Hey there, real estate enthusiast! Ever wondered how the value of that shiny office building downtown is determined? You're not alone. Understanding commercial property valuation can feel like navigating a maze, but fear not, we're here to break it down.

In a nutshell, commercial property valuation is like finding the sweet spot in a negotiation. Buyers aim low, sellers aim high, and the right valuation process ensures a fair deal for all. It's more than just slapping a price tag on a building; it's about considering location, transferability, property condition, and a whole lot more. Think of it like baking a cake – you need the perfect blend of ingredients (experience and knowledge) to get that delicious outcome (a fair valuation).

But why is accurate valuation so important? Well, for sellers, it's about maximizing their return without scaring away potential buyers. For buyers, it's about making a smart investment and avoiding buyer's remorse. The bottom line? Getting the valuation right is crucial for a smooth and successful transaction.

Decoding the Language of Valuation: Key Terms to Know

Before we dive into the nitty-gritty of valuation methods, let's get familiar with some common real estate jargon:

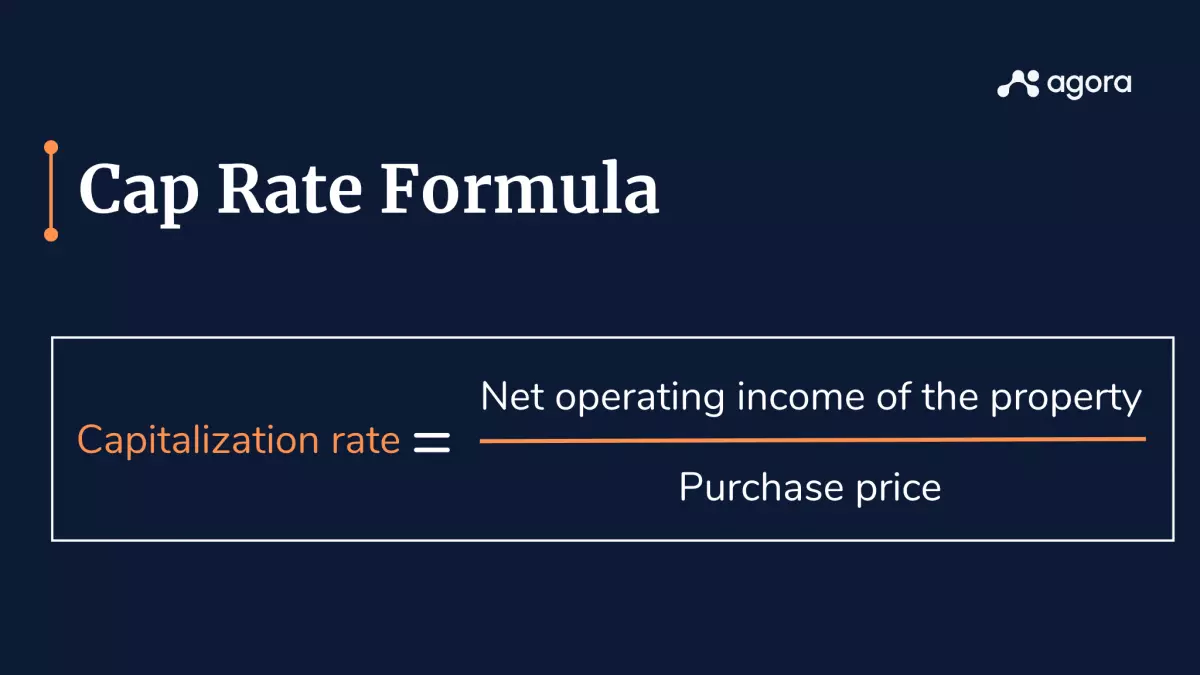

Cap Rate (Capitalization Rate)

Think of this as the rate of return you can expect on your investment. It's like calculating the interest you earn on a savings account, but instead of money in the bank, it's a property.

Debt Service

This is the money you need to shell out each year to keep up with your loan payments (both principal and interest).

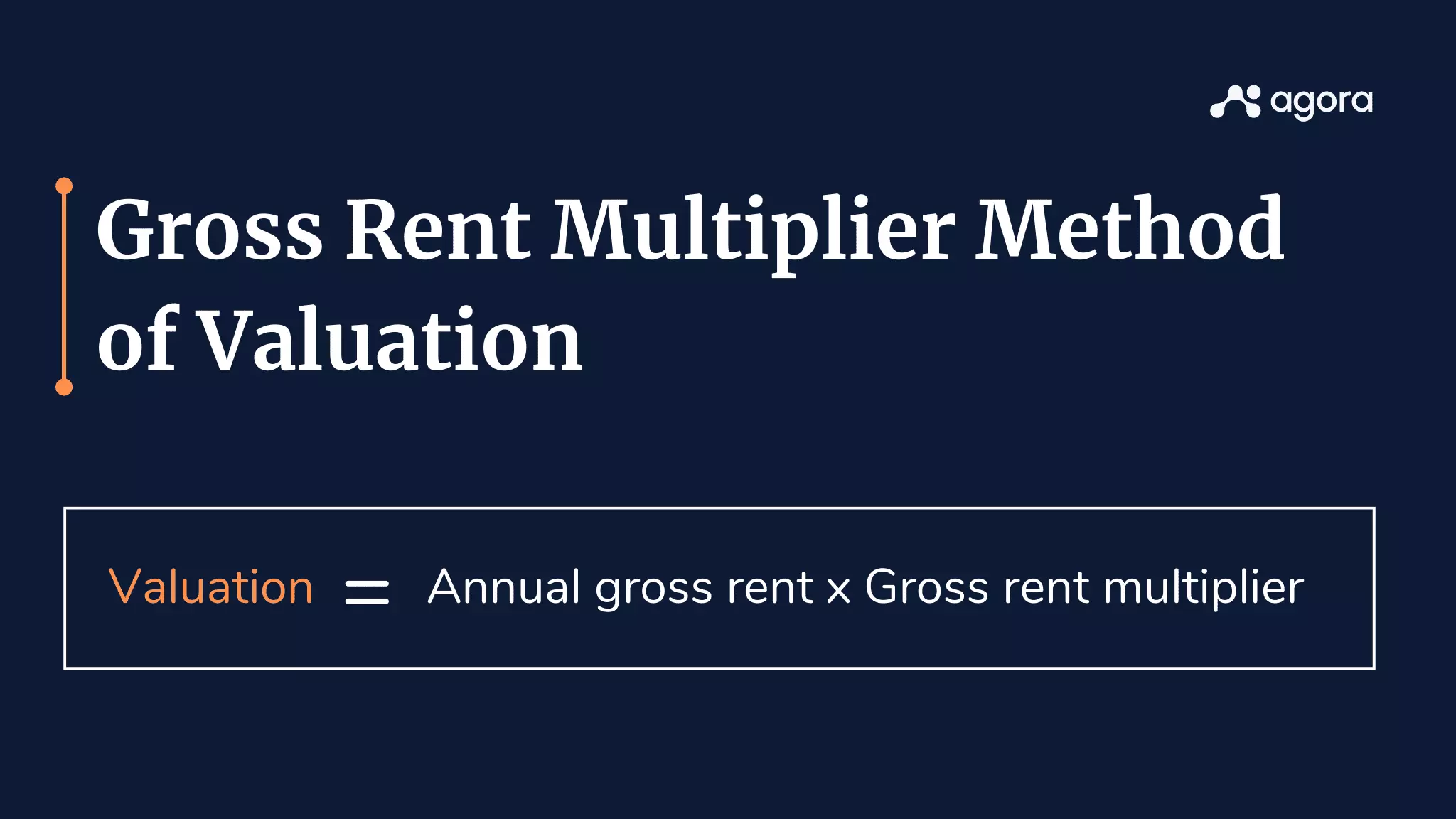

Gross Rent Multiplier (GRM)

This metric tells you the relationship between a property's price and its annual rental income. Think of it as a quick snapshot of a property's income-generating potential.

Net Operating Income (NOI)

This is the cash flow a property generates after deducting all operating expenses. It's like calculating your take-home pay after taxes.

Price per Square Foot

This one's pretty straightforward – it tells you how much you're paying for each square foot of space.

Return on Investment (ROI)

The golden metric! ROI calculates the profit you make on your investment after factoring in all costs.

Value

This refers to a property's worth – basically, the present value of all the future benefits it can bring.

Factors That Make All the Difference: What Impacts Commercial Property Value?

Now that we've demystified some key terms, let's look at the factors that influence valuation. Remember that real estate is all about location, location, location! But it's also about:

- Supply and Demand: Just like that limited-edition sneaker release, high demand and low supply drive prices up.

- Property Use and Location: A property's intended use and its location play a huge role. Is it in a prime spot? Does the layout work?

- Scarcity: Rare finds are valuable finds. Unique properties or those in high-demand areas command higher prices.

- Transferability: How easy is it to transfer ownership? Properties with simpler transfer processes are generally more desirable.

- Cost vs. Price vs. Market Value: Understanding these distinctions is key. Cost is what you paid, price is what you agree on, and market value is the property's estimated worth.

- Local Market Trends: A bustling local market with limited inventory can send prices soaring.

- Market Stability: Stable markets are predictable, making valuations more reliable.

7 Methods to Crack the Code: How Commercial Property Values Are Determined

Now for the main course – the valuation methods themselves! Each approach uses different criteria to determine a property's worth. It's like having different tools in a toolbox – you choose the one that best suits the job.

1. Cost Approach

This method focuses on the cost of constructing a similar property from scratch, taking depreciation into account. It's often used for unique properties or in slow markets where comparable sales data is limited.

2. Discounted Cash Flow (DCF)

This method analyzes a property's projected future cash flows (both incoming rent and eventual sale proceeds) and discounts them back to their present value. It's a forward-looking approach that's useful when future income streams are predictable.

3. Sales Comparison Approach

This method compares the property to similar recently sold properties in the area, making adjustments for any differences. It's like checking the "recently sold" listings to gauge the market value of your own home. This approach is most effective when there are plenty of comparable sales.

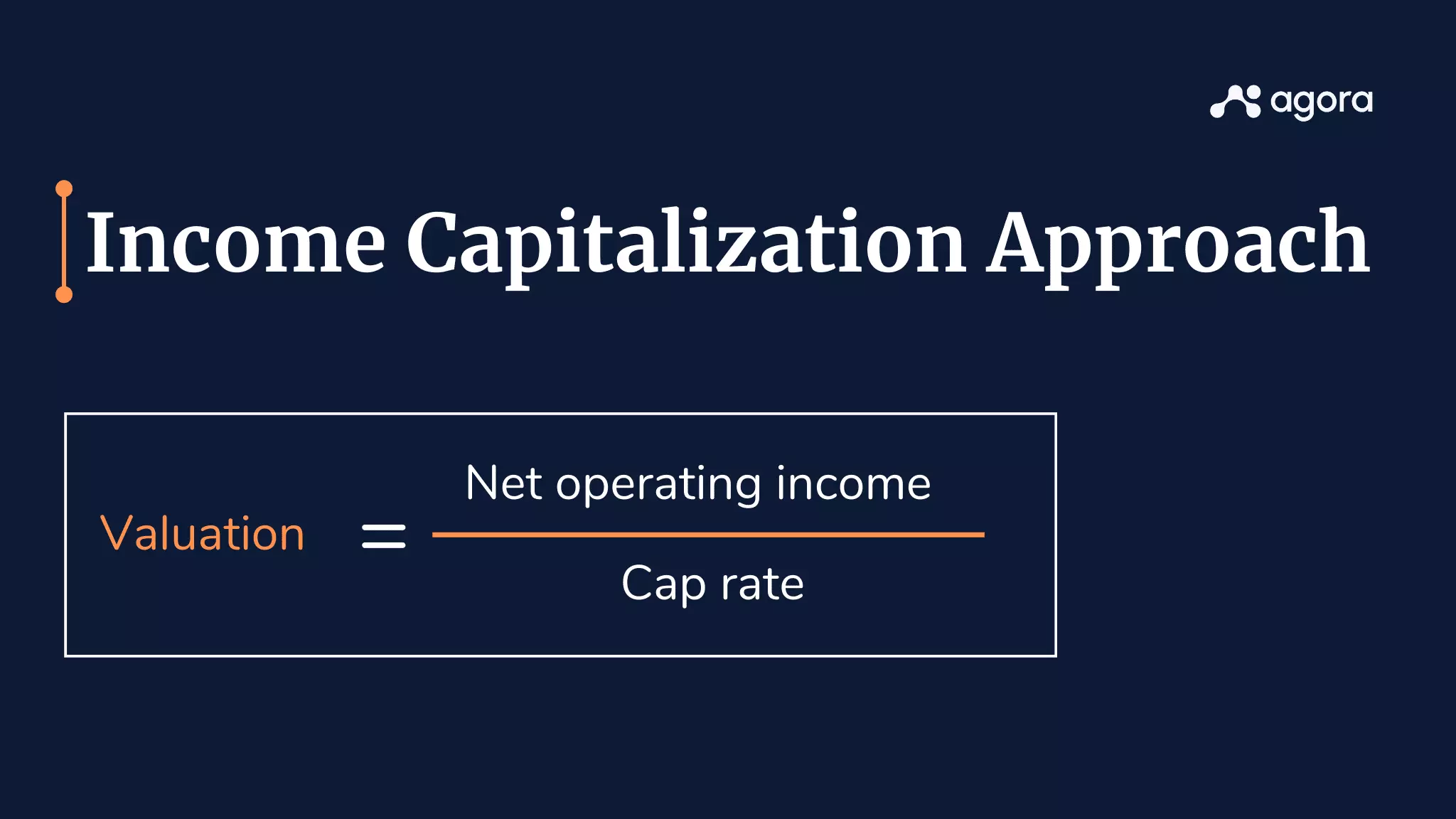

4. Income Capitalization Approach

This method divides the property's net operating income (NOI) by a chosen capitalization rate. It's a popular choice for income-generating properties.

5. Value per Gross Rent Multiplier

This simplified method uses gross rent instead of NOI, making it useful for quick comparisons between similar properties.

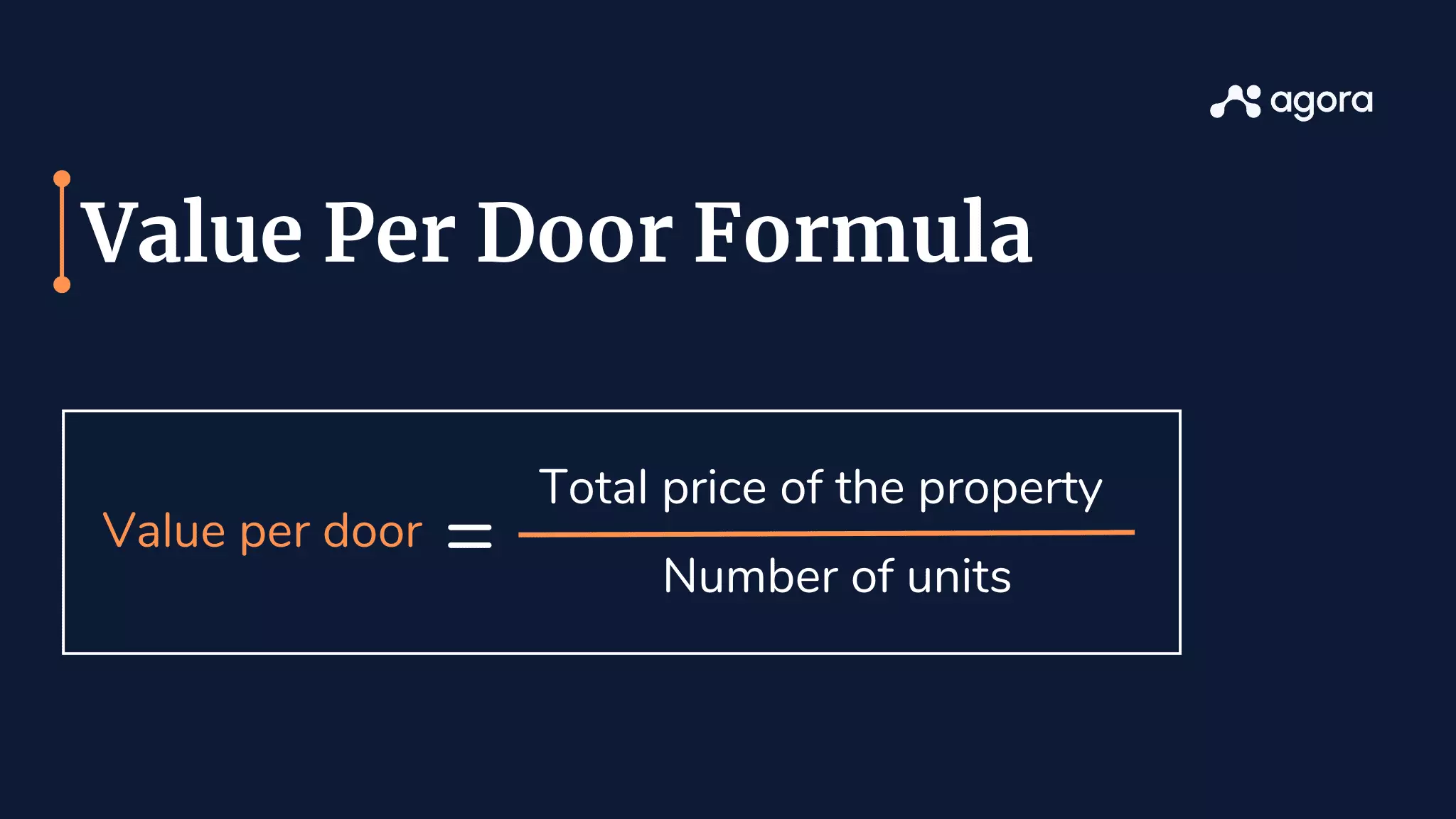

6. Value per Door

Primarily used for multi-unit residential properties, this method can also apply to commercial properties with multiple, similar units.

7. Cost per Rentable Square Foot

This method divides the property's price by its total rentable square footage, including shared spaces. It's often used for high-end commercial properties.

Overcoming the Challenges: The Art and Science of Accurate Valuation

Commercial real estate valuation isn't an exact science. Each property is unique, and market conditions are constantly in flux. However, by using reliable data, making realistic assumptions, and carefully considering all relevant factors, we can arrive at a valuation that is as accurate and insightful as possible.

Remember, valuation methods are tools, and choosing the right one (or a combination) is key. The real magic lies in combining these tools with a deep understanding of the market and the property itself.

So, there you have it! You're now well on your way to navigating the world of commercial property valuations.