Image source: franckreporter/E+ via Getty Images

Image source: franckreporter/E+ via Getty Images

Real estate has long been a strong sector for building long-term wealth. While private real estate may seem out of reach for some investors, there is a way to gain exposure to this asset class: Real Estate Investment Trusts (REITs).

Personally, I strive to have 20% to 30% exposure to the REIT sector within my dividend portfolio. Despite the challenges posed by the pandemic, the REIT sector has shown resilience and even experienced a strong comeback in recent years.

In 2020, the S&P 500 saw significant volatility, but the REIT sector (VNQ) fell by only 5%. However, in 2021, the roles were reversed, with the Vanguard REIT ETF climbing 40.5% compared to the S&P 500's 28.7% growth. This performance highlights the potential of the REIT sector.

As we navigate through economic uncertainties, such as rising interest rates, geopolitical turmoil, and high inflation, investing in REITs can still be a lucrative opportunity. In this article, I will discuss five of my favorite REITs for 2022 and beyond.

#1 Realty Income (O)

Realty Income, also known as The Monthly Dividend Company, is one of the most well-known REITs globally. This company has taken advantage of industry consolidation and expanded its portfolio significantly.

CEO Sumit Roy emphasizes the strength of Realty Income's core retail opportunities leased to high-quality clients. The company's low cost of capital sets it apart from others in the sector and allows for sizable investment spreads.

With an attractive forward P/FFO of 17.1x and a safe dividend yield of 4.4%, Realty Income presents an intriguing investment opportunity.

#2 Simon Property Group (SPG)

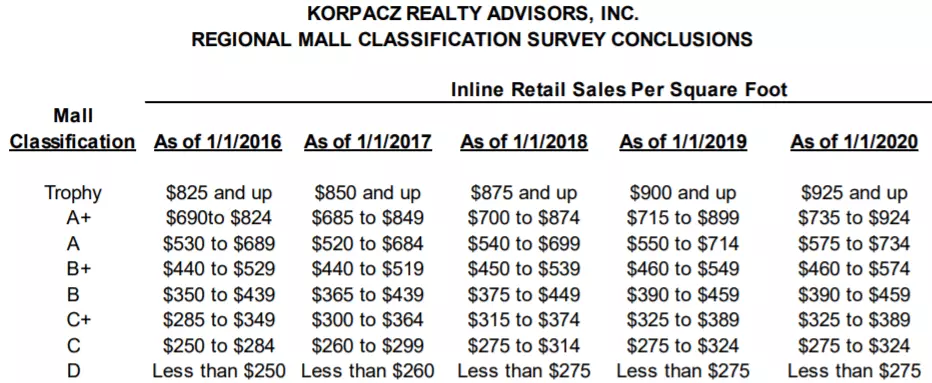

Simon Property Group has the largest and best portfolio of mall properties worldwide, particularly class A malls. In 2020, the company acquired TCO, and its shares surged by 95% in 2021.

While some mall properties have struggled, class A malls have remained resilient. Simon Property Group's leadership team, led by CEO David Simon, has navigated economic cycles successfully.

With shares currently trading at $130 and a forward P/FFO of only 11x, Simon Property Group presents an excellent long-term investment opportunity.

#3 VICI Properties (VICI)

VICI Properties specializes in the gaming sector and recently acquired MGM Growth Properties, making it the largest landlord on the Las Vegas strip. The pent-up demand for properties owned by VICI is significant, benefiting both the company and its operators.

Despite trading at a lower FFO multiple of 13.9x compared to other top net-lease REITs, VICI's growth potential makes it an intriguing investment option.

#4 Medical Properties Trust (MPW)

Medical Properties Trust has a strong presence in the hospital real estate space, owning the largest portfolio of non-governmental owned hospital properties globally. Their flexible acquisition model allows hospital operators to keep facilities in excellent condition.

With built-in escalators tied to CPI within their lease agreements, Medical Properties Trust benefits from inflation. Shares of MPW present an attractive long-term opportunity, trading at a forward P/FFO of 10.9x.

#5 Public Storage (PSA)

Public Storage is the largest self-storage REIT in the US. While its appreciation potential may be limited due to its recent surge, the company's strong management team and A2/A credit rating make it an appealing investment for those seeking stability.

Although shares currently trade at a forward P/FFO of 24x, keeping Public Storage on your watchlist could be worthwhile in case of a stock pullback.

Investor Takeaway

REITs are a great option for investors looking to increase their passive income. The five REITs discussed in this article all share the common characteristic of high quality. With attractive valuations and solid growth potential, these REITs present compelling investment opportunities for 2022 and beyond.