Real estate investments have the potential to significantly boost your financial situation. They can provide additional wealth to fund your retirement, increase your emergency fund, pay off debts, and expand your asset portfolio. With the right strategy, owning income-producing property can generate passive income through rental earnings and property appreciation. So, let's delve into the basics of income-producing real estate and explore the various options available to potential investors.

What Is an Income-Producing Asset?

Income-producing assets are the key to generating cash flow. By investing in these assets, individuals expect to earn income from them in the future. While some income-generating assets require little financial investment, others demand a significant amount of capital. Diversifying your portfolio across multiple income-producing assets can safeguard your finances against potential losses. This approach ensures that if one income stream falters, others can make up for it.

Stocks, bonds, savings accounts, and certificates of deposit are common examples of income-producing assets. However, real estate investments have the potential to yield high returns with relatively low risk. Investors can earn income from a property through rental earnings, making it an attractive option.

Investors may be interested in diversifying their portfolio of income-producing assets between several types

Investors may be interested in diversifying their portfolio of income-producing assets between several types

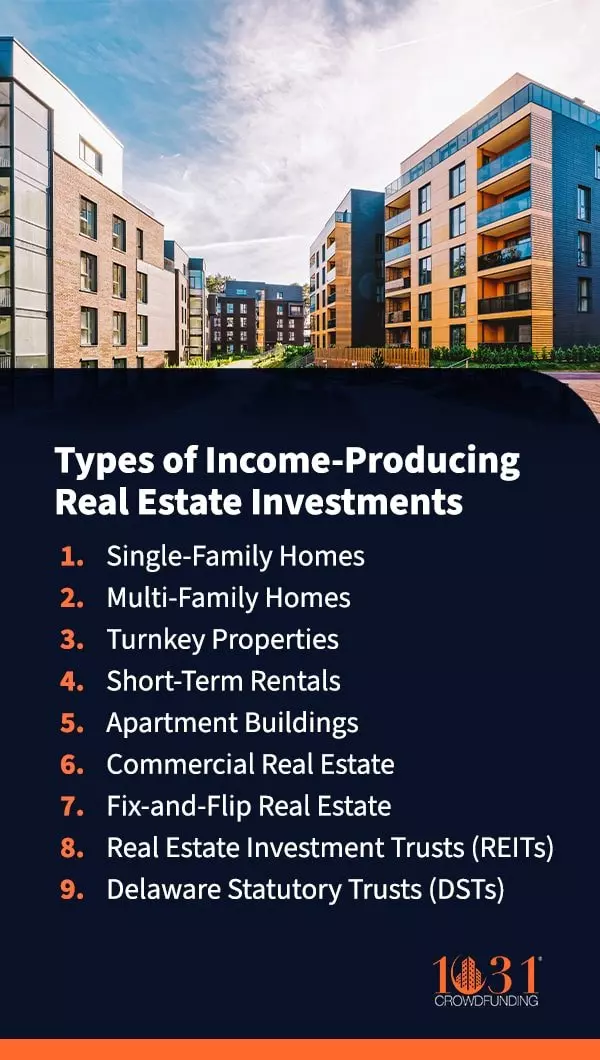

Types of Income-Producing Real Estate Investments

Real estate investments offer a myriad of avenues for generating passive income. Investors are drawn to real estate because it provides multiple opportunities for return, such as rental income and potential property appreciation. Additionally, real estate properties offer tax advantages through 1031 exchanges, enabling investors to defer capital gains taxes while buying and selling like-kind properties.

Let's explore some of the common types of income-producing real estate investments:

1. Single-Family Homes

Investing in single-family homes allows you to rent out a property to a single tenant. Financing a single-family home is typically straightforward, as you can get preapproved for a mortgage and calculate potential returns easily. Single-family homes are an ideal income-producing asset for both new real estate investors and those who have the time to manage properties themselves.

Advantages of investing in single-family homes include:

- Long-term appreciation: Single-family homes tend to appreciate over time, leading to greater returns.

- Consistent demand: Despite rising prices, sales of single-family homes have increased over the past few years. They are in high demand, making them relatively easy to rent and resell, depending on location and market conditions.

- Affordable property taxes: Property taxes on single-family homes are generally lower compared to multi-family homes or commercial properties.

However, investing in single-family homes also has some disadvantages:

- Fewer rental opportunities: Single-family homes provide only one income stream, limiting the potential return on investment.

- Dependence on tenants: Attracting the right tenants to the location is crucial for success.

2. Multi-Family Homes

Multi-family homes include properties with multiple units, such as duplexes, triplexes, and fourplexes. Financing multi-family homes requires a commercial mortgage, and lenders assess the property's expected income. Investors new to multi-family homes may choose to partner with experienced investors when starting out.

Advantages of investing in multi-family homes include:

- Multiple cash flow opportunities: With multiple units, investors can generate income from numerous tenants. Having multiple tenants also lowers the investor’s risk profile.

- Economies of scale: As investors acquire more properties, certain efficiencies can be achieved. For example, repairs or replacements are generally less expensive per unit in a multi-family home compared to a single-family home.

However, investing in multi-family homes has its challenges:

- More challenging financing: Lenders require a thorough process for providing funding for multi-family housing properties as they function more like businesses.

- Higher upfront cost: Purchasing a multi-family home requires a more significant financial investment than buying a single-family property. Additionally, managing more units may lead to higher maintenance costs.

3. Turnkey Properties

Turnkey properties are housing units that require minimal or no renovation before being rented out. They are a popular choice for both new and experienced investors as they provide convenience and require less effort. Many turnkey properties are renovated, sold, and managed by turnkey real estate companies. This arrangement relieves investors from the pressure of managing the property. Financing turnkey properties is generally easier, especially if the property already has a tenant.

Investing in turnkey properties offers advantages such as:

- Lower improvement costs: Investors in turnkey properties can save significant money on improvements and maintenance.

- Immediate rental income: Since turnkey properties don't require any improvements, investors can start generating rental income right away.

- Easier portfolio expansion: Turnkey rental properties allow investors to diversify their real estate portfolio beyond their local area if managed by a third party.

However, investing in turnkey properties has some disadvantages:

- Less control over the interior: As these properties are already finished, investors have less control over the design and layout without incurring additional costs.

- Limited control over the management company: Owners of turnkey properties may not be involved in the tenant screening process, as the management company usually approves the tenants. Investors should also investigate the renovation work done on the property to avoid future financial problems.

Continue reading the article here