Image: JuSun

Image: JuSun

Investing in real estate has always been a popular way to grow wealth, and buying rental properties is a common approach. However, this traditional method of investment comes with its fair share of challenges and expenses. Fortunately, there is a better way to own real estate, and it involves investing in Real Estate Investment Trusts (REITs) like AvalonBay Communities.

Why choose AvalonBay Communities?

AvalonBay Communities (NYSE:AVB) is one of the largest multifamily REITs in the market today. With 296 apartment communities strategically located in major metropolitan areas across the United States, AvalonBay offers investors a unique opportunity to diversify their real estate holdings.

AVB has consistently outperformed its peers in terms of total returns, generating an impressive 109% return over the past 10 years. This performance surpasses that of the Vanguard Real Estate ETF (VNQ) and peer Equity Residential (EQR), although it falls behind West Coast-focused peer, Essex Property Trust (ESS). Additionally, AVB investors have enjoyed a growing dividend while witnessing above-average annual returns.

Image: AVB vs. Peers Total Return (Seeking Alpha)

Image: AVB vs. Peers Total Return (Seeking Alpha)

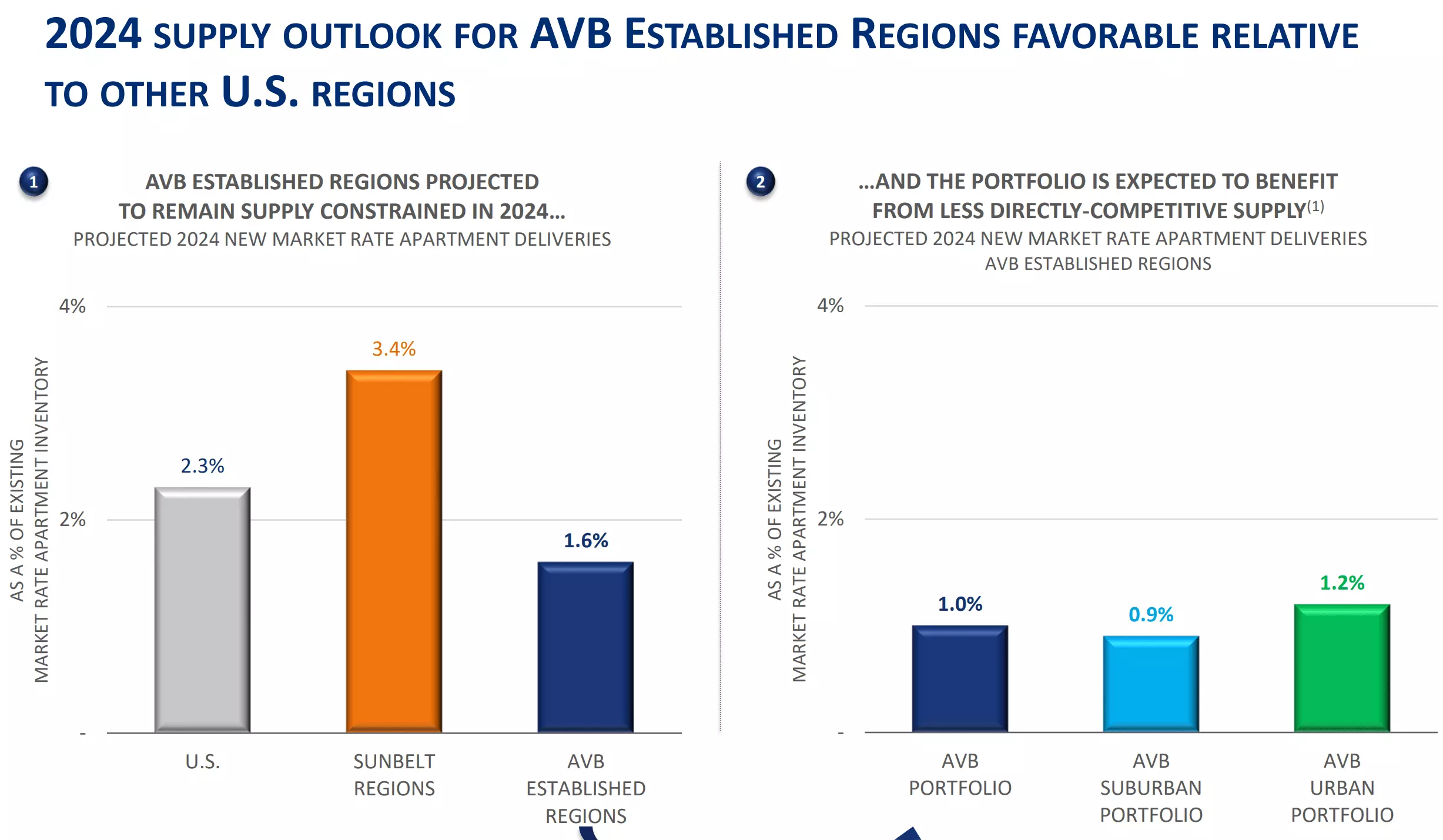

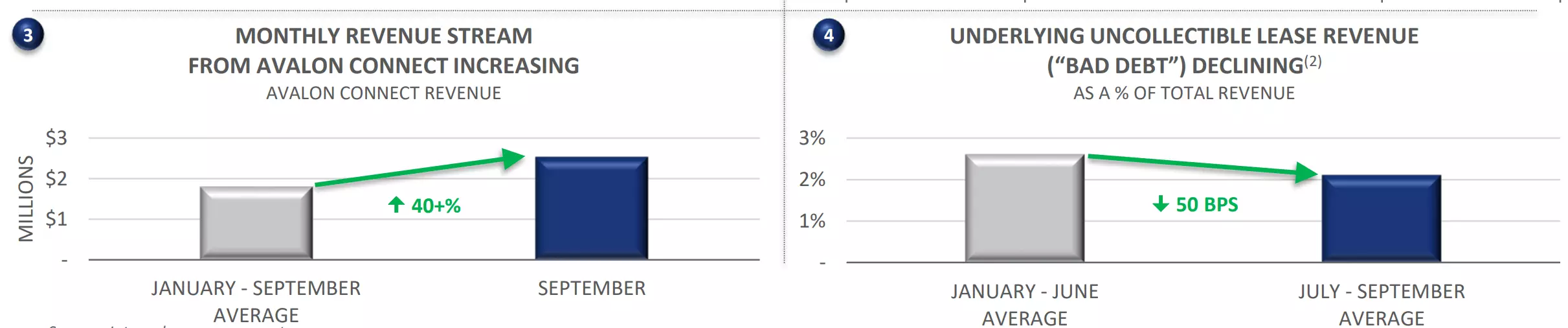

Supply-constrained regions and strong growth potential

One of the major advantages of investing in AVB is its presence in supply-constrained regions. This translates to higher barriers to entry and less competition, ultimately resulting in better long-term prospects for investors. According to estimates, new apartments are expected to represent just 1.6% of the total supply in AVB's markets, compared to an average of 2.3% for the entire U.S.

Furthermore, AVB has demonstrated strong growth, with Core Funds from Operations (FFO) per share growing by 6.4% year over year. This growth is a testament to the company's ability to capitalize on the bounce-back in demand and its solid positioning in key markets such as San Francisco.

Image: Investor Presentation

Image: Investor Presentation

A solid balance sheet and reliable dividends

When it comes to investing, having a strong balance sheet is crucial. AVB boasts one of the strongest balance sheets among REITs, with a net debt-to-core EBITDAre ratio of just 4.1x. Additionally, AVB maintains a high interest coverage ratio and the majority of its developments are match-funded with debt, ensuring a balanced approach to interest payments.

Notably, AVB has a long history of uninterrupted dividend payments dating back 29 years. Even during challenging economic periods such as the 2008-2009 financial recession and the recent pandemic-induced recession, AVB has continued to pay reliable dividends. Currently, AVB offers a well-covered dividend yield of 3.6%.

A compelling valuation and growth potential

Despite its impressive track record and strong fundamentals, AVB's valuation remains appealing. With a forward price-to-FFO ratio of 17.3, below its normal ratio of 22.2, AVB presents an attractive investment opportunity. Analysts also expect 4% to 10% annual FFO/share growth between now and 2026.

Image: FAST Graphs

Image: FAST Graphs

For investors seeking alternatives, other quality multifamily REITs such as Essex Property Trust, Camden Property Trust (CPT), and Equity Residential are worth considering. These companies also offer attractive portfolios in Tier 1 markets and trade at a discount to AVB from an EV/EBITDA perspective.

Investor Takeaway

In conclusion, AvalonBay Communities provides a better way to invest in real estate. With its presence in supply-constrained regions, strong growth potential, solid balance sheet, and reliable dividends, AVB offers a compelling opportunity for long-term investors. While it may not be a get-rich-quick stock, AVB's high-quality portfolio, low leverage, and analyst expectations for future growth make it an appealing choice for those looking to diversify their real estate holdings. Therefore, I maintain a 'Buy' rating on AVB.

Disclaimer: The information provided in this article is solely for informational purposes and should not be construed as financial advice.