Image: Warehouses with solar panels (abadonian)

Image: Warehouses with solar panels (abadonian)

Dream Industrial REIT (DIR.UN:CA / DREUF) is a prominent company within the Dream family, managing and owning a diverse portfolio of distribution, urban logistics, and light industrial assets across Canada, the US, and Europe. While DIR may initially appear inexpensive, a closer examination reveals that it is adequately valued and offers limited margin of safety. In this article, we delve into the details to shed light on the potential of DIR in comparison to its competitors.

A Snapshot of DIR's History

Over the past few years, DIR has made significant acquisitions, amassing properties worth over $4 billion while divesting approximately $300 million of non-core assets. Its commendable 5-year total return of around 28% has outperformed the TSX Composite Index by about 7 points and the TSX Capped REIT index by approximately 41 points. In November '22, DIR partnered with the Singaporean Sovereign Wealth Fund, GIC, in a joint venture to acquire Summit Industrial Income REIT for a whopping $5.9 billion, solidifying its position in the market.

Image: Portfolio Snapshot (Empyrean; DIR)

Image: Portfolio Snapshot (Empyrean; DIR)

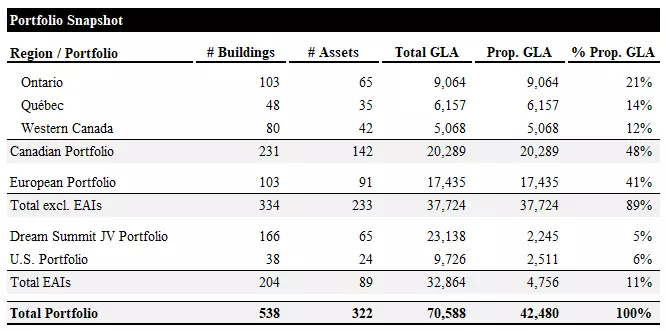

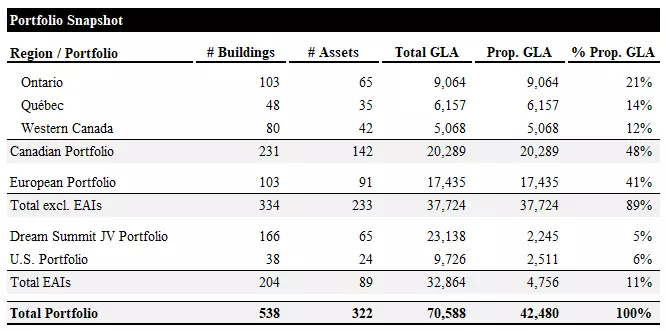

Analyzing DIR's Portfolio

DIR's expansive portfolio consists of 233 properties spread across Canada and Europe, totaling approximately 37.7 million square feet of gross leaseable area (GLA). Additionally, its collaborations in the form of the Dream Summit and US JVs own 89 properties, contributing around 32.9 million square feet of GLA (approximately 4.8 million at DIR's share). It is worth noting that the top ten tenants of DIR account for only about 11% of gross recurring revenue and GLA. However, the creditworthiness of these tenants falls short in comparison to other major Canadian industrial REITs. While this may not be a significant concern, it is an aspect to consider when evaluating DIR against its competitors like Granite.

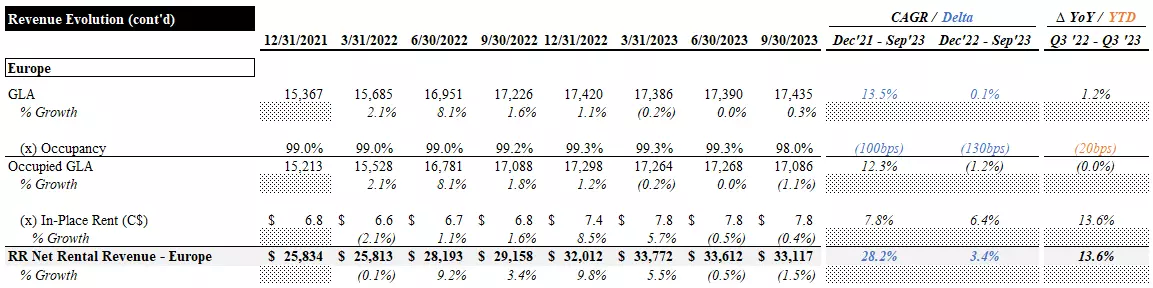

Recent Performance and Financial Analysis

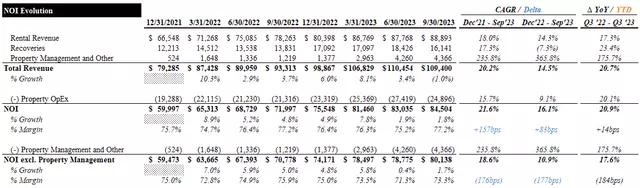

In terms of earnings and cash flow evolution, DIR's performance from year-end '21 to Q3 '23 has been commendable. Rental revenue has grown at an impressive compound annual growth rate (CAGR) of around 20%, outpacing recoveries. Furthermore, net operating income (NOI) has shown a CAGR of approximately 19%. However, it is vital to note that DIR does not report Adjusted Funds from Operations (AFFO), but our calculations suggest an AFFO growth of around 19% on a CAGR basis.

Image: FFO and AFFO Evolution (Empyrean; DIR)

Image: FFO and AFFO Evolution (Empyrean; DIR)

Evaluating DIR's Valuation

Valuing DIR requires careful consideration of various factors. Compared to its competitor Granite, DIR trades at slightly lower multiples, with Granite trading at around 14.2x and 16.1x LQA FFO and AFFO, respectively. DIR's target price, based on a 5% discount to its net asset value per unit (NAVPU), reflects the lower quality of its tenants, greater exposure to Europe, and its continued issuance of units. Even without the discount, DIR does not offer a significant margin of safety. However, given the strength of the industrial market and its considerable loss-to-lease opportunity, which could drive robust growth, we give DIR a "Hold" rating. Investors seeking global industrial exposure through a Canadian REIT may find Granite to be a more appealing option.

Image: Valuation Summary (Empyrean; DIR)

Image: Valuation Summary (Empyrean; DIR)

Risks and Catalysts

Despite the challenges posed by new supply in the Canadian market, the industrial sector remains strong. Market rent growth continues to be positive, especially in Ontario and Quebec, where rental rates are significantly higher than the current rates. DIR also benefits from the opportunity to capitalize on loss-to-lease in its portfolio, supporting potential topline growth. However, Europe presents a more challenging environment, with slower economic growth potentially impacting DIR's growth in this region.

Management Business and Conclusion

DIR's property management agreements contribute only a small portion of its overall income, accounting for approximately 3% of NOI in Q3. While this segment offers room for growth, it does not significantly impact our valuation.

In conclusion, DIR initially appears to be an affordable entry point into the industrial market. However, after a thorough evaluation of the portfolio and financials, it is evident that the lower quality of assets, European exposure, and reliance on equity-funded growth justifies the discount. We believe that Granite offers a more favorable opportunity in the industrial sector. Investors interested in DIR should exercise caution in their decision-making process.

Editor's Note: This article discusses securities that are not traded on major U.S. exchanges. Please be mindful of the risks associated with these stocks.