Brookfield India Real Estate Trust is set to launch its initial public offering (IPO), becoming the third Real Estate Investment Trust (REIT) to do so after the successful listings of Blackstone Group-backed Mindspace Business Parks REIT in 2020 and Embassy Office Parks REIT in 2019.

In this article, we will delve into the key details and insights surrounding the Brookfield India Real Estate Trust IPO. So, let's get started!

1) IPO Dates

The IPO subscription period will open on February 3, 2021, and close on February 5, 2021.

2) Price Band

The price band for the IPO has been fixed at Rs 274 to Rs 275 per unit.

3) Issue Size

Brookfield REIT aims to raise up to Rs 3,800 crore through the IPO. The company has already received Rs 1,710 crore from anchor investors.

4) Bids

Retail investors can bid for a minimum of 200 units and in multiples of 200 units thereafter. This means that the minimum application size for retail investors would be Rs 55,000 at the higher price band.

5) Objectives of the Issue

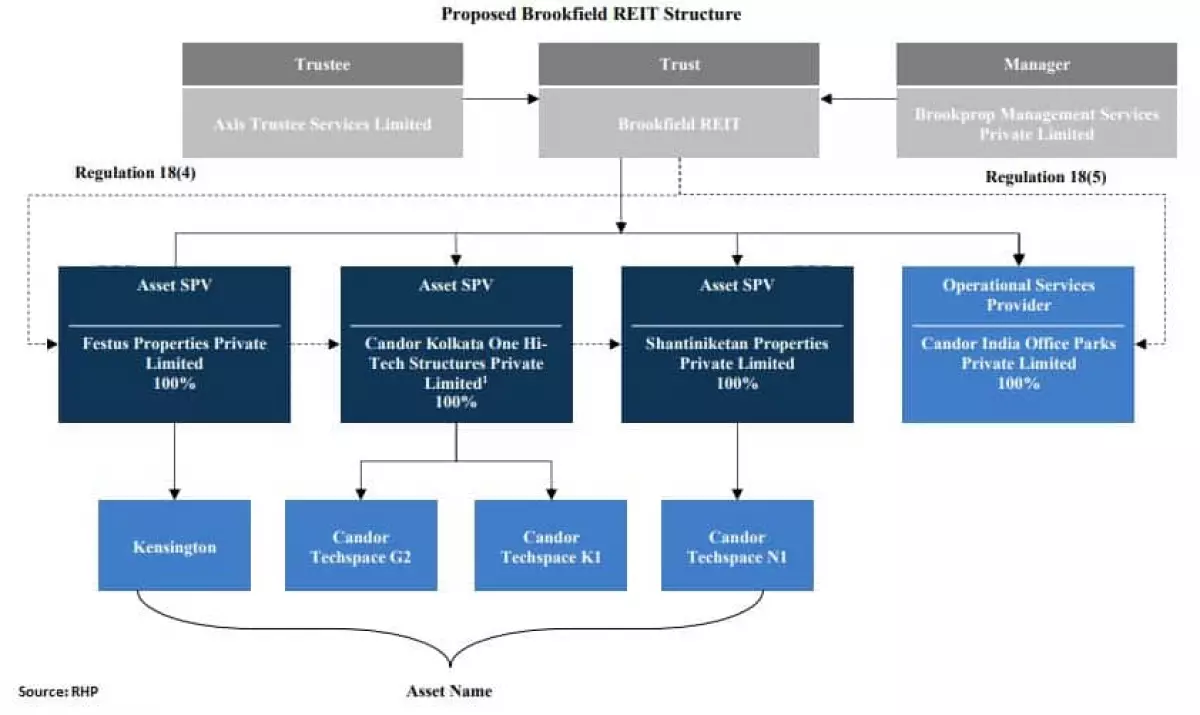

The net proceeds from the IPO will be utilized for partial or full pre-payment or scheduled repayment of existing debts of asset SPVs (special purpose vehicles), as well as for general corporate purposes.

6) Company Profile

Brookfield REIT is India's only institutionally managed public commercial real estate vehicle. It is sponsored by Brookfield Asset Management (BAM), one of the world's largest alternative asset managers with approximately $575 billion in assets under management as of September 2020.

The initial portfolio of Brookfield REIT comprises four large campus-format office parks strategically located in Mumbai, Gurugram, Noida, and Kolkata. With a total area of 14.0 million square feet, the portfolio includes completed areas, under construction areas, and potential future development areas.

The office parks boast a diversified tenancy profile, with marquee tenants such as Barclays, Bank of America Continuum, RBS, Accenture, Tata Consultancy Services, and Cognizant. The committed occupancy of the initial portfolio stands at an impressive 92 percent.

7) Key Operating Metrics for its Initial Portfolio

The office parks under Brookfield Group's ownership and management have shown significant operating progress. With high levels of committed occupancy and healthy growth in per square foot rents, the portfolio has been able to attract new development.

8) Competitive Strengths

Brookfield REIT believes that it stands out from other public commercial real estate companies and REITs in India due to the following competitive strengths:

- Global Sponsorship with Local Expertise

- Difficult to replicate, dominant, and strategically located properties

- Placemaking Capabilities in Manager and Sponsor's design, development, and operating philosophy

- Diversified blue-chip tenant roster and cash flow stability

- Significant identified internal and external growth opportunities

- Experienced, cycle-tested senior management team

- Institutional corporate governance framework and strong alignment of interests

9) Business and Growth Strategies

Brookfield REIT aims to maximize total returns for unitholders by focusing on growth and value creation at the asset level. The company plans to achieve this objective through the following strategies:

- Leveraging Brookfield and Manager's operating expertise for proactive asset and property management

- Capitalizing on the initial portfolio's embedded organic growth and on-campus development potential

- Pursuing disciplined and accretive acquisition growth opportunities

- Maintaining a prudent and flexible capital structure positioned for growth

10) Management

The corporate governance framework of Brookfield REIT is implemented by Manager - Brookprop Management Services. The Board of Directors comprises four directors, including two independent directors.

Akila Krishnakumar, an independent director of the Manager, brings her extensive industry experience to the table. Shailesh Vishnubhai Haribhakti, another independent director, is a seasoned professional in the field of finance and accounting.

Anuj Ranjan, a non-executive director, is part of the senior leadership of BAM and oversees investment initiatives and operations in Europe, Asia-Pacific, South Asia, and the Middle East. Ankur Gupta, also a non-executive director, is the country head of Brookfield Group in India and oversees investments and operations of the Brookfield Property Group.

Caption: Image from the original article

Caption: Image from the original article

To sum it up, the Brookfield India Real Estate Trust IPO presents an opportunity for investors to be part of India's only institutionally managed public commercial real estate vehicle. With its strategic portfolio, diversified tenancy profile, and competitive strengths, the trust aims to deliver long-term value to its unitholders. Make sure to consider all the key aspects and stay informed before making any investment decisions.

Caption: Image from the original article

Caption: Image from the original article

Caption: Image from the original article

Caption: Image from the original article

Remember, investing in IPOs involves risks, and it is essential to conduct thorough research and seek professional advice before making any investment decisions.