If you're looking for a smart investment in the real estate sector, look no further than Vanguard Real Estate Index Funds. This mutual fund, managed by Vanguard's Equity Index Group, offers investors the chance to benefit from the steady appreciation of real estate values and above-average dividend yields. Let's delve deeper into the potential of this fund and understand how it can work for you.

Overview

Vanguard Real Estate Index Fund (VGSLX) is a well-diversified mutual fund that invests in various types of REITs, including office, healthcare, hotel, and other equity REITs. Additionally, it also holds stocks of real estate management companies and development firms. With a portfolio comprising 189 different companies and total net assets of $64.2 billion, this fund has a strong foundation.

How the Fund Works

The objective of Vanguard Real Estate Index Fund is to provide high income and moderate long-term capital growth by investing in stocks issued by commercial REITs. Vanguard's professional investment managers utilize their expertise to evaluate the potential for return and manage risk effectively. The fund tracks the MSCI US REIT Index, which serves as a benchmark for its performance. As the underlying investments increase in value, the fund's shares and net asset value (NAV) also grow.

Investing in the Fund

Investing in the Vanguard Real Estate Index Fund is easy and accessible to a wide range of investors. Depending on your investment preferences, you can choose from different share classes:

-

Admiral Shares (VGSLX): With a minimum investment of $3,000, these shares offer a lower fee structure, featuring an expense ratio of only 0.12%. This is significantly below the industry average of 1.21%.

-

Investor Shares (VGSIX): Previously offered by Vanguard, these shares are being transitioned to Admiral Shares. Investors can either transition their shares themselves or allow Vanguard to do it gradually over a year. The only difference between the share types is the fees charged by Vanguard.

-

ETF Shares (VNQ): These shares have no minimum investment requirement, making them accessible to investors with varying budgets.

-

Institutional Shares (VGSNX): For institutional investors, these shares require a minimum initial investment of $5,000,000 and offer an even lower fee structure with an average expense ratio of 0.05%.

Portfolio

The portfolio of Vanguard Real Estate Index Fund is well-diversified, with investments spread across 189 equity REITs. The fund's top ten holdings consist of high-performing publicly traded REITs, including American Tower Corp, Crown Castle International Corp, and Simon Property Group, among others. These top holdings make up 42.1% of the fund's total net assets.

Image Source: Vanguard

Image Source: Vanguard

Fund Benefits

Investing in Vanguard Real Estate Index Funds comes with several benefits. One of the major advantages is diversification since the fund invests in a wide range of real estate properties. This provides investors with exposure to different sectors and helps mitigate risks associated with industry concentration. Moreover, Vanguard offers Admiral Shares with a remarkably low expense ratio of 0.12%, resulting in significant savings compared to similar funds. According to Vanguard, investors can save up to $2,430 over ten years on a $10,000 investment.

Fund Risks

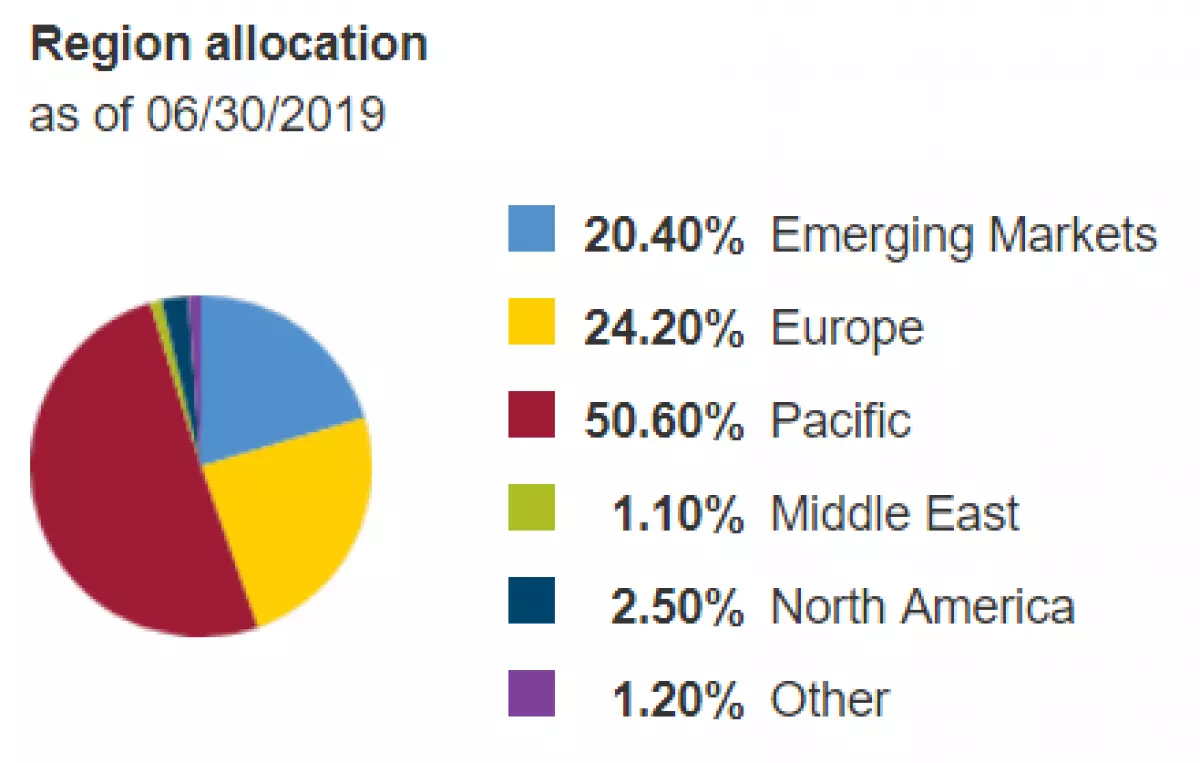

Like any investment, the Vanguard Real Estate Index Fund does come with certain risks. The primary risk is industry concentration since all the investments are within the real estate sector. Changes in economic conditions or regulations could impact the broader real estate industry and potentially lower share prices and dividend payments. However, Vanguard mitigates this risk by diversifying the fund across different REIT subsectors and regions.

Another risk associated with this fund is the higher rate of volatility compared to other investment types. As the fund primarily invests in stocks, investors should be prepared for market fluctuations. Vanguard suggests that investing in this fund is best suited for individuals with a long-term investment horizon of ten years or more.

Should You Invest in Vanguard Real Estate Index Funds?

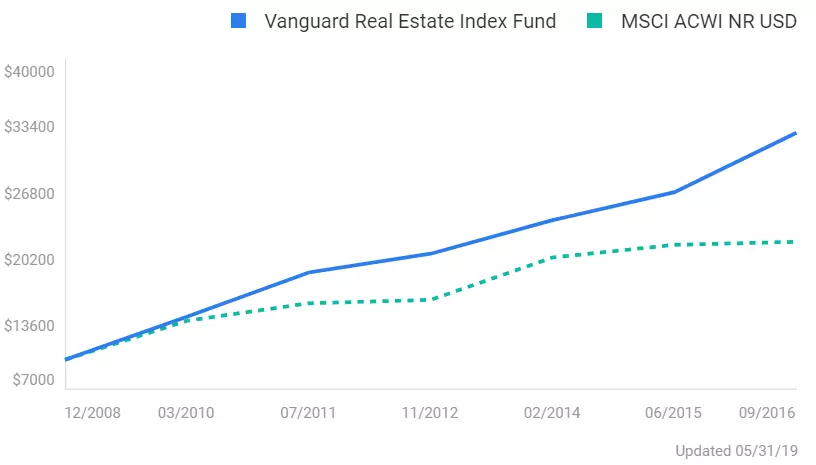

The performance of Vanguard Real Estate Index Funds speaks for itself. With a year-to-date return of 21.73% and a track record of consistent growth, this fund holds strong potential for investors. Not only does it outperform the MSCI US REIT Index, but it also boasts below-average expense ratios, resulting in significant cost savings. However, it's important to note that Vanguard recommends a hold period greater than ten years for optimal results.

Investing in Vanguard Real Estate Index Funds can provide you with diversification, convenience, and professional management. So, take a closer look at this fund and consider making it part of your investment portfolio for a bright financial future.

Original Article Source: Investing in Vanguard Real Estate Index Funds