Ever wondered how those numbers on your commercial property tax bill are actually calculated? It's a question that often leaves property owners scratching their heads. In this article, we're going behind the scenes to uncover the methods used to determine the assessed value of commercial properties. We'll break down complex concepts into easy-to-understand language and provide a clear roadmap of the valuation process. Let's demystify the world of commercial property assessments together!

The Legal Framework: Where It All Begins

Our journey begins with the legal foundation of property valuation. Two key statutes dictate how we operate:

- Illinois Tax Code: This code mandates that we determine the "fair cash value," also known as fair market value, for all properties in Cook County every three years. This essentially sets the stage for our valuation process.

- Cook County Ordinance: This ordinance specifies the assessment levels for different property types. Residential properties and apartments are assessed at 10%, while most commercial properties are assessed at 25%.

Inside the CCAO's Valuation Process: From Property Analysis to Final Assessment

Now, let's roll up our sleeves and dive into the step-by-step process the Cook County Assessor's Office (CCAO) uses to arrive at those all-important assessed values.

1. Property Use Determination: Getting to Know Your Property

The first step involves understanding the specific use of your property. We accomplish this by:

- Examining historical data, including property class and tenant information.

- Analyzing business activities conducted on the property.

- Reviewing external photographs to get a visual grasp of the property's characteristics.

Think of it as building a profile for your property, allowing us to group it with similar properties for a more accurate assessment.

2. Income and Expense Estimation: The Financial Snapshot

Next, we delve into the financial aspects of your property by estimating its income and expenses.

- Income: For most commercial properties, rent forms the primary source of income. However, we also factor in additional income streams, such as parking fees or advertising revenue.

- Expenses: This encompasses a range of costs, including property taxes, insurance premiums, repair and maintenance expenses, property management fees, and professional service costs.

This step provides us with a clear picture of your property's financial performance, which is crucial for determining its value.

3. Market Vacancy Analysis: Factoring in Real-World Conditions

We all know that a certain level of vacancy is expected in the commercial real estate market. Our analysis considers:

- Location-based vacancy: We examine vacancy rates in your property's specific area.

- Property type vacancy: Different types of properties naturally experience varying vacancy rates.

However, we also take into account unusual circumstances that may contribute to vacancy, such as unforeseen events or new construction in the area.

4. Capitalization Rate Calculation: Converting Income to Value

Now, let's talk about capitalization rates, also known as cap rates. This is where things get interesting!

- The Formula: Cap Rate = Net Operating Income (NOI) / Property Value

- The Relationship: Cap rates have an inverse relationship with property value. A lower cap rate generally indicates a higher value, while a higher cap rate suggests a lower value.

By plugging in the estimated income and expense data, we can calculate the cap rate for your property.

5. Building Value Estimation: Putting the Pieces Together

With the cap rate in hand, we can estimate your building's market value using this simple formula:

Market Value = Estimated Income / Cap Rate

For example, if your property generates $100,000 in net income and has a cap rate of 9.5%, its estimated market value would be $1,052,631.

6. Level of Assessment Application: Determining the Taxable Portion

Remember the Cook County Ordinance we discussed earlier? Here's where it comes into play.

- Residential/Apartments: Assessed at 10% of market value.

- Commercial: Assessed at 25% of market value.

So, a commercial property with a market value of $1,000,000 would have an assessed value of $250,000.

7. Reassessment Notice: Keeping You Informed

Finally, we send out reassessment notices to all property owners. If your property is divided into multiple Property Index Numbers (PINs), you'll receive separate notices for each PIN, detailing the assessed value.

Diving Deeper: Key Concepts Explained

Let's explore some important concepts in more detail:

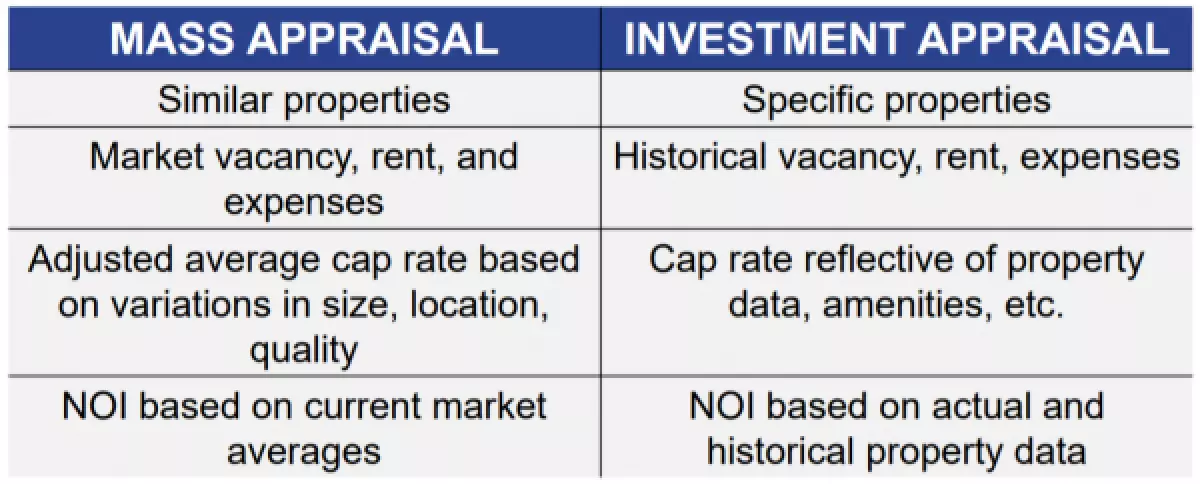

Mass Appraisal vs. Investment Appraisal: Two Different Approaches

- Mass Appraisal (CCAO): Focuses on average market data for rents, vacancy rates, expenses, and cap rates. This approach ensures fairness and consistency across similar properties.

- Investment Appraisal: Used by investors, this method analyzes the unique characteristics of individual properties to determine a specific value.

Data Sources: The Foundation of Our Analysis

We rely on a variety of credible sources to gather accurate market data:

- Professional Data Providers: CoStar, Trepp, CBRE, Cushman and Wakefield, JLL

- Qualitative Interviews: We conduct interviews with local brokers, appraisers, and property owners to gain valuable market insights.

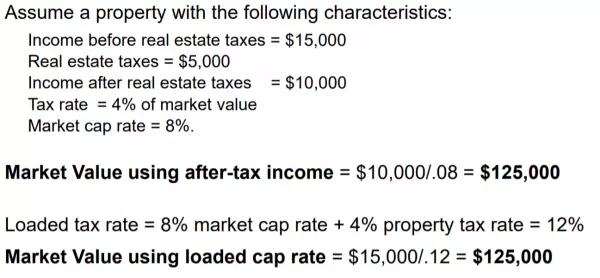

Loaded vs. Unloaded Cap Rates: The Tax Factor

- Unloaded Cap Rate (Used by CCAO): Calculated using net income after real estate taxes are deducted.

- Loaded Cap Rate: Calculated using net income before real estate taxes are deducted.

We use the unloaded cap rate because Cook County's tax rates are variable and difficult to predict in advance.

Conclusion: Transparency in Valuation

We hope this behind-the-scenes look at our valuation process has shed light on how we determine the assessed value of your commercial property. Our goal is to provide transparency and clarity, ensuring fairness for all property owners.