While homebuyers search for affordable homes, real estate investors have their sights set on properties with high cash flow potential. If you're looking for investment opportunities in your local market, knowing where and what to look for is crucial. In this article, I'll share my strategy for analyzing cash flow real estate investment properties, helping you uncover hidden gems in your area. We'll cover essential metrics such as net operating income, capitalization rate, return on investment, monthly cash flow, and more.

Research Rental Comps

Research Rental Comps from Zillow

Research Rental Comps from Zillow

Before you embark on your search for cash flow properties, it's crucial to have a deep understanding of your local rental market. Start by looking at comparables (comps) for three-bedroom, two-bathroom, single-family homes that are 30 to 50 years old. These homes often have functional floor plans and two-car garages, making them attractive to renters. Newer homes tend to fetch higher rents but come at a higher price point.

You can find rental comps on websites like Craigslist, Zillow, and Rentometer. Rental rates vary based on factors such as location desirability, home age, nearby schools, and the number of bedrooms and bathrooms. These factors influence what families are willing to pay in rent. By comparing potential rental income to available homes for sale using the Rental Multiplier, you can identify properties with positive cash flow potential.

Narrow Your Search Using the Rental Multiplier

Calculate the Capitalization Rate banner

Calculate the Capitalization Rate banner

The Rental Multiplier enables you to refine your search. Identify neighborhoods with higher rents, and then use the Rental Multiplier to determine the maximum price your investor could pay for a home in that area while still achieving a positive cash flow of $200 or more per month. The calculation assumes a traditional investor mortgage loan with a 20% down payment.

| Address | Beds | Baths | Rent | Multiplier | Maximum Price |

|---|---|---|---|---|---|

| 100 Main Street | 4 | 2 | $2,000 | 130 | $260,000 |

| 555 Fifth Avenue | 3 | 2 | $1,755 | 130 | $234,000 |

The Rental Multiplier equates to rental rates higher than 0.75% of the sales price or the monthly rental rate times 130. For example, if the average rental rate for a three-bedroom, two-bathroom home built in the 1980s is $2,000 per month, you should target homes priced close to $260,000 ($2,000 x 130 = $260,000).

If the Rental Multiplier makes finding properties with positive cash flow challenging, your investor clients may need to increase their down payment. It's also worth considering alternative markets if viable options are scarce in your area. Many suburban and rural areas are experiencing increased demand as more people work from home. Research reciprocity and portability laws in neighboring states to explore better deals.

Calculate the Capitalization Rate

Example of How to Calculate CAP Rate for Cash Flow Real Estate

Example of How to Calculate CAP Rate for Cash Flow Real Estate

The capitalization rate, or CAP rate, is a simple equation that helps you determine the potential return on an investment property. CAP rates allow investors to compare properties without considering individual financing details. They depend on a property's income, expenses, and price.

To calculate the CAP rate, follow these four steps:

- Calculate the Gross Income: Add up the monthly rental income and subtract the vacancy rate (around 6-8%).

- Add Together the Owner-paid Expenses: Include annual property taxes, water/sewer costs, trash service fees, insurance, and other relevant expenses.

- Subtract Gross Annual Expenses to Get Net Operating Income (NOI): Calculate the property's income after deducting expenses.

- Calculate the CAP Rate: Divide the NOI by the property's asking price.

CAP rates vary based on location and demand. Lower CAP rates may indicate stability but could lead to lower long-term appreciation. It's important to consider your investor's goals when determining the target CAP rate. Typically, a CAP rate below 5% makes it challenging to generate positive cash flow unless a substantial down payment is made.

Calculate the Annual Cash-on-Cash Return

Three Green Miniature House Models

Three Green Miniature House Models

The cash-on-cash return, or return on investment (ROI), demonstrates the potential annual return on your client's cash investment. To calculate the ROI, include all costs associated with acquiring the property, such as the down payment, closing costs, and inspection fees.

Divide the property's total annual cash flow by the total out-of-pocket expenses to determine the ROI. For example, if the annual cash flow is $6,098 and the total out-of-pocket expenses are $49,850, the ROI would be 12.23%.

Consider the ROI in conjunction with other financial factors, including tax advantages, depreciation, and the potential for capital gains taxation upon sale.

How to Calculate Monthly Cash Flow

Tax Withholding and Estimated Tax

Tax Withholding and Estimated Tax

Monthly cash flow indicates the amount left over after paying expenses and mortgage principal and interest (PI) payments. Start with the Net Operating Income (NOI) and subtract the annual PI payments. Divide the result by 12 to determine the monthly cash flow.

Monthly Cash Flow = (NOI - PI Payments) / 12

Consider financing options, especially for larger multi-unit properties that may require commercial loans. Commercial financing generally demands higher down payments and offers higher interest rates than single-family financing.

Other Factors to Consider

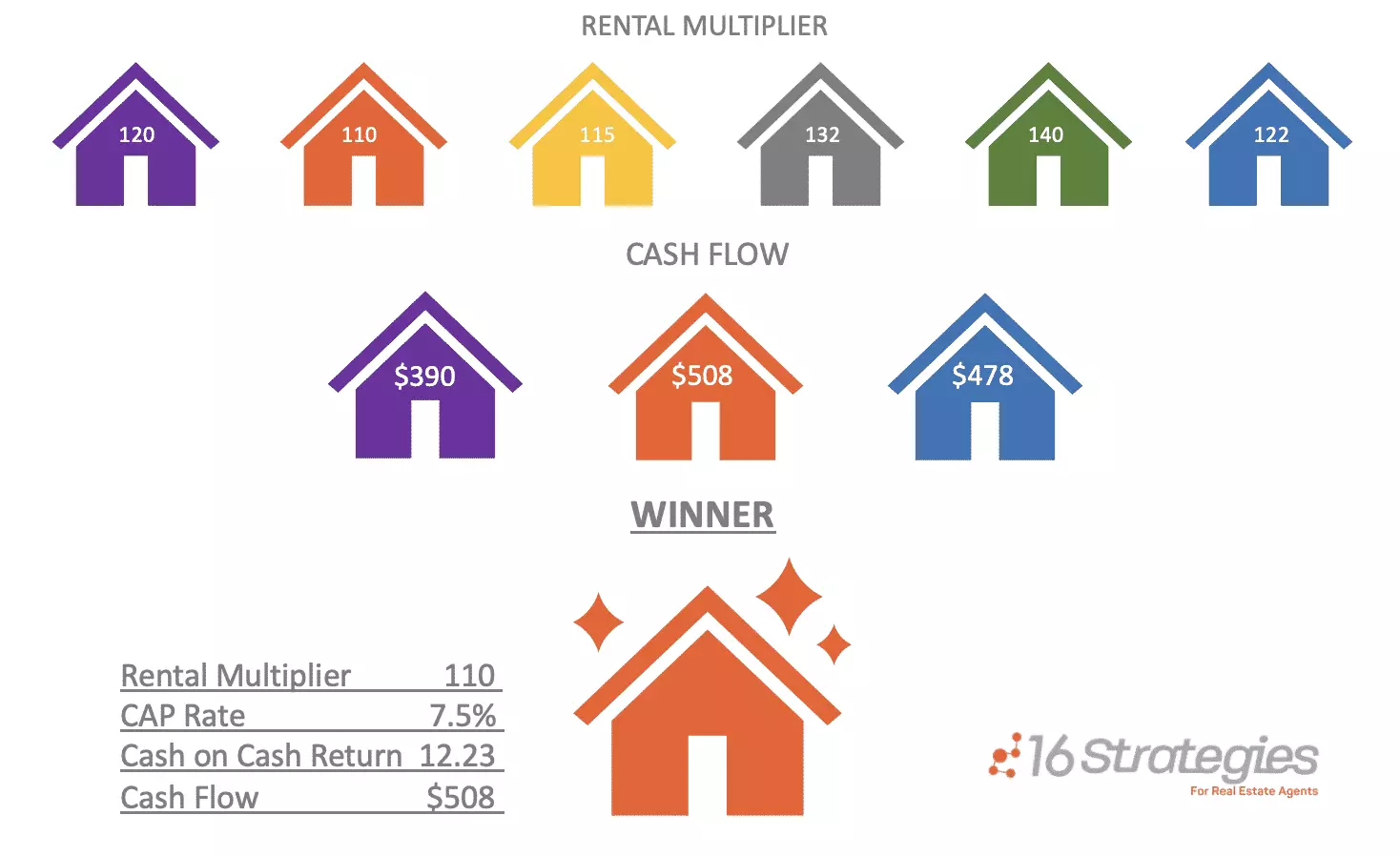

Rental Multiplier Infographics

Rental Multiplier Infographics

Although CAP rate, cash flow, and ROI are essential metrics, there are additional financial aspects to consider. Real estate investments offer tax advantages, such as interest deductions and depreciation benefits. However, be aware that the IRS may recapture depreciation and tax capital gains upon property sale. Section 1031 Exchange can be an option for investors looking to defer taxes.

Use the Financials to Negotiate Your Offer

How to Analyze Cash Flow Real Estate Investments + Attract Investor Clients

How to Analyze Cash Flow Real Estate Investments + Attract Investor Clients

Utilize the Rental Multiplier to narrow down your search and identify the most promising properties. Once you have a shortlist, calculate the CAP rate, return, and cash flow for each property. Armed with this financial information, you can guide your investor client's offer price. Remember, the right price isn't always the lowest; it should align with the property's financial potential.

The Bottom Line

You attract bees with flowers, and you attract investors with cash flow real estate. Mastering the art of finding and analyzing profitable cash flow investment properties is your key to attracting investors and building another income stream in your real estate career. Embrace these strategies and financial insights to navigate the world of cash flow real estate investments effectively.