Owning a house comes with various costs, and property tax is one of the important ones to consider. Whether you're a homeowner or a potential buyer, knowing the property tax associated with a particular address can help you evaluate the value of the property and plan your budget effectively. In this article, we will walk you through the process of finding property tax by address using three different methods.

Method 1: Get detailed property reports with BeenVerified

One of the easiest and fastest ways to find a property's tax information is by using a reverse address lookup tool like BeenVerified. This powerful and reliable people search website collects millions of public data records and provides comprehensive property reports. Here's how you can use it:

-

Visit the BeenVerified Property Records page.

-

Enter the address you want to search and click on "SEARCH".

Caption: Perform a property search on BeenVerified

Caption: Perform a property search on BeenVerified

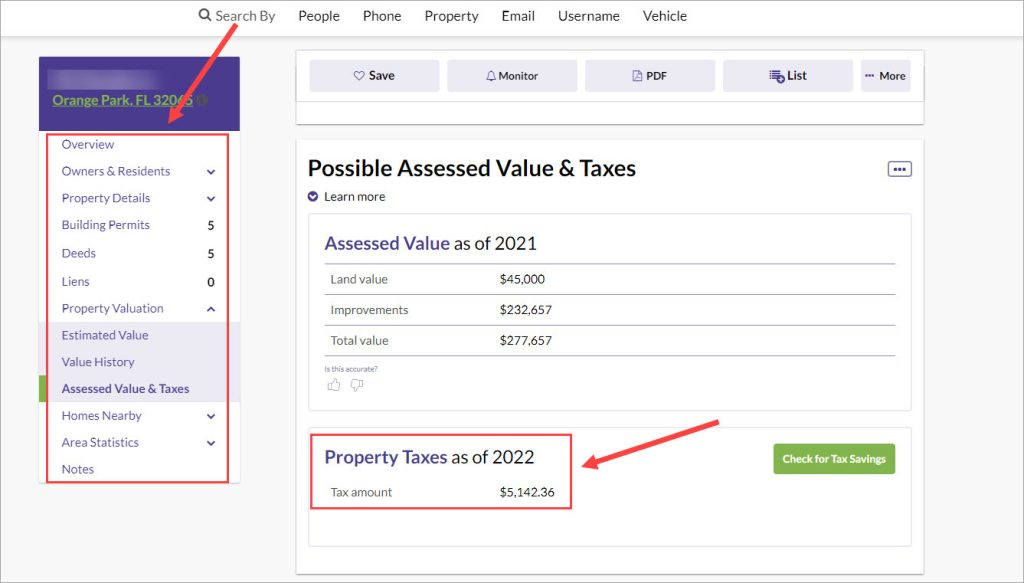

- BeenVerified will generate a detailed report that includes essential information about the property, including the tax assessment. You can scroll through the report or use the menu on the left to navigate to specific sections.

Caption: View property tax information in the BeenVerified report

Caption: View property tax information in the BeenVerified report

Method 2: Look up tax bills from the county database

If you prefer not to use a third-party service, you can directly request property information from local recorders or tax assessors. Many counties provide digital databases where you can access property records online, or you may need to visit the county recorder's office in person. Follow these steps to search for a property's tax bill by address:

-

Visit the Public Record Online Directory for quick links to government websites. Look for the website of the county where the property is located.

-

Navigate to the tax collector or treasurer section of the county's website.

Caption: Access the Public Record Online Directory for government websites

Caption: Access the Public Record Online Directory for government websites

- Look for options like "View Tax Bills" or similar. Select the appropriate year and choose to search by street address.

Caption: View tax bills based on the time period

Caption: View tax bills based on the time period

- Fill in the street address field and click on "SEARCH". The database will identify the correct property.

Caption: View property details and tax bill in the county database

Caption: View property details and tax bill in the county database

- Click on "View Details" and then "VIEW TAX BILL" to access the property's tax bill in a PDF format. Note that the process may vary slightly depending on the county.

Method 3: Check on a real estate app or consult a professional

Real estate websites and apps like Realtor.com or Zillow also provide extensive property information, including estimates of home prices, interest rates, property taxes, and more. You can use these platforms to get an idea of the property tax for a specific address.

Caption: Use real estate websites like Realtor.com to estimate property taxes

Caption: Use real estate websites like Realtor.com to estimate property taxes

Alternatively, you can seek assistance from a real estate agent or professional who can gather property information and calculate taxes for you.

That's how you can find property tax by address. If you have any questions or suggestions, feel free to leave a comment below. Happy property hunting!