I'm excited about the future of real estate, and Fundrise is at the forefront of this exciting industry. With the convergence of various factors like effective vaccines, inflation, low mortgage rates, and a growing desire for income-producing assets, real estate is poised for success. Let's delve into a comprehensive Fundrise overview to understand why this platform stands out.

Fundrise: Revolutionizing Real Estate Investment

Fundrise is a leading real estate crowdfunding platform that caters to both accredited and unaccredited investors. Established in 2012, Fundrise introduced the concept of eREITs, private real estate investment trusts that were once exclusive to high-net-worth individuals and institutions. This groundbreaking innovation opened doors for everyday people to invest in private real estate.

As of 2022, Fundrise manages over $3.2 billion in equity, a substantial increase from $1 billion in 1Q2021. The platform boasts over 400,000 active investors, a testament to its growing popularity. Fundrise's commitment to market fundamentals and their investors' interests sets them apart.

Insightful Interview with Ben Miller, Founder of Fundrise

In a detailed interview with Ben Miller, Founder and CEO of Fundrise, we uncover the value proposition of Fundrise and its unique approach to real estate investing. Fundrise's mission is to build a better financial system for individual investors. Unlike traditional financial services and investment managers, Fundrise seeks to empower individuals and make private real estate accessible through a low-cost, user-friendly platform.

By leveraging technology, Fundrise eliminates excessive costs and fees associated with middlemen, providing investors with the opportunity to invest directly in institutional-quality assets. This direct-to-consumer model ensures that investors can benefit from historically strong investment assets, such as private real estate.

Managing Over $3.2 Billion in Equity

Fundrise's success lies in its ability to manage more than $3.2 billion in equity with the support of over 371,000 active individual investors. By cutting out intermediaries and reducing overall costs, Fundrise offers lower fees compared to traditional private real estate managers. This cost advantage, combined with their technology-driven approach, creates the potential for higher risk-adjusted returns.

[New way of investing in real estate - Fundrise overview]

[New way of investing in real estate - Fundrise overview]

Fundrise: Setting Itself Apart from Other Crowdfunding Platforms

Fundrise differentiates itself from other real estate crowdfunding platforms by moving away from the traditional deal-by-deal fundraising model. Instead, they offer individuals the opportunity to invest directly into diversified pools of institutional-quality assets, like eREITs. These assets are carefully selected based on their size, scale, partnership quality, and risk-return profile.

This approach ensures that investors have access to high-quality assets, mirroring the type of investments typically reserved for exclusive private equity funds. Fundrise's focus on value-based investing and its technology-driven platform set it apart from other crowdfunding platforms in the market.

[Investing in real estate using an app - Fundrise Overview]

[Investing in real estate using an app - Fundrise Overview]

Navigating Real Estate Post-COVID-19

Real estate, like any asset class, has experienced both winners and losers during the COVID-19 pandemic. Sectors such as hotels, traditional retail, large urban office buildings, and luxury urban apartments have faced significant challenges. On the other hand, e-commerce-focused industrial assets, suburban housing, and affordable apartments in the south and southeast have shown resilience.

Fundrise's investment philosophy centers around market fundamentals and the protection of upside while minimizing downside risks. This focus on stability and long-term value has allowed Fundrise to outperform the stock market during times of volatility. Real estate continues to be a valuable asset class that offers stability and income generation.

Fundrise: A Platform for All Investors

Fundrise is an appealing investment platform for individuals seeking to diversify their portfolios beyond traditional public markets. It caters to investors with various investment amounts, making real estate accessible to everyone. Fundrise provides an opportunity to own real estate without the hassle of being a landlord, offering the potential for stable long-term returns.

The platform's user-friendly interface ensures a seamless onboarding experience. By answering a few questions about investment goals, investors can choose the account type and investment plan that aligns with their objectives. Fundrise's diversified portfolios and frequent updates on asset performance provide transparency and a front-row seat to the dynamic nature of real estate investing.

[Fundrise investment offerings]

[Fundrise investment offerings]

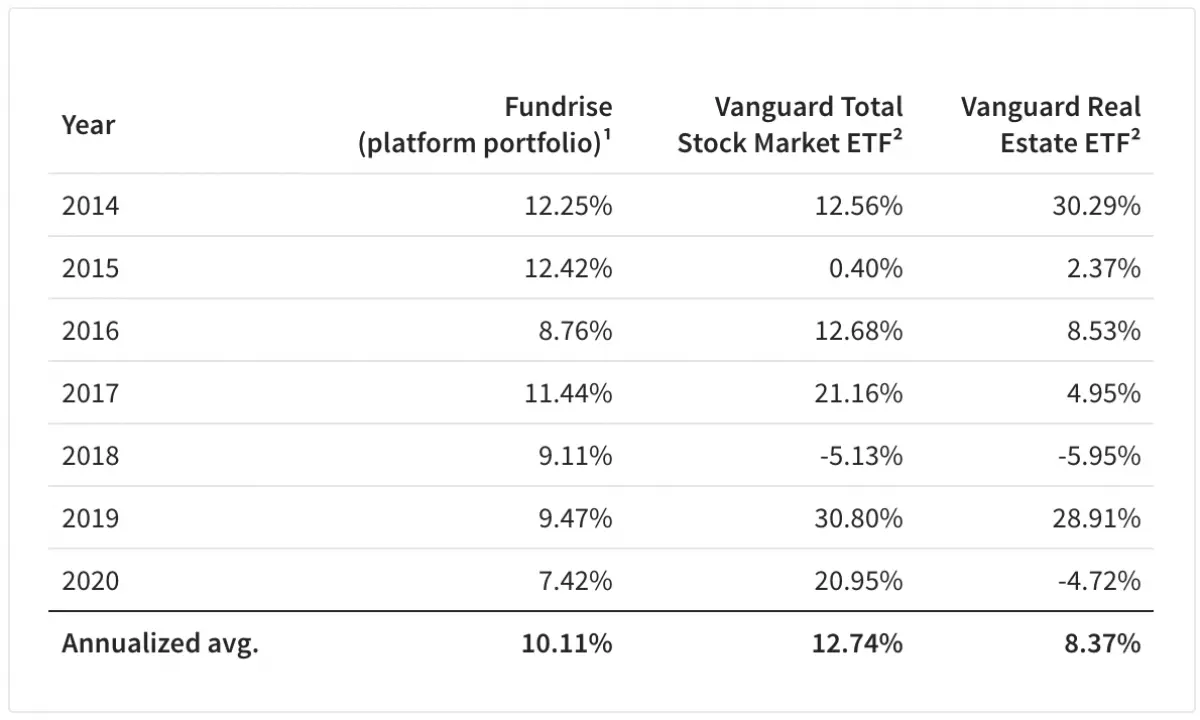

Historical Performance and Bright Future

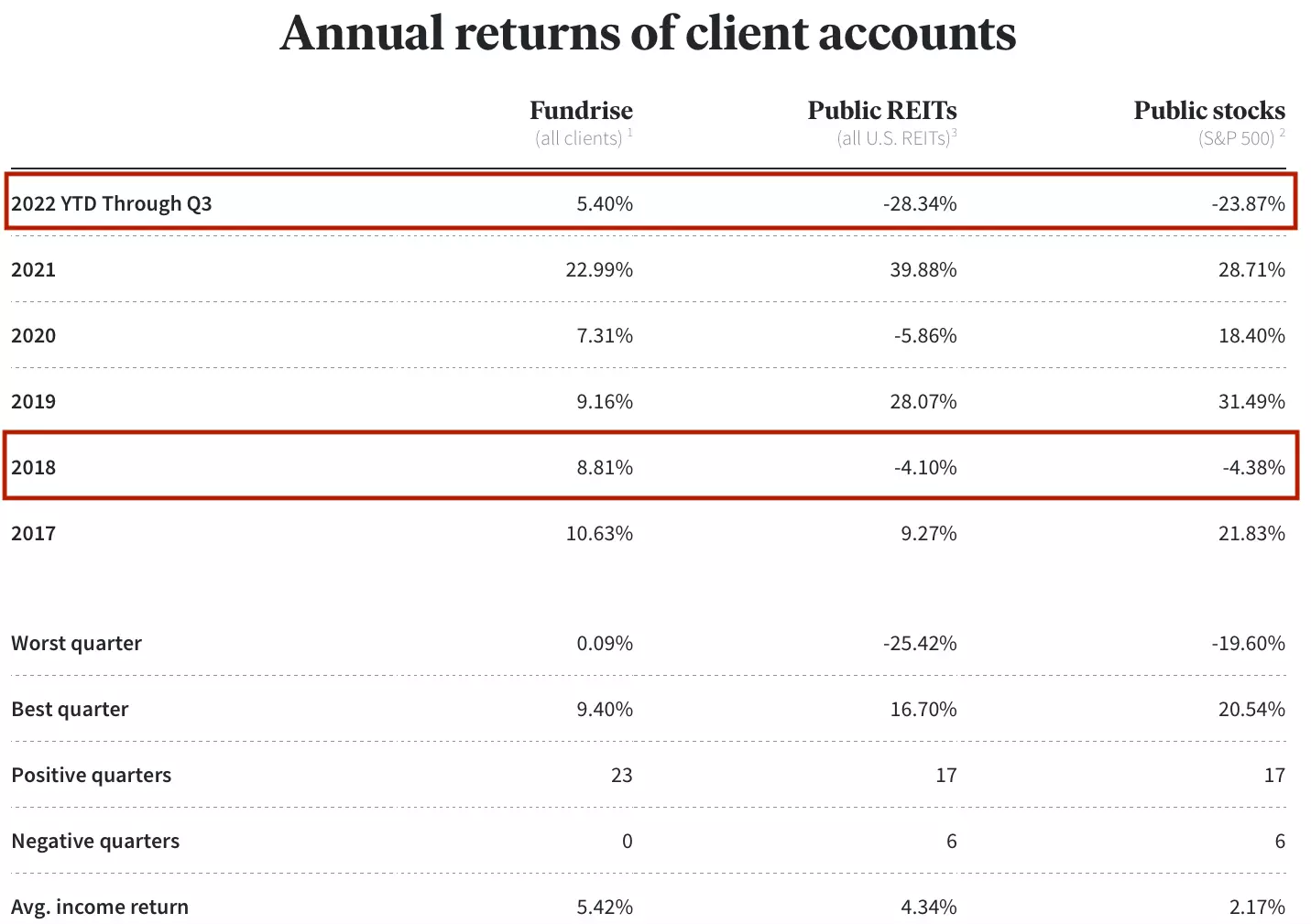

Fundrise's historical performance reflects consistency and long-term value. While returns may vary from year to year, Fundrise's approach to real estate investing stands strong against market volatility. The platform aims to deliver strong returns, comparable to or exceeding those of publicly available asset classes in a low-fee, passive manner.

As Fundrise continues to grow and refine its business model, investors can expect even stronger returns through enhanced efficiency. Real estate, with its stability and potential for income generation, remains an attractive investment option for the long term.

In a year marked by market turmoil, real estate has outperformed stocks by over 27%. Investors looking to diversify their portfolios and navigate potential stock market corrections can turn to Fundrise for a smoother investment experience. While stock valuations remain high, investing in real estate can provide a buffer against inflationary or deflationary pressures.

Ready to Explore Fundrise?

Don't miss out on the opportunity to explore real estate investing with Fundrise. Sign up and experience the future of investment. Remember, Fundrise is not a get-rich-quick scheme but a platform that aims to provide long-term consistency and stable returns.

[Sign up and explore for free]

[Sign up and explore for free]