If you're considering buying a house, you may be questioning whether it's a good time to take the plunge or if it's wise to wait. While there are pros and cons to both options, several factors can influence your decision. In this article, we will explore the components of the Fannie Mae Home Purchase Sentiment Index (HPSI) and delve into the implications for the housing market.

Understanding the Current Housing Climate

The decision to buy a house is not one to be taken lightly. It involves careful consideration of both personal financial stability and the broader economic landscape. The HPSI provides valuable insights into consumer sentiment regarding the housing market.

According to the October report, overall sentiment remained largely flat. While there were positive indicators such as improved job security and household income, consumer frustration towards housing unaffordability and concerns about an economy battling inflation continued to impact sentiment.

The October HPSI increased by 0.4 points to reach 64.9, representing an 8.2-point increase compared to the same period last year. However, a significant highlight is the record-high 85% of consumers who indicated that it's currently a "bad time" to buy a home. The primary reasons cited for this sentiment are high home prices and elevated mortgage rates.

Consumer Perceptions: Good Time to Buy vs. Good Time to Sell

- The percentage of respondents who believe it is a good time to buy a home decreased from 16% to 15%.

- Conversely, the percentage of those who think it is a bad time to buy increased from 84% to 85%.

- Meanwhile, the perception of whether it's a good or bad time to sell remained relatively stable, with 63% considering it a good time and 37% a bad time.

Home Price and Mortgage Rate Expectations

- The percentage of respondents expecting home prices to go up in the next 12 months decreased from 42% to 40%.

- Concerns about mortgage rates saw a shift, with 47% anticipating an increase, up from 46%.

Job Loss Concerns and Household Income

- The percentage of respondents concerned about job loss decreased from 23% to 21%.

- Positive perceptions of household income saw an increase, with 20% stating it is significantly higher than the previous year.

Expert Insights: Doug Duncan's Analysis

According to Doug Duncan, Fannie Mae Senior Vice President and Chief Economist, consumers express greater pessimism toward the larger economy, attributing it to concerns about inflation. Despite a strong labor market and increased wages, consumers may feel that their purchasing power has not kept up with rising prices, contributing to the affordability challenges in the housing market.

In summary, the October HPSI reflects a complex interplay of economic factors influencing consumer sentiment. While the housing market has seen improvements compared to the previous year, challenges such as high home prices, inflation, and mortgage rates persist. Prospective homebuyers should carefully assess their financial situations and market conditions before making decisions in the current real estate landscape.

Image source: Fannie Mae

Image source: Fannie Mae

Assessing Current Market Conditions

Understanding the current state of the housing market is crucial when deciding whether to buy a house. Consider the following key factors:

-

Interest Rates: Mortgage interest rates play a significant role in determining the affordability of a home purchase. Research and monitor interest rate trends to make an informed decision.

-

Home Prices: Examine the trend of home prices in the area you're interested in. Are prices currently high or stable? Are they expected to increase or decrease in the near future? Understanding price trends can guide your timing.

-

Inventory Levels: Consider the availability of homes on the market. A low inventory of homes for sale might lead to more competition among buyers and potentially higher prices. Conversely, a higher inventory might give you more options to choose from.

-

Economic Conditions: Evaluate the broader economic environment. Factors like job stability, local job market trends, and overall economic indicators can impact your ability to make mortgage payments in the long run.

Your Personal Financial Situation

Beyond market conditions, your personal financial situation is crucial in determining whether it's the right time to buy a house. Consider the following:

-

Financial Readiness: Assess your financial health. Do you have a stable income and a good credit score? Have you saved enough for a down payment, closing costs, and potential emergencies?

-

Long-Term Goals: Consider your long-term goals. How does buying a house align with your overall financial plan? Are you planning to stay in the area for an extended period? Your answers can help you determine if homeownership is the right choice.

-

Budget and Affordability: Create a detailed budget to understand how much you can comfortably afford for a monthly mortgage payment. Remember that owning a home involves more than just the mortgage; property taxes, insurance, maintenance, and utilities are additional costs to consider.

Buy Now or Wait?

After evaluating market conditions and your personal financial situation, you'll be better equipped to decide whether to buy a house now or wait:

Buy Now If:

- Interest rates are low, making homeownership more affordable.

- You've saved for a down payment and other associated costs.

- The housing market in your area is stable or showing positive growth.

- You've evaluated your long-term goals, and buying aligns with them.

Wait If:

- Interest rates are high, and you anticipate they might decrease in the near future.

- Your financial situation needs improvement, such as increasing your credit score or saving more for a down payment.

- The housing market in your area is volatile or experiencing a downward trend in prices.

- Your long-term plans are uncertain, and committing to homeownership doesn't currently make sense.

Is it a Good Time to Buy a House for First-Time Buyers?

For first-time homebuyers, assessing whether it's a good time to purchase a house is a crucial decision. Several factors influence this decision, including mortgage credit availability, market conditions, and personal financial stability.

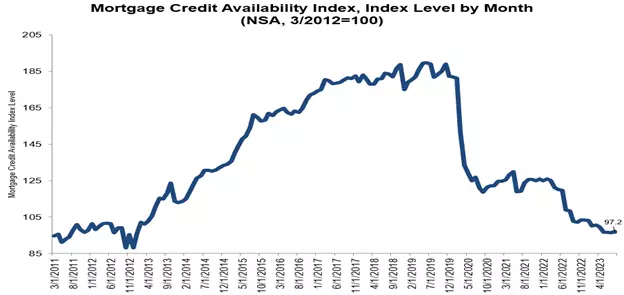

The Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA), brings positive news for potential homebuyers, particularly first-time buyers. The MCAI increased by 0.6 percent to reach 97.2 in September, signaling a slight loosening of credit standards.

Components of the MCAI

Breaking down the MCAI, both the Conventional MCAI and the Government MCAI increased by 0.6 percent. Notably, the Jumbo MCAI experienced an 0.8 percent increase, while the Conforming MCAI rose by 0.2 percent. These variations reflect nuanced changes in credit availability across different loan categories.

Insights from Joel Kan, MBA’s Vice President and Deputy Chief Economist

Joel Kan, MBA’s Vice President and Deputy Chief Economist, provided insights into the drivers behind the uptick in credit availability. Lenders responded to the changing needs of borrowers, particularly those facing higher mortgage rates. The increase in loan programs for Adjustable Rate Mortgages (ARM) and non-Qualified Mortgage (non-QM) products played a role in this positive shift.

Kan mentioned that the expansion of the Jumbo index for the second consecutive month was driven by the growth in ARM and non-QM offerings. This suggests a broader range of options for borrowers seeking lower initial monthly payments and alternative financing solutions.

Implications for First-Time Buyers

The slight loosening of credit standards, coupled with the expansion of loan programs, presents a positive scenario for first-time buyers. As they navigate the housing market, potential homeowners should take advantage of the increased credit availability, explore diverse loan options, and carefully consider the evolving landscape of mortgage rates.

Conclusion: Considering Your Options

For first-time buyers, the increase in mortgage credit availability, especially in the jumbo loan segment, is a positive sign. However, careful consideration of personal financial circumstances, market trends, and interest rates is crucial in determining whether it's the right time to buy a house.

Evaluating your financial readiness and understanding the implications of current credit trends will aid in making an informed homebuying decision.

Remember, the decision of whether it's a good time for first-time buyers to buy a house depends on a multitude of factors beyond just mortgage availability. Other important considerations include personal financial stability, real estate market conditions, interest rates, long-term plans, down payment affordability, employment stability, and government programs.

Given these factors, it's recommended that first-time buyers consult with financial advisors, mortgage professionals, and real estate experts to make an informed decision. It's important to note that the decrease in mortgage credit availability might present some challenges, but it doesn't necessarily mean that it's universally a bad time for first-time buyers to purchase a house. The broader context of personal circumstances, market conditions, and financial preparedness should guide the decision-making process.

*Sources: