The office real estate market is heading into a challenging year, confronted with significant obstacles posed by disruptive industry trends and upcoming financial maturities. Recent data from Trepp reveals that a staggering $2.77 trillion of commercial real estate debt, accounting for half of all outstanding commercial real estate debt, is set to mature between 2023 and 2027. Out of this, nearly $500 billion is due in 2024 alone.

This impending maturity cliff, coupled with declining property values and high interest rates, presents a daunting challenge for lenders and borrowers alike when it comes to refinancing this massive volume of debt.

Office Real Estate Industry Confronts Major Hurdles

Dr. Stephen Buschbom, the research director at Trepp, highlighted the current challenges faced by the commercial real estate (CRE) and CRE debt markets. He stated that higher interest rates and tighter liquidity have created significant obstacles for new transactions and refinancing maturing loans, comparing the situation to past economic cycles.

Buschbom acknowledged an increase in loan modifications and creative capital structuring, expressing hope for potential rate decreases later in the year. However, he also emphasized additional complications that may arise from banking regulations and geopolitical risks, potentially further restricting liquidity.

Fed Beige Book's Warnings

The latest Fed Beige Book, which provides qualitative economic assessments, revealed suppressed commercial real estate transactions in the Kansas City district. The report also highlighted that "CRE loan modification activity was inhibited by lenders' concerns about credit performance and borrower liquidity."

Lauren Hochfelder, co-CEO of Morgan Stanley Real Estate, recently shared in a Bloomberg interview that specific factors are bringing buyers and sellers back into the commercial real estate market after two years of sluggishness. However, there are still areas characterized by an oversupply of properties and excessive debt.

CRE Stocks On The Decline

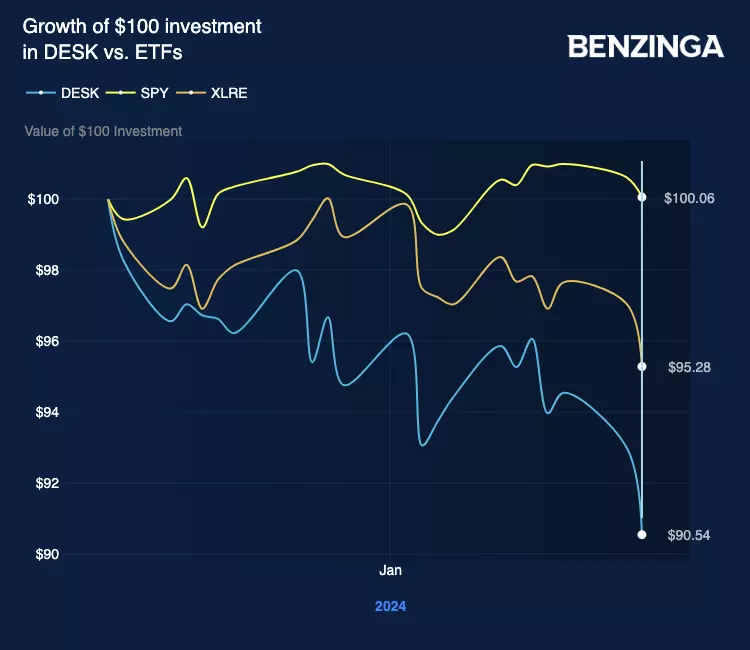

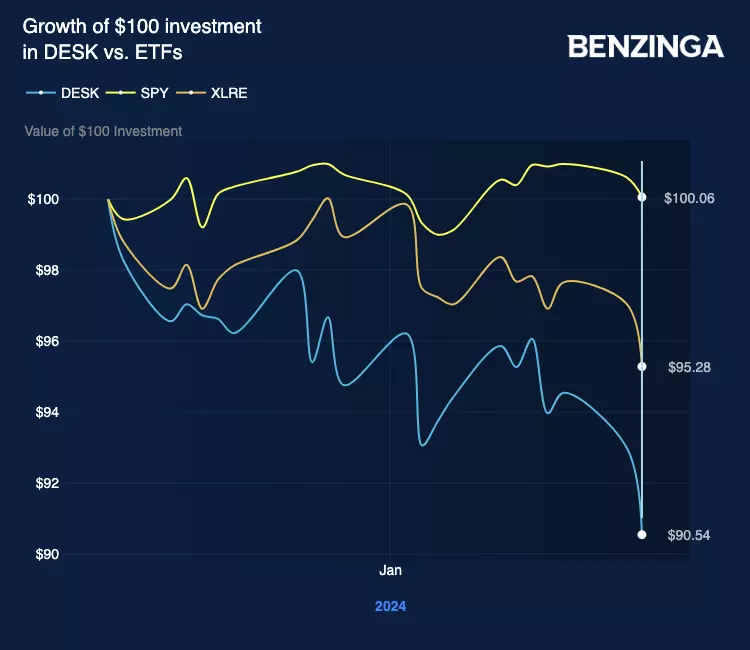

Despite initial optimism for rate cuts in 2024 to provide relief to the real estate sector, the year's start has challenged these expectations. U.S. economic strength and rising global instability factors led Fed members to reconsider early rate cut hopes. As a result, stocks in the office real estate sector, as tracked by the VanEck Office and Commercial REIT ETF (NYSE:DESK), declined by 10% from their late December peak.

Worst-Performing CRE Stocks Year-To-Date

- Office Properties Income Trust

- Orion Office REIT Inc.

- Hudson Pacific Properties, Inc.

- Paramount Group, Inc.

- Vornado Realty Trust

- Kimco Realty Corporation

As the office real estate market faces these challenges, it is crucial for owners, lenders, and borrowers to navigate this critical year with informed strategies and careful planning. The landscape may be uncertain, but proactive measures can help mitigate risks and seize opportunities amidst the changing tide of the industry.

Read Now: How to Invest in Real Estate Online

Photo: Jason Dent on Unsplash