Healthcare Trust Inc. Shareholders may have Claims

The White Law Group continues to investigate FINRA arbitration claims involving Healthcare Trust Inc. (ARC Healthcare Trust II) and the liability broker dealers may have inappropriately recommended it to investors. Unfortunately, it appears that many financial advisors and brokerage firms that sold non-traded REITs like Healthcare Trust Inc. may have downplayed or misrepresented the risks and liquidity problems associated with these investments.

Healthcare Trust Inc., formerly known as ARC Healthcare Trust II, is a non-traded real estate investment trust (REIT) that focuses on acquiring healthcare-related assets such as medical office buildings, seniors housing, and other healthcare facilities. The REIT, sponsored by American Realty Capital (now known as AR Global), was part of an empire involved in an accounting scandal a few years ago.

Disappointing Net Asset Value (NAV) per share

The Board of Directors recently updated the Net Asset Value per share for Healthcare Trust Inc. As of December 31, 2022, the REIT declared a new Net Asset Value of $14.00 per share, down from $14.50 in 2020, $15.75 in 2019, and $17.50 in 2018. This decrease in value is concerning for investors who initially purchased shares at $25.00 each.

Secondary Sales Price Indicates Losses for Investors

According to Central Trade and Transfer, a secondary market for non-traded REITs, shares of Healthcare Trust Inc. have recently been sold for as low as $3.75 per share. This means that many investors would experience significant losses on their initial capital investment.

Are Non-Traded REITs Suitable for you?

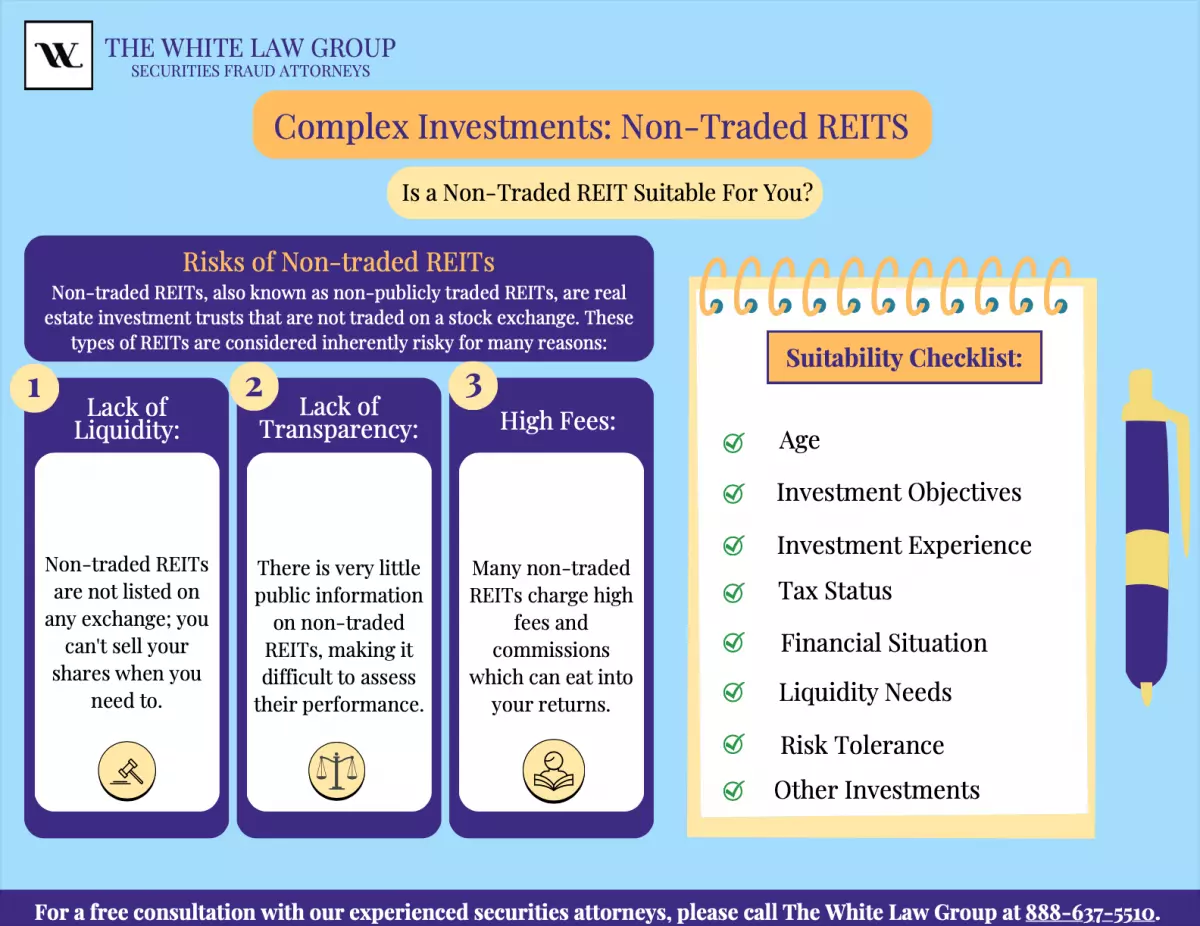

Non-traded REITs are high-risk, complex investments that are not suitable for every investor. Before recommending an investment, brokerage firms are required to disclose all the risks associated with it. Recommendations should only be made if the investment aligns with an individual investor's age, investment objectives, experience, and risk tolerance. Brokerage firms that fail to perform adequate due diligence or make unsuitable recommendations can be held accountable for investment losses through FINRA arbitration.

Non-traded REITs are high-risk, complex investments that are not suitable for every investor. Before recommending an investment, brokerage firms are required to disclose all the risks associated with it. Recommendations should only be made if the investment aligns with an individual investor's age, investment objectives, experience, and risk tolerance. Brokerage firms that fail to perform adequate due diligence or make unsuitable recommendations can be held accountable for investment losses through FINRA arbitration.

High commissions can motivate unscrupulous financial advisors to sell non-traded REITs regardless of their clients' investment objectives. Additionally, the high commissions and expenses associated with these investments make it difficult for them to perform in line with the market.

Investigating Potential Lawsuits involving Healthcare Trust Inc.

If you have invested in Healthcare Trust Inc. (ARC Healthcare Trust II) and would like to explore your litigation options, please contact the securities attorneys at The White Law Group for a free consultation. The White Law Group is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in all 50 states. With over 30 years of securities law experience, they have handled over 700 FINRA arbitration cases and can help you recover your investment losses. Visit their website here for more information.

To learn more about The White Law Group's investigation of Healthcare Trust Inc., please see: Healthcare Trust Inc. (ARC Healthcare Trust II) Decrease in Value UPDATED

Tags: AR Global, AR Global Healthcare Trust Inc., non-traded REITs