Investing in commercial real estate can be a lucrative venture, but assessing the profitability of a deal can be challenging. That's where the equity multiple comes in. This financial metric allows investors to evaluate commercial real estate opportunities and determine their potential returns. In this article, we will dive into the concept of the equity multiple, its calculation, examples, and the pros and cons associated with its use.

What is an Equity Multiple in Commercial Real Estate?

The equity multiple is a straightforward metric that compares the initial investment in a commercial property with the total cash distributions received from the project. By dividing the cash earned from the transaction by the sum invested, investors can determine the profitability of the deal. It is important to note that the equity multiple calculation only considers two numbers: the equity invested in the property and the total cash received from the investment.

Equity Multiple vs IRR

While the equity multiple is a useful measure, it does have its limitations. One such limitation is that it does not consider the time value of money. In other words, it fails to account for the fact that receiving a certain amount of cash over a shorter period is more profitable than receiving the same amount over a longer period.

To overcome this limitation, investors can also use the internal rate of return (IRR) in conjunction with the equity multiple. The IRR provides the annual rate of return on the investment by considering the timing of the cash flows and the time value of money. By utilizing both metrics, investors gain a comprehensive understanding of the amount of money earned on the deal and the annual rate of return.

Equity Multiple vs. Cash on Cash Return

Another metric often used in real estate investment analysis is the cash on cash return. This metric calculates the percentage of total cash distributions received in a year to the total equity invested. While the equity multiple considers the entire life of the investment, the cash on cash return focuses on a specific period, usually a year.

How to Calculate the Equity Multiple

Calculating the equity multiple is a straightforward process that can be applied to both existing and potential investments. Simply divide the total cash inflows over the project's life by the total equity investment. The resulting number is the equity multiple.

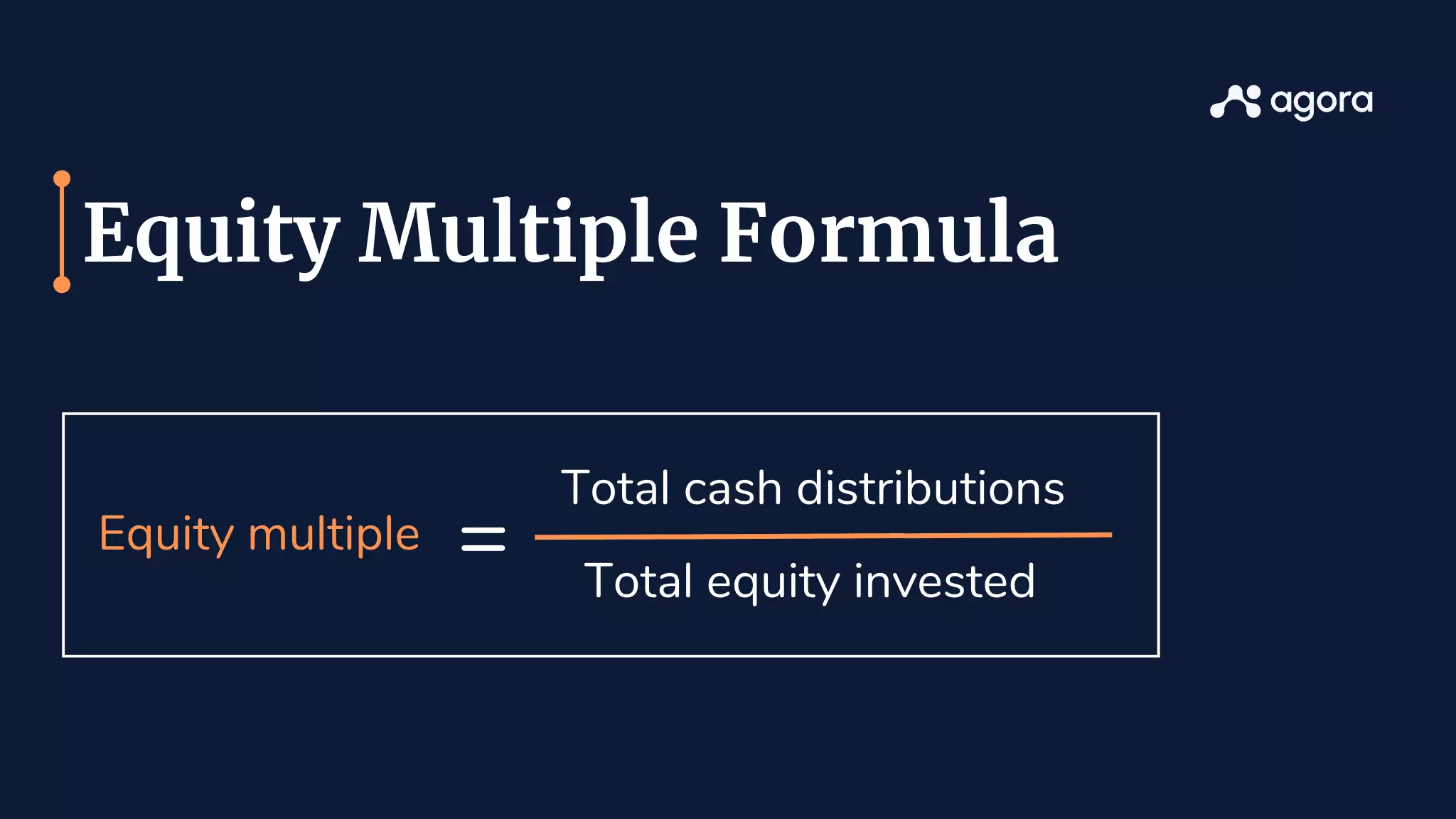

Equity Multiple Formula

To evaluate a potential investment, divide the future cash flows from the project by the proposed equity investment. For an existing investment, divide the cash inflows by the outflow. The formula is as follows:

Equity Multiple Examples

Let's explore some examples to better understand the equity multiple calculation:

Example 1

- Initial investment in a commercial real estate property: $500,000

- Cash inflows received from Year 1 to Year 10: $150,000

- Sum received from the sale of the property at the end of Year 10: $700,000

By applying the equity multiple formula:

Equity multiple = (Total cash distributions) $850,000 / (Total equity invested) $500,000 = 1.7

In this example, the investor has earned $1.7 for every dollar invested in the property.

Example 2

- Initial investment in a commercial real estate property: $1,000,000

- Cash distributions received from Year 1 to Year 10: $300,000

- Sum received from the sale of the property at the end of Year 10: $700,000

Applying the equity multiple formula:

Equity multiple = $1,000,000 / $1,000,000 = 1

In this case, the investor has recovered the principal investment, but there is no profit.

What is a Good Equity Multiple?

A higher equity multiple generally indicates a better return on investment. An equity multiple greater than one means that not only has the initial capital been recovered, but a profit has also been made. However, it is important to note that the equity multiple alone does not consider factors such as risk or the time value of money.

While a higher ratio is generally favorable, it is crucial to consider other indicators and factors before making investment decisions. A high equity multiple may be misleading if other risk factors are ignored.

Pros and Cons of the Equity Multiple

The equity multiple offers a simple and easily understandable measure of return, making it a popular choice for evaluating property investments. It is a metric that cuts through complexity and provides a quick assessment. However, it has its limitations, particularly regarding the time value of money. Additionally, the equity multiple does not provide insights into the inherent risk associated with a transaction.

To make informed investment decisions, it is important to supplement the equity multiple with other tools such as IRR and comprehensive risk assessments. Achieving successful real estate investments requires a balanced approach that takes into account various factors, rather than solely focusing on the highest multiple.

The Bottom Line

Investing in commercial real estate can be both rewarding and complex. The equity multiple serves as a valuable metric that allows investors to evaluate the potential returns of a deal. By understanding how to calculate the equity multiple and considering its pros and cons, investors can gain valuable insights and make informed investment decisions.

Remember, while the equity multiple provides a quick and digestible measure of return, it should not be the sole factor in investment decision-making. Taking into account other metrics and risk considerations is vital to ensure a well-rounded evaluation of a commercial real estate opportunity.