Real estate is often overlooked as a powerful asset for charitable giving, despite representing the largest asset class in the United States. While many individuals may opt to sell their appreciated property and then donate the after-tax proceeds to charity, this approach diminishes the size and impact of their gift. Donating real estate directly to charity offers significant benefits that should not be overlooked.

The Untapped Potential of Real Estate Giving

Donors are often unaware that they have the option to give real estate directly to charity. Additionally, the complexity of real estate gifts, which often involves a team of experts to execute, can deter potential donors. However, understanding the advantages of direct real estate giving is essential for maximizing the impact of your philanthropy.

Caption: Donating real estate directly to charity can have significant financial and philanthropic benefits.

Caption: Donating real estate directly to charity can have significant financial and philanthropic benefits.

Why Choose Direct Real Estate Giving?

Direct gifts of real estate to 501(c)3 public charities offer several notable benefits:

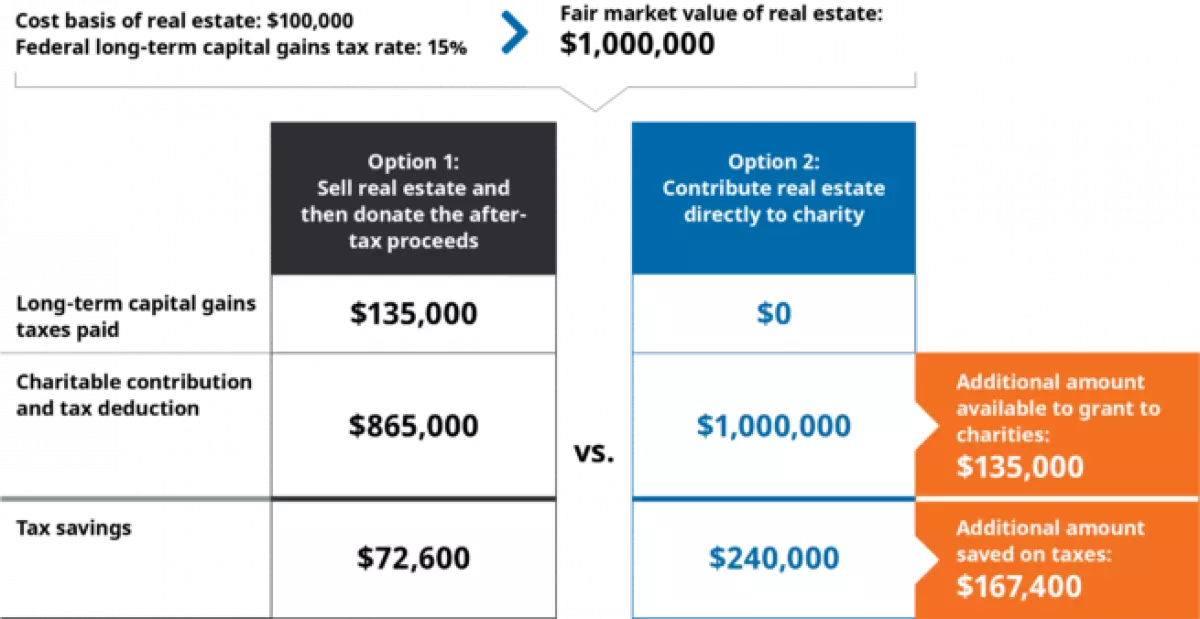

- Avoid Capital Gains Tax: By donating real estate directly to charity, you can bypass the capital gains tax that would be incurred if you were to sell the property.

- Charitable Income Tax Deduction: You can claim a charitable income tax deduction based on the fair market value of the property, providing potential tax savings.

- Retirement Income Enhancement: Direct real estate giving allows you to increase your income for retirement through options such as charitable gift annuities or charitable remainder trusts.

- Enhance Your Private Foundation: If you have a private foundation, direct real estate giving can complement its unique advantages, enabling you to amplify your philanthropic impact.

- Leave a Lasting Legacy: By donating real estate directly, you can create a lasting legacy for both you and your family.

However, it's important to note that not all charities are equipped to receive or process complex gifts like real estate. Finding the right avenue for your donation is crucial.

Donor-Advised Funds: The Solution to Complex Gifts

Donor-advised funds provide a solution for liquidating real estate gifts, allowing you to give or grant to the charities of your choice. By executing or signing a deed transferring ownership to a community foundation, such as The San Diego Foundation, you can donate long-term real estate (held for more than one year).

The value of your gift will depend on the property's fair market value, which needs to be established by an independent appraisal. Not only will you receive the previously mentioned benefits, but you will also have the flexibility to grant additional funds to your favorite causes over time as your original donation grows tax-free.

"We partnered with The San Diego Foundation to donate our family condo in Oregon to our donor-advised fund," said Foundation donor Jim Ward. "We relied heavily on their expert staff to guide us through the steps needed to maximize our donation and avoid paying unnecessary capital gains tax."

"I felt comfortable and secure donating my real estate to The San Diego Foundation," said donor Mike House. "I was getting the best advice and was able to lean on the team to maximize my gift."

At The San Diego Foundation, collaboration with your team of experts, including accountants, tax attorneys, and estate planning attorneys, ensures a smooth process for real estate gifts.

"The Foundation has been my partner in philanthropy for many years," said Laura Nichols, Certified Specialist in Estate Planning, Trust & Probate Law at Buchalter Law Offices. "My clients and I work with their giving advisors to realize estate planning goals, which often include using sophisticated trusts to increase charitable impact and maximize tax deductions."

Donating Non-Cash Assets: Simplifying Real Estate Giving

While gifts of real estate can be complex and less liquid than conventional assets, working with a community foundation like The San Diego Foundation alleviates many of the challenges. Since 1975, the foundation has been dedicated to helping socially-minded citizens create positive impacts in communities across San Diego. If you or your clients are interested in exploring the benefits of gifting complex, non-cash assets such as real estate to establish a donor-advised fund, the charitable giving experts at The San Diego Foundation are ready to assist you.

Note: For more information, please contact:

- Leslie S. Klein, CFP®, AEP®: Director, Gift Planning Advisor at The San Diego Foundation - Email: [email protected], Phone: (619) 814-1353

- Jason Rogers, AIF, CWS: Director, Wealth Advisor Relations at The San Diego Foundation - Email: [email protected], Phone: (619) 814-1397

Remember, by donating real estate directly to charity, you unlock the full potential of your philanthropy while securing significant benefits for yourself and your community. Speak with the experts at The San Diego Foundation to discover the power of real estate giving today.