to consider the current exchange rate when investing in Costa Rica. If the currency is currently high, it may be more expensive to purchase property in Costa Rica. However, if you are able to hold the property for a long period of time, the appreciation in value may outweigh the effect of the currency exchange.

Is it a Good Time to Buy Real Estate in Costa Rica Then?

Time to conclude!

2024 presents a favorable opportunity to invest in property in Costa Rica due to the country's exceptional stability. With a history of political peace and strong institutions, Costa Rica offers a secure environment for property investments, minimizing potential risks associated with uncertainty. This stability enhances the confidence of investors and ensures the long-term value of real estate holdings.

Moreover, Costa Rica's economic prospects position it for robust growth in the coming years. The country has been actively fostering a conducive business environment, attracting foreign investments and promoting various sectors such as technology, eco-tourism, and agriculture. This anticipated growth bodes well for property values, as increased economic activity often translates into higher demand for real estate, potentially leading to capital appreciation.

The incremental rise in the country's population's wealth also contributes to the attractiveness of property investment. As the population experiences a gradual increase in income, there is a potential surge in demand for housing, both for personal use and rental purposes. This demand-driven market can provide real estate investors with opportunities for rental income and property value appreciation.

While the projected moderate inflation in Costa Rica might not be an overly exciting signal, it is nonetheless a neutral factor that adds stability to the investment climate. Predictable inflation rates can help investors plan for their long-term property investments without excessive concerns about eroding returns.

On the flip side, the relatively high value of Costa Rica's currency can be viewed as a negative signal for property investment. A stronger currency might make the initial investment costlier for foreign investors and impact the competitiveness of the country's exports. However, it's worth considering that this factor could potentially lead to more favorable negotiation terms when purchasing property, balancing out the currency-related challenges.

In conclusion, 2024 presents a compelling window for property investment in Costa Rica due to its stability, growth prospects, improving population wealth, attractive rental yields, and a neutral inflation outlook. While the strong currency could pose challenges, the overall investment climate seems promising, making it an opportune time to consider real estate ventures in this vibrant Central American nation.

We genuinely hope this article has provided you with valuable insights and information. If you need to know more, you can check our our pack of documents related to the real estate market in Costa Rica.

This article is for informational purposes only and should not be considered financial advice. Readers are advised to consult with a qualified professional before making any investment decisions. We do not assume any liability for actions taken based on the information provided.