If you're considering investing in real estate investment trusts (REITs), there are a few options that are worth your attention. While the ultra-high yield from Annaly Capital may seem enticing, it might be wiser to consider the opportunities for growth that Prologis and Rexford Industrial can offer. Let's take a closer look at these two REIT stocks and why they could be great additions to your investment portfolio.

Prologis is Everywhere

Prologis is one of the largest REITs you can buy, with a market cap of roughly $110 billion. Its impressive portfolio spans over 5,500 warehouses across North America, South America, Europe, and Asia. With a total of 1.2 billion square feet of warehouse space in 20 countries, Prologis is a one-stop shop for customers in need of global distribution hubs.

Currently, Prologis is benefiting from the rollover of existing leases to current market lease rates, resulting in significant growth. New leases signed in the fourth quarter of 2023 were approximately 74% higher than the expiring leases. While this level of growth may not last forever, the staggered expiration dates of leases ensure that Prologis will continue to benefit from lease expirations in the future.

In addition to its existing portfolio, Prologis also owns undeveloped land around its properties, presenting a $40 billion opportunity for building new warehouses. With short-term and long-term growth prospects, Prologis is an attractive investment option.

REXR Chart

REXR Chart

Rexford is in One Very Attractive Place

While Prologis boasts a highly diversified property portfolio, Rexford Industrial takes a different approach. This REIT operates exclusively in Southern California, the largest warehouse market in the U.S. with low vacancy rates. The region is actively working to increase housing and limit warehouse development, ensuring high demand for years to come. This favorable market condition has led to strong rent growth for Rexford Industrial.

Despite its smaller market cap of almost $12 billion and a portfolio of 45 million square feet of warehouse space, Rexford Industrial's unique focus on Southern California positions it well for continued success. The dividend yield may be modest at 2.8%, but the consistent dividend growth of around 18% per year over the past five years makes it an attractive choice for investors.

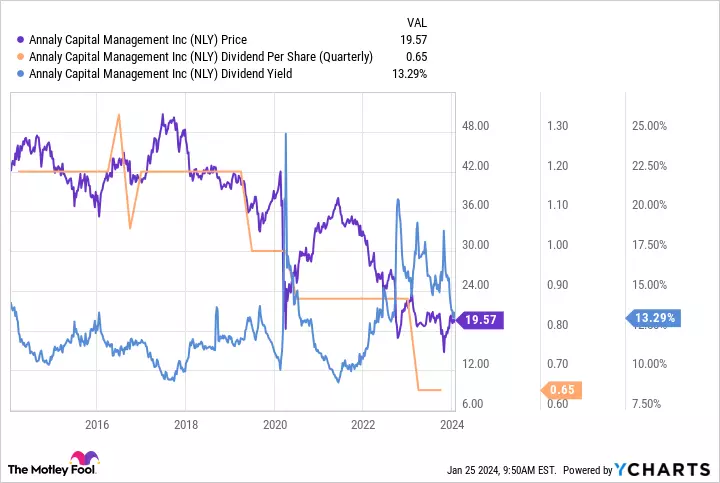

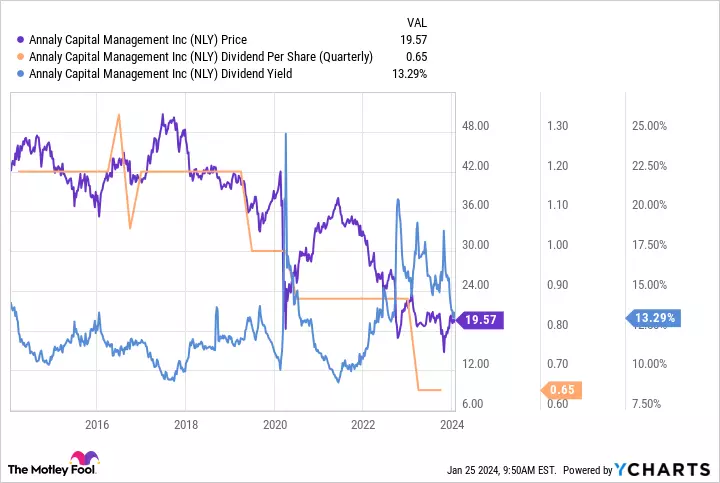

Annaly Keeps Letting Dividend Investors Down

Annaly, on the other hand, has not been a great stock for dividend investors. Despite offering a 10%-plus dividend yield for most of the past decade, Annaly has experienced multiple dividend cuts and a steep decline in share price.

NLY Chart

NLY Chart

While Annaly is not a bad REIT per se, it operates as a mortgage REIT, a business that is heavily influenced by interest rate changes and property market dynamics. This complexity, combined with its history of dividend cuts and share price decline, makes Annaly a risky choice for individual dividend investors.

Be Careful What You Wish For

While the 13.2% yield from Annaly may seem attractive, it's important to remember that a high dividend yield alone should not be the sole reason to invest in a stock. Prologis and Rexford offer lower yields but present stronger growth opportunities. These two REIT stocks are more likely to provide better long-term returns for investors.

So, if you're looking to invest in REITs, it's wise to consider Prologis and Rexford Industrial. Their potential for growth outweighs the allure of Annaly's high yield. Choose wisely and watch your investment portfolio flourish.