Lately, I've become fascinated with preferred stocks as an income-oriented investment vehicle. In a low-interest rate, low-yield environment, the relatively high yields typically offered by preferred shares become more attractive.

With my experience in real estate, I am particularly interested in the preferred shares of real estate investment trusts ("REITs") that offer high yields backed by commercial real estate. These are tough times for many real estate sectors, as the pandemic and social distancing policies have taken a punishing toll on a large number of CRE tenants, especially in retail, restaurants, lodging, and entertainment. If one knows where to look, however, there are still some great deals to be had in various corners of the REIT preferred market.

In what follows, I'll give a quick primer on preferred stocks and then offer six individual REIT preferreds currently yielding 7% or more with safe payouts and upside to par value. Compare this to the InfraCap REIT Preferred ETF (PFFR), which includes preferreds from higher risk sectors such as lodging and mortgage REITs and still yields only 6.67%.

Barring some new, catastrophic development in the pandemic or the U.S. economy, these six preferred stocks should continue to faithfully reward shareholders for years to come.

Quick Primer On Preferreds

Preferred stocks, also simply called "preferreds," are a special class of shares that fall between debt and common equity in seniority. Preferred dividends must be paid before common equity dividends can be paid, but interest on the debt must be paid before preferred dividends can be paid. They act like debt in that preferred shares pay out a fixed dividend and typically have a par value (often set at $25), but various other elements make them more like equity. There is a fairly large amount of variety under the general umbrella of preferreds, with some varieties acting more like debt and others more like equity.

For instance, a minority of preferreds have a set redemption date, much like the maturity date for bonds. Most, however, are perpetual, meaning that they can remain outstanding indefinitely. Likewise, most preferreds have a call date, which is the date after which a preferred series can be called at any time by the issuing company. Also, after the call date, a company can redeem a preferred series either in whole or in part; they do not need to redeem all of it at once. Some preferreds are convertible into a predetermined number of common equity shares, which make them somewhat like an option.

Preferreds can be cumulative or non-cumulative. Non-cumulative preferreds are only obligated to pay out dividends when the company has adequate profits to cover those dividends, and quarters in which profitability is inadequate to pay out dividends (in full) will not be made up in future quarters. Cumulative preferreds, on the other hand, are obligated to pay out the full promised quarterly dividend each quarter, and if the company is unable to do so, it is obligated to pay them out in arrears when profitability makes this feasible. Companies with cumulative preferreds must pay out the full amount owed to preferred shareholders before dividends on the common stock can be paid again. Also, if the company wishes to call its cumulative preferred shares with dividends still in arrears, it must also pay all accumulated dividends at the time of redemption.

The following six REIT preferred stocks are arranged in order of my personal preference for them, from last to first. That preference is determined by my assessment of the dividend safety as well as the risk-adjusted total returns offered at present prices.

1. UMH Properties PFD Series C Cumulative & Perpetual (UMH.PC)

Current Yield: 7.0%

Upside to Par Value: 3.76%

Call Date: 7/26/2022

UMH Properties (UMH) owns and operates manufactured housing communities in Northeastern and Midwestern states. Manufactured homes (sometimes called trailer homes) have been a steady and reliable business for UMH over the years. Though the company had to cut its dividend during the Great Recession, it has managed to keep its dividend steady since then, consistently offering a high yield.

So why not just buy the almost 6%-yielding common shares of UMH? I am not attracted to the common equity because of the company's large debt load and high payout ratio. Net debt to EBITDA sat at 5.4x at the end of Q1, but that doesn't tell the whole story. Much of UMH's capitalization comes from preferred equity. Combining net debt with preferred equity, the two reach a startling 11.7x EBITDA. Together, they make up around two-thirds of the company's total capitalization.

About 35% of UMH's capitalization is preferred equity, and that percentage is growing. UMH Pfd Series C shares have increased ~70% YoY, and Series D shares total 2.6x their value at the end of Q1 2019. This is due to issuance. It appears that UMH has decided to issue more preferred equity in order to avoid common equity dilution or taking on more loans.

And though the company continues to pay out its quarterly 18 cents per share dividend, it cannot really afford to keep paying it. In Q1, UMH brought in only 15 cents in FFO, and analysts estimate the company will bring in only 66 cents of FFO for all of 2020, compared to 72 cents in dividends being paid out annually.

The good news is that over two-thirds (68.3%) of UMH's debt matures after 2024, and almost none matures in 2021. And while the common equity dividend is not covered by cash flows, FFO would need to drop considerably before the preferred equity shares are at risk of a cut.

As already mentioned, there are two other preferred series for UMH right now: B and D. Series B yields the most at 7.86% (compared to yield at par of 8%), but it is trading at a premium of 1.76% to par, and the call date is October 20th of this year. Series D trades at a nearly 5% discount to par but offers only a 6.7% yield.

What's more, UMH's series C has the largest dollar value of shares outstanding of the three series, with $244 million at the end of Q1 compared to series D's $130 million and series B's $95 million. It would be most cost-effective to redeem series B first, and after that, the company would need to come up with a huge chunk of cash to redeem a significant amount of series C shares.

Assuming UMH redeemed this series of preferreds on the call date, the annual total return would come to 8.9%, while the total return would reach 17.8%.

2. iStar Inc. PFD Series I Cumulative & Perpetual (STAR.PI)

Current Yield: 7.8%

Upside to Par Value: 3.12%

Call Date: 3/1/2009

iStar Inc. (STAR) is a real estate investment trust that focuses predominantly on net lease real estate, RE finance, and ground leases through its $2.2 billion stake in Safehold Inc. (SAFE), a rapidly growing ground lease REIT. STAR founded and remains the majority shareholder of SAFE, a company that has been absolutely on fire since the beginning of 2019 as interest rates fall. Over half of STAR's investment in SAFE is unrealized gains.

Ground leases are a unique play on real estate in which the ground lease owner owns the land and leases it to the owner of the improvements (building or buildings) over an ultra-long period. The initial lease terms are typically 99 years, and if the improvements owner defaults on the ground lease rent, the owner of the ground lease has the right to take possession of the improvements as well. This makes the rental income from ground leases ultra-safe - hence the ticker symbol of the REIT.

In total, 71% of STAR's portfolio is either in ground leases (via SAFE) or net-leased CRE. These are the asset types that the company plans to focus on going forward, especially ground leases.

Source: STAR June Presentation

Source: STAR June Presentation

This makes STAR's cash flow very steady. For instance, in April of this year (probably the worst month of the pandemic for the U.S. economy thus far), STAR collected the vast majority of scheduled rent:

Source: STAR May Presentation

Source: STAR May Presentation

What's more, though STAR is heavily indebted with $3.6 billion in total debt compared to a market cap of a little over $900 million, its weighted average interest rate is a mere 4.3% and it has no debt maturities until Q3 2022.

The call date for STAR.PI has already passed - over 11 years ago, in fact - but the series has no redemption/maturity date. And though dividends are cumulative, the payout has never gone into arrears, having been paid on time and in full every quarter since the series IPO:

Source: Seeking Alpha

Source: Seeking Alpha

If STAR.PI was called one year from now (which I find unlikely due to the presence of higher yielding STAR preferreds, the company's large debt load, and the fact that this series has been around since 2004), the total return would come to 10.9%.

3. Global Net Lease PFD Series B Cumulative & Perpetual (GNL.PB)

Current Yield: 7.24%

Upside to Par Value: 5%

Call Date: 11/26/2024

Global Net Lease (GNL) is a triple-net lease REIT that focuses on single-tenant properties in the United States, United Kingdom, Europe, Canada, and Puerto Rico. Most (63%) of the REIT's properties are located in the U.S., with the U.K. taking the second place with 17%.

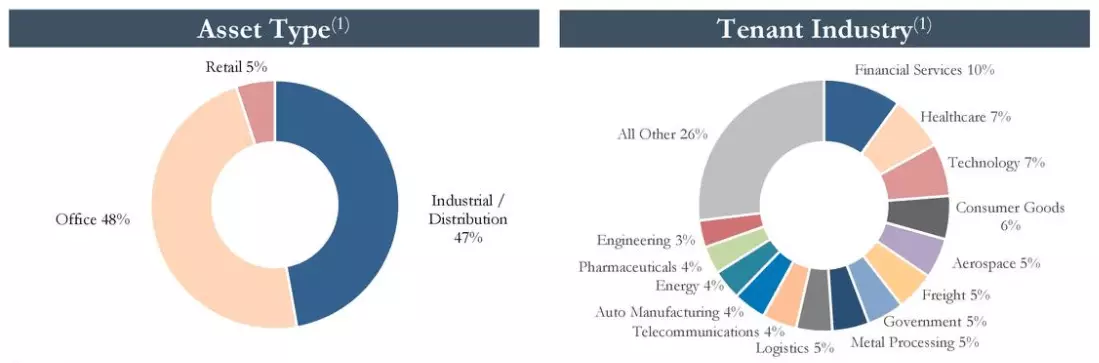

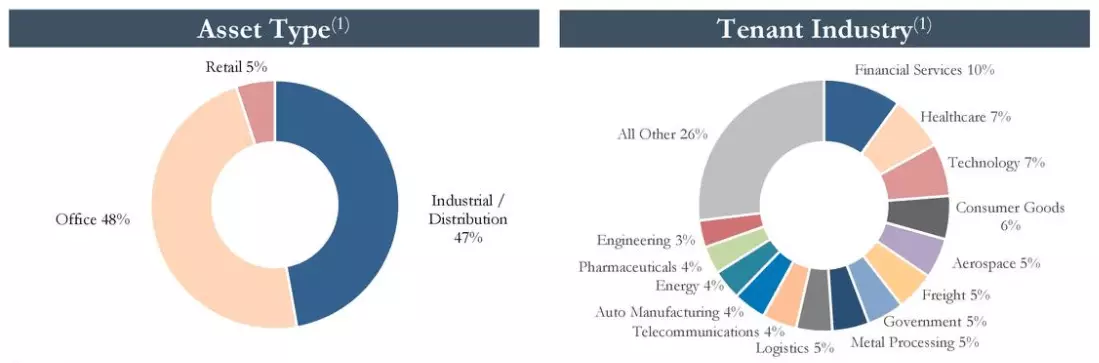

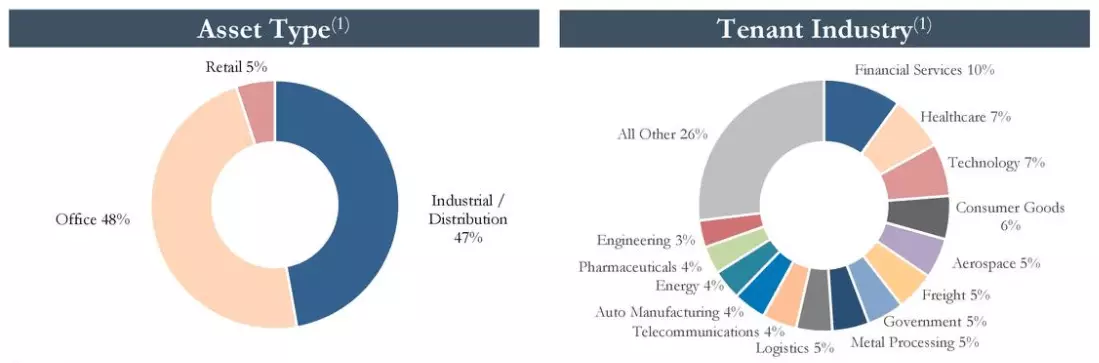

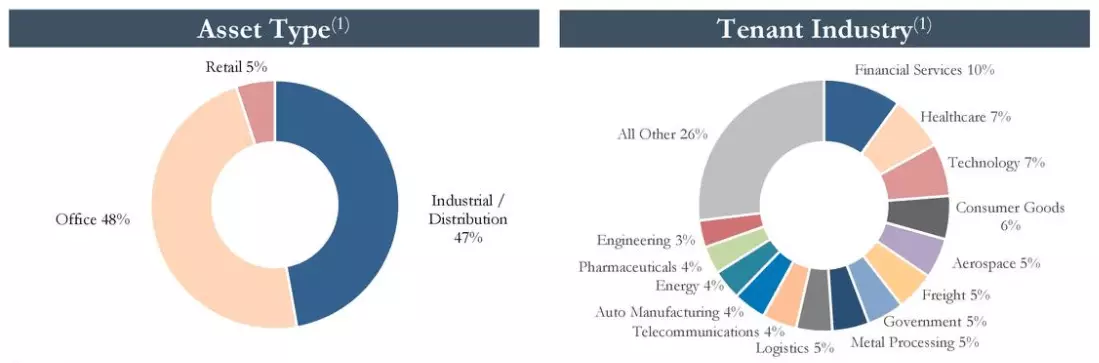

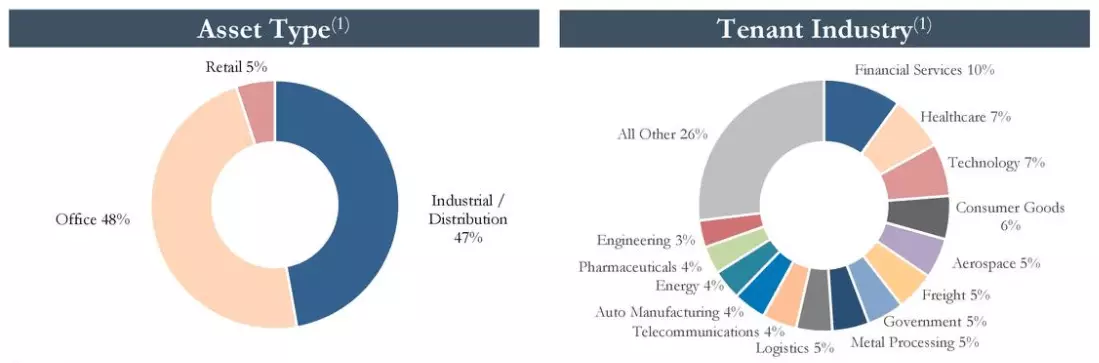

Two-thirds (67%) of its tenants by rent are investment grade or "implied investment grade" such as FedEx (FDX), Whirlpool (WHR), AT&T (T), Deutsche Bank, and HarperCollins. Most properties are either office or industrial/warehouse assets, and the portfolio is well-diversified by tenant industry.

Source: GNL Q1 Presentation

Source: GNL Q1 Presentation

Almost 94% of GNL's properties have built-in rent escalations, and the portfolio has a weighted average remaining lease term of 9.0 years. Only 2% of leases (as a percentage of square feet) are expiring by the end of 2021. What's more, its weighted average interest rate is a very low 3.1%, due largely to the fact that it is able to borrow in euros and British pounds, where rates are lower. And though there is very little by way of debt maturities until 2023 ($28 million), the company's debt load is moderately high at 7.1x net debt to EBITDA.

In Q1, GNL had to cut its dividend by 25% to get the quarterly payout under its AFFO. During the first quarter, the REIT paid out 90.1% of AFFO. This is great news for GNL preferred shareholders, as it means that the company won't need to financially weaken itself to continue paying out both the preferred and common dividends.

More good news is that rent collection has remained extraordinarily high across the portfolio. GNL collected 98% of contractual rent in Q2, with about half of the remainder under deferral agreements.

So why not own common shares? My reason is that GNL has an external management structure, which tends to set up a conflict (or, at least, tension) of interests between management and shareholders. With external management structures, one often finds poor financial management, even if the company's assets are high quality. Per-share total return tends to be poor because management is incentivized to grow the AUM rather than the FFO per share.

Sure enough, that is exactly what we find with GNL: of FFO per share, stock price, and total assets, the latter was the only one to grow over the last three years.

Why choose GNL's series B preferreds instead of the slightly higher yielding Series A? The latter offers a current yield of 7.3%. But there are two reasons why one would choose the series B over the series A: the discount to par value and the call date. The series A has a smaller discount to par of 0.72%, and its call date is over two years earlier: September 12th, 2022.

Buying the series B preferred shares would render an 8.4% annual total return, assuming the shares are redeemed on their call date. The total return over the 4+ years until then would come to 36.2%.

4. Taubman Centers PFD Series J Cumulative & Perpetual (TCO.PJ)

Current Yield: 7.59%

Upside to Par Value: 14.3%

Call Date: 8/14/2017

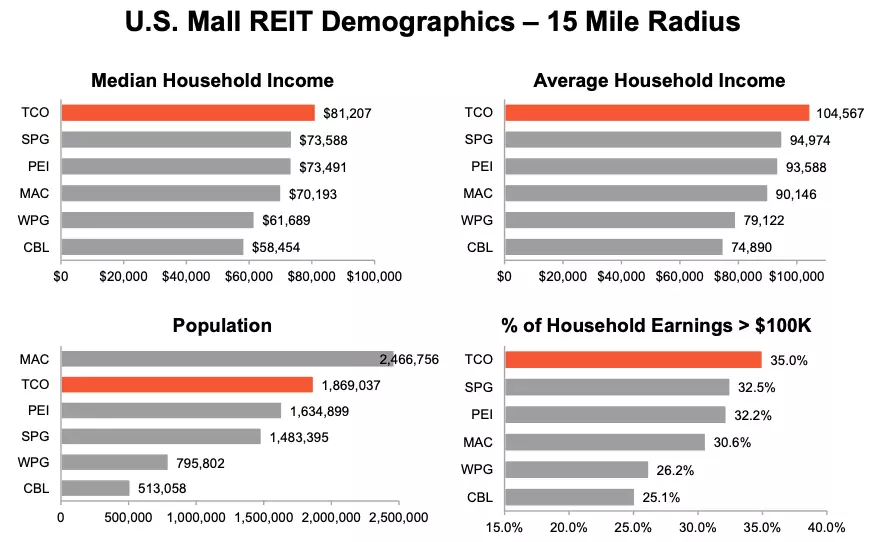

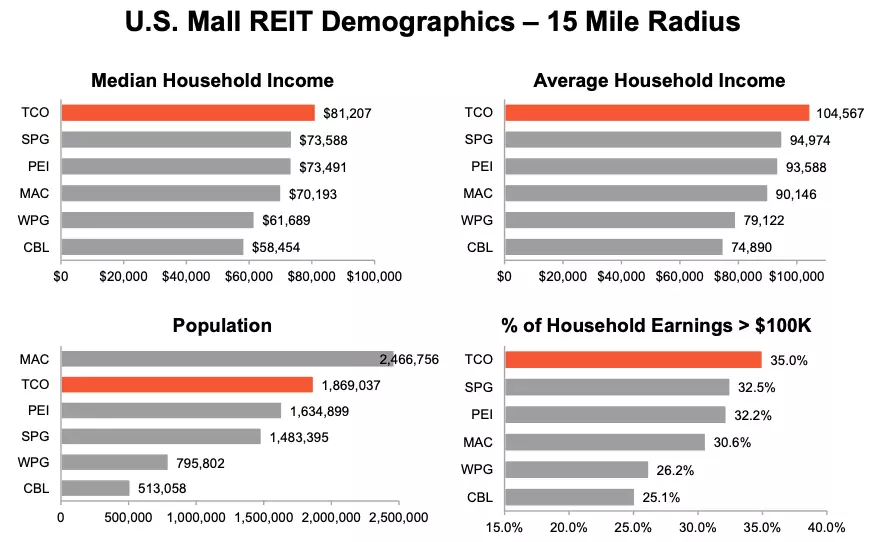

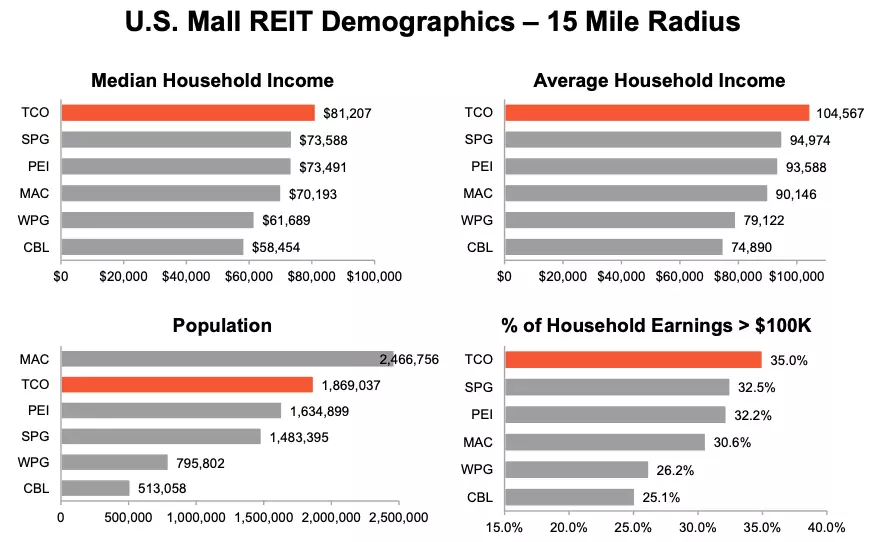

Taubman Centers (TCO) owns high-end, well-located indoor shopping malls in densely populated urban centers as well as in China and South Korea. Taubman's malls are the most productive, by tenant sales per square foot and rent per square foot, in the country. In terms of asset quality, Taubman's portfolio is second to none.

Source: 2019 Taubman Centers Presentation

Source: 2019 Taubman Centers Presentation

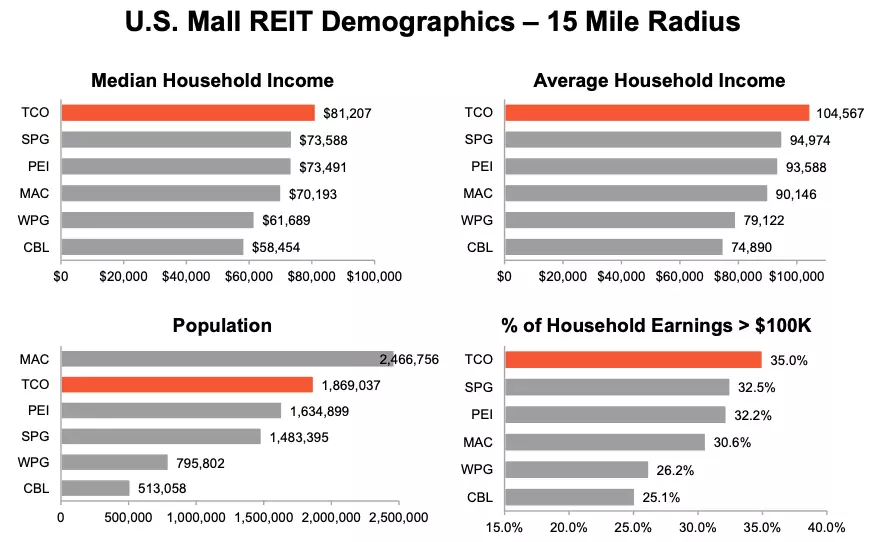

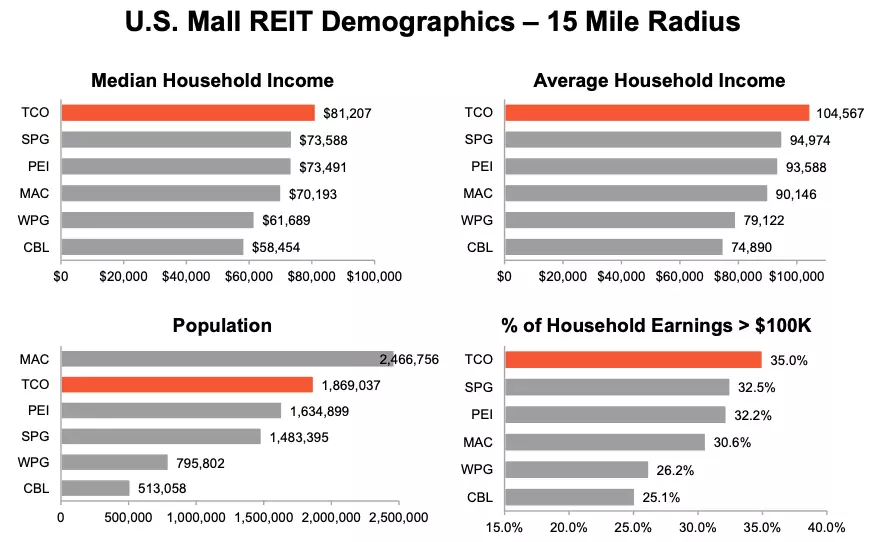

Taubman's portfolio also enjoys some of the best demographics in the industry.

Source: 2019 Taubman Centers Presentation

Source: 2019 Taubman Centers Presentation

And with interests significantly aligned between shareholders and management (who are heavy shareholders themselves), it isn't surprising to see that high asset quality has been translated into generally growing NOI and AFFO over time:

Source: 2019 Taubman Centers Presentation

Source: 2019 Taubman Centers Presentation

Again, why not own the common shares? Again, my answer is debt and the dividend payout.

Even before COVID-19 and the failed merger with Simon Property Group (SPG), Taubman had a very high debt load of over 8x net debt to EBITDA. Interest and fixed charge coverage ratios had been deteriorating since 2015. And the company faces a large debt rollover hurdle in 2021, with $1.25 billion (about 25% of its total debt) coming due next year.

And then there's the dividend. In the midst of the merger battle with Simon, Taubman has already suspended its common dividend, and I would not expect it to be fully reinstated any time soon. Taubman's payout ratio was already getting quite high before the pandemic struck.

But the preferred shares, on the other hand, make up only 4% of Taubman's total capitalization, and thus preferred dividends eat up only a small portion of operating cash flows. But again, with another preferred option (series K), why choose series J? Series K has also passed its call date, and thus both can be called at any time (although I don't find it likely anytime soon). But the series K is trading at a lower discount to par value (13.8%) than the series J's 14.3%, and its current yield is lower at 7.25%, versus series J's 7.59%.

Assuming the preferred series J shares are redeemed a year from now, investors can lock in a 21.9% total return by buying today.

5. Urstadt Biddle Properties PFD Series H Cumulative & Perpetual (UBP.PH)

Current Yield: 7.14%

Upside to Par Value: 12.5%

Call Date: 9/18/2022

Urstadt Biddle Properties (UBA) primarily owns shopping centers but also a few net leased restaurants, bank branches, office buildings, and one childcare center, all located in "in the suburban, high demographic, high barrier to entry communities surrounding New York City" (quoting the website's Corporate Overview). This region is sometimes called the "New York tri-state" area, spanning New Jersey, New York, and Connecticut.

Source: 2019 Annual Report

Source: 2019 Annual Report

UBA targets grocery-anchored shopping centers in particular, with 84% of all properties (by square footage) anchored by grocery stores, wholesale clubs, or pharmacies. Occupancy fell about one percentage point from the end of FY 2019 to the end of April 2020. UBA's portfolio was 91.9% leased in Q2, compared to 92.9% at the end of fiscal 2019.

At the beginning of June, UBA had collected 68.7% of April rent and just 60.3% of May rent. Though that sounds terrible, it was on the high side for shopping center REITs. The company generated 27 cents per share in FFO in their fiscal Q2 (which ended April 30th), compared to 35 cents in the year prior. The 75% dividend cut effectively made their Q2 payout ratio a mere 26%, freeing up $8 million per quarter going forward.

Again, as with other companies that have cut their common dividends, this bodes well for the preferred dividends, as more cash can be conserved to strengthen the business, thus strengthening the safety of the preferred payout. The very fact that UBA did not need to cut its entire dividend, as some shopping center REITs have done, is a sign of the company's strength.

Also on the plus side, there are no significant debt maturities for the next 20 months.

Urstadt Biddle has two outstanding preferred share series right now: series H and series K. To be honest, there are positives to each, and I like them both. The series H has less upside to par value but a slightly higher current yield, while the series K has more upside to par (16.3%) and longer until the call date (10/1/2024) but a slightly lower yield (7.02%).

My preference is for the series H due to the higher total returns assuming shares of both are redeemed on their respective call dates. The series K offers a total return of 10.9% per year if shares are redeemed on their call date, but the series H offers an annual total return of 13.0% if those shares are redeemed on their call date. Considering the demographic advantage as well as the recession- and eCommerce-resistant nature of UBA's portfolio, a 13% annual total return strikes me as very attractive.

6. American Finance Trust PFD Series A Cumulative & Perpetual (AFINP)

Current Yield: 8.5%

Upside to Par Value: 11.8%

Call Date: 3/26/2024

American Finance Trust (AFIN) is an externally managed REIT that primarily owns single-tenant net lease properties but also has a sizable multi-tenant (retail) portfolio. AFIN's high-quality portfolio has aided in its solid performance through the pandemic months of Spring.

Among AFIN's top ten tenants, 80% of rent comes from investment-grade tenants, and 74% from the top twenty is investment-grade. [Among single-tenant properties, 66% are investment-grade.] This focus on IG tenants has materially aided in rent collection.

For the month of April, for instance, AFIN received 79% of total contractual rent. The STNL segment of the portfolio was particularly strong, bringing in 92% of contractual rent. Half of the uncollected rent from the STNL segment is due to deferral agreements already in place, while the other half remained in negotiation in May. Meanwhile, 47% of the multi-tenant (shopping center) rent either had approved deferrals or deferrals under negotiation.

A June 2nd update announced that 79% of Q2-to-date contractual rent was collected by June 1st, which means that collections will likely be several percent higher than that by the end of the quarter. The STNL segment had brought in 93% of contractual rent thus far.

Despite this relative strength, I don't care to invest in AFIN shares for the same reason as my decision not to invest in GNL shares: external management. As I discussed in that previous article, I just don't believe that the incentive structure lends itself to long-term success for common shareholders. The stock has never seen its yield fall enough to make equity issuance remotely worth it, so instead management has loaded the company up with debt. At the end of Q1, net debt to EBITDA stood at 8.1x.

But the preferred stock is a different story. Distributable cash flow would need to fall by a little over $25 million per quarter for the preferred share dividends to be threatened. And yet, AFFO was flat QoQ from Q4 2019's $25.2 million to Q1 2020's $25.2 million.

Having collected 83% of Q2 rent, AFFO should come in around $21 million for the second quarter, which won't be enough to cover the common dividend (even after a 23% cut) but will be plenty to protect the preferred dividend. And this should be the worst quarter for AFIN all year.

Buying now would render an annual total return of 11.7%, assuming the preferred shares are redeemed on their call date.

Conclusion

Why is this my order of preference? Clearly, it isn't solely determined on the basis of potential total returns, nor is it solely on the basis of the current yield. Truthfully, the order is somewhat based on my guesstimates and foggy assessments of risk. They are foggy because many things are unclear with the pandemic ongoing. Retail, for instance, may be in for another hard slog through shutdowns, or maybe we won't have shutdowns like we did in the Spring. Maybe people will be unwilling to shelter-in-place for months - and bear the economic and employment consequences that go along with it - or maybe governments will need to enforce such policies based on the course of the virus.

AFINP is my favorite pick due to the quality of its portfolio and its excellent positioning for the more online world to come after COVID-19 has faded away. It wouldn't surprise me one bit to see the common dividend cut again, but the preferred dividend is well protected.

UBP.PH is also backed by a high-quality portfolio in the affluent Tri-state area, and the company is a second-generation family business. I've got a soft spot for family businesses, but there's a good reason to think that this family business will bounce back strongly and treat shareholders well in the long run.

TCO.PJ obviously has the most upside, but it also has a large and difficult-to-quantify amount of risk being a high-end mall owner. Will malls have to shut down again? How will the REIT navigate its upcoming mountain of maturing debt in 2021?

GNL.PB provides a good mix of moderate returns with low risk, as the REIT enjoys a portfolio uniquely well-suited to weather the ravages of COVID-19. STAR.PI, like many of the others on this list, is backed by quality assets that should continue to provide a steady and uninterrupted stream of income, but the company's debt load is massive. Lastly, UMH.PC comes in last because of its rapid issuance of preferred equity in the last year. While I still find it worth buying in small quantities at its current price, its modest total return isn't as attractive as the other preferreds discussed above.

*** Let me know which preferreds you own - and which you wouldn't touch with a ten-foot pole - in the comments below! And be sure to click the orange "Follow" button at the top of the page for more ideas like these.