Introduction

Are you looking for a unique investment opportunity that offers consistent distributions, capital preservation, and capital appreciation? Look no further than Ares Industrial Real Estate Income Trust (AIREIT). In this article, we will delve into the key aspects of AIREIT, including its portfolio, performance, investment requirements, and how to invest in this exciting opportunity.

What is Ares Industrial Real Estate Income Trust (AIREIT)?

AIREIT is a non-traded real estate investment fund managed by Ares Management, a renowned alternative asset manager with a global presence. AIREIT specializes in industrial real estate investments, focusing on high-quality bulk and last-mile distribution facilities in key logistics markets across the US. This industry segment has shown strong rent growth, low vacancy rates, and a demand that outpaces supply in recent years, making it an attractive investment option.

AIREIT Portfolio

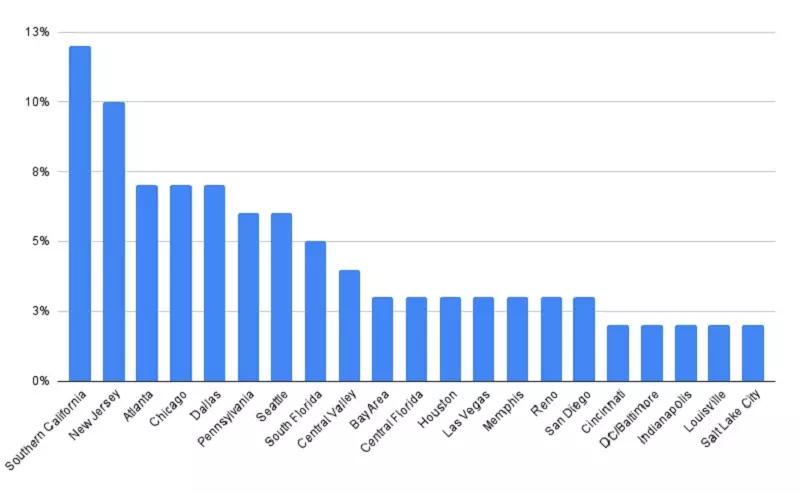

The AIREIT portfolio boasts impressive numbers, with a total asset value of $8.9 billion as of November 30th, 2023. The portfolio consists of 256 buildings spread across 29 geographic markets within the US.

Figure 1: AIREIT Portfolio Allocation, September 30th, 2023

Figure 1: AIREIT Portfolio Allocation, September 30th, 2023

The portfolio is entirely focused on industrial real estate, with 97.8% of the space leased to 431 tenants. With a weighted average remaining lease term of 4.1 years and a leverage ratio of 37.3%, AIREIT ensures a balanced and stable investment environment.

AIREIT Performance Summary

AIREIT has consistently delivered strong performance since its inception on November 1st, 2017. The returns vary depending on the share class, but all classes have delivered attractive results.

Please refer to the original article for the tables of returns and distributions.

The Fund's success can be attributed to the extensive 25-year experience of Ares in sourcing, acquiring, developing, and operating industrial real estate assets.

AIREIT Investment Requirements

To invest in AIREIT, retail investors need to meet certain eligibility requirements. Investors must either have a net worth of at least $250,000 (excluding primary residence, home furnishings, and automobiles) or a gross annual income of at least $75,000 and a net worth of $70,000 (excluding primary residence, home furnishings, and automobiles).

The minimum investment amount for Class T Shares, Class S Shares, and Class D Shares is $2,000, which makes AIREIT accessible to a wide range of investors. Compared to other private investment funds, AIREIT offers a more affordable entry point.

AIREIT Fees and Costs for Retail Investors

Investing in AIREIT involves various fees and costs related to the management and operation of the Fund. These fees vary based on the share class, but they are transparent and fully disclosed.

Please refer to the original article for the breakdown of fees.

To evaluate how these fees will affect your investment performance, you can utilize the interactive Alternatives Investor private real estate return calculator provided by AIREIT.

How to Invest in AIREIT Shares

Investing in AIREIT shares is straightforward and can be done through various channels depending on the share class:

- Class T Shares and Class S Shares are available to the general public, allowing easy access to individual investors.

- Class D Shares are available through fee-based programs, participating broker-dealers, registered investment advisers, bank trust departments, and other authorized entities.

- Class I Shares cater to institutional investors, retirement plans, financial intermediaries, and certain eligible purchasers.

For retail investors, working with an investment advisor is a common approach to gain access to private real estate investment funds like AIREIT. Leading wealth management firms and online alternative investment platforms offer opportunities to invest in AIREIT and similar investment options.

So, if you're looking for a unique investment avenue that combines consistent distributions, capital preservation, and capital appreciation, consider AIREIT - your gateway to the promising world of industrial real estate investing.

*Note: The images in this article are from the original AIREIT article and are intended to enhance the visual experience.