The Austin housing market is a dynamic landscape with shifting trends and promising signs for potential homebuyers. Recent reports and predictions have sparked discussions among real estate experts and residents, raising questions about the future of the Austin housing market. In this article, we will delve into the current state of the market, analyze market trends and insights, provide expert opinions, and offer a detailed analysis of housing trends in key Austin areas. Let's explore whether the Austin housing market is poised for a crash in 2024.

How is the Austin Housing Market Performing Currently?

Despite higher mortgage rates, the Austin housing market remains strong. According to the Austin Board of REALTORS® November 2023 Central Texas Housing Market Report, the median home price across the Austin Round-Rock MSA dropped 8.4% to $424,450 last month. This drop in median home prices suggests that Austin's housing supply is becoming more affordable for buyers. The Central Texas housing market also experienced a slight increase in residential homes sold across the MSA, rising 0.2% to 2,065 total sales. These numbers indicate a positive trend for potential homebuyers.

Market Trends and Insights

Impact on Buyers

Buyers in Central Texas now have a more abundant selection of homes at lower price points than in previous years. According to Ashley Jackson, the 2023 ABoR president, the drop in median home prices means that buyers can be more selective in finding a home that meets their criteria. If you are actively looking to purchase a home or waiting for the right moment, now is the time to contact your REALTOR® and get serious about buying a home.

Sales Dollar Volume and Days on Market

In November, the sales dollar volume dropped 5.7% year over year to $1,117,612,190 across the MSA. Homes spent an average of 75 days on the market, up 18 days from November 2022, indicating a shift in the pace of the market. These numbers suggest that the market is becoming more balanced and less frenzied, providing potential buyers with an opportunity to explore their options.

Inventory Dynamics

Housing inventory increased by 0.7 months to 3.7 months of inventory. New listings rose 11.6% year over year to 2,676 listings, active listings increased 7.2% year over year to 9,334 listings, and pending listings rose 9.2% year over year to 2,065 listings. This significant increase in housing options signifies a positive shift for potential buyers, giving them a wider range of choices.

Insights from Housing Economist

Clare Losey, Ph.D., housing economist for ABoR, pointed out that elevated mortgage rates are contributing to the decline in home prices and an increase in active listings. However, she also mentioned that rates peaked in late October and early November, indicating a rise in buyers' purchasing power moving into 2024. This suggests that although there may be a dip in home prices, the market could potentially stabilize and even rebound in the future.

Local Initiatives and Future Outlook

The Austin City Council recently passed Phase I of the Home Options for Middle-income Empowerment initiative, which aims to create more homeownership and rental options for current and future residents. As ABoR and residents in the Central Texas area continue to advocate for more housing inventory and attainable housing options across the region, the jump in listings is an encouraging sign for buyers. Clare Losey emphasizes that embracing opportunities to generate more housing supply is crucial for the city.

Detailed Analysis of Housing Trends in Key Austin Areas

To gain a deeper understanding of the Austin housing market, it is essential to analyze trends in key areas within the city. Let's take a closer look at some of the most significant trends in key Austin areas.

City of Austin

- Residential Homes Sold: 516 residential homes were sold, reflecting a 6.0% decrease compared to November 2022.

- Median Price: The median price for residential homes in the City of Austin was $518,000, marking a 1.3% increase from November 2022.

- New Listings: There were 788 new home listings on the market, a substantial 14.7% increase from the same period last year.

- Active Listings: The market saw a notable increase with 2,747 active home listings, up by 20.4% compared to November 2022.

- Pending Sales: Despite a 3.3% decrease, there were 493 pending sales in the City of Austin.

- Months of Inventory: The months of inventory increased to 3.8, representing a 1.2 months rise from November 2022.

- Total Dollar Volume: The total dollar volume of homes sold reached $350,511,473, showing a 2.2% decrease from November 2022.

Travis County

- Residential Homes Sold: Travis County saw 840 residential homes sold, a 6.9% decrease compared to the same month in 2022.

- Median Price: The median price for residential homes in Travis County was $510,000, marking a 1.9% decrease from November 2022.

- New Listings: There were 1,240 new home listings on the market, a notable 14.2% increase from the previous year.

- Active Listings: The market experienced a 15.2% increase with 4,489 active home listings in Travis County.

- Pending Sales: Despite a 4.0% increase, there were 838 pending sales in Travis County.

- Months of Inventory: The months of inventory increased to 3.9, representing a 1.1 months rise from November 2022.

- Total Dollar Volume: The total dollar volume of homes sold in Travis County was $571,627,789, showing an 8.5% decrease from November 2022.

Williamson County

- Residential Homes Sold: Williamson County saw 697 residential homes sold, reflecting a -6.4% decrease compared to November 2022.

- Median Price: The median price for residential homes in Williamson County was $416,545, marking a 3.1% decrease from November 2022.

- New Listings: There were 818 new home listings on the market, a slight 0.4% decrease from the previous year.

- Active Listings: The market saw a 12.2% decrease with 2,587 active home listings in Williamson County.

- Pending Sales: Despite a 4.2% increase, there were 763 pending sales in Williamson County.

- Months of Inventory: The months of inventory remained the same at 3.0, compared to November 2022.

- Total Dollar Volume: The total dollar volume of homes sold in Williamson County was $322,184,052, showing an 11.7% decrease from November 2022.

Hays County

- Residential Homes Sold: Hays County experienced a significant increase with 381 residential homes sold, a 41.6% rise from November 2022.

- Median Price: The median price for residential homes in Hays County was $368,995, marking a 10.3% decrease from November 2022.

- New Listings: There were 431 new home listings on the market, a substantial 39.9% increase from the previous year.

- Active Listings: The market saw a 20.0% increase with 1,503 active home listings in Hays County.

- Pending Sales: With a 41.8% increase, there were 339 pending sales in Hays County.

- Months of Inventory: The months of inventory increased to 4.0, representing a 0.6 months rise from November 2022.

- Total Dollar Volume: The total dollar volume of homes sold in Hays County was $169,825,434, showing a 22.6% increase from November 2022.

Bastrop County

- Residential Homes Sold: Bastrop County saw 88 residential homes sold, a 17.0% decrease compared to November 2022.

- Median Price: The median price for residential homes in Bastrop County was $346,000, marking a 3.5% decrease from November 2022.

- New Listings: There were 147 new home listings on the market, a 2.1% increase from the previous year.

- Active Listings: The market saw a 12.5% increase with 566 active home listings in Bastrop County.

- Pending Sales: With a 24.7% increase, there were 96 pending sales in Bastrop County.

- Months of Inventory: The months of inventory increased to 4.7, representing a 0.8 months rise from November 2022, making it the highest inventory in the MSA.

- Total Dollar Volume: The total dollar volume of homes sold in Bastrop County was $33,671,470, showing a 24.3% decrease from November 2022.

Caldwell County

- Residential Homes Sold: Caldwell County experienced a notable increase with 59 residential homes sold, a 51.3% rise from November 2022.

- Median Price: The median price for residential homes in Caldwell County was $313,275, marking a 5.1% decrease from November 2022.

- New Listings: There were 40 new home listings on the market, a 2.6% increase from the previous year.

- Active Listings: The market saw a substantial 70.3% increase with 189 active home listings in Caldwell County.

- Pending Sales: With a 6.0% decrease, there were 29 pending sales in Caldwell County.

- Months of Inventory: The months of inventory increased to 4.3, representing a 1.7 months rise from November 2022.

- Total Dollar Volume: The total dollar volume of homes sold in Caldwell County was $19,075,593, showing a 45.6% increase from November 2022.

Conclusion and Future Outlook

The detailed analysis of housing trends across key areas in Austin reveals a diverse market landscape with varying trends in sales, pricing, and inventory levels. While some areas experienced decreases in residential homes sold and median prices, others saw significant increases, reflecting the dynamic nature of the Central Texas housing market.

As stakeholders continue to implement initiatives to address affordability and housing inventory concerns, the future outlook suggests ongoing shifts in the market. Potential homebuyers and investors should closely monitor these trends and work with real estate professionals to make informed decisions in this ever-evolving real estate landscape.

Austin Housing Market Forecast for 2024

Let's now turn our attention to the forecast for the Austin housing market in 2024. According to Zillow, as of November 30, 2023, the average home value in the Austin-Round Rock area stands at $455,424. This reflects a 9.2% decrease over the past year. Homes are going pending in approximately 55 days, providing insight into the current dynamics of the market.

One-Year Market Forecast

Zillow's one-year market forecast, as of November 30, 2023, projects a -2.1% change for the Austin-Round Rock area. While this forecast suggests a potential continued adjustment in the housing market over the next year, it doesn't necessarily indicate a market crash. Real estate markets are influenced by various factors, and a moderate adjustment over the forecasted period is common. It's essential for stakeholders to monitor trends and adapt strategies accordingly.

Inventory and Listings

Looking at the current for-sale inventory, there are 11,152 homes on the market as of November 30, 2023, providing potential buyers with a range of options. Additionally, there were 2,262 new listings in November 2023, indicating ongoing activity and potential opportunities for both buyers and sellers.

Price Dynamics

The median sale price as of October 31, 2023, is $458,667, providing insights into the pricing landscape within the Austin-Round Rock area. The median list price as of November 30, 2023, is $526,600, offering a benchmark for both buyers and sellers in the market.

Sales Metrics

Examining sales metrics, the median sale to list ratio as of October 31, 2023, is 0.980. This ratio provides a key indicator of the relationship between listing prices and actual sale prices. Furthermore, 14.2% of sales recorded as of October 31, 2023, were above the list price, indicating competitive dynamics in the market. On the other hand, 68.5% of sales were recorded below the list price, offering insights into negotiation trends.

Is Austin a Buyer's or Seller's Housing Market?

The current market dynamics suggest a more balanced playing field for both buyers and sellers. While the average home value has decreased over the past year, the mix of inventory, new listings, and pricing metrics indicates opportunities for both those looking to buy and those looking to sell. The market is neither heavily favoring buyers nor sellers, providing a fair market for all parties involved.

Are Home Prices Dropping?

Yes, home prices in the Austin-Round Rock area have experienced a 9.2% decrease over the past year. This could be an advantageous factor for potential buyers looking for more affordable options in the market. However, it's crucial to note that the one-year market forecast suggests a -2.1% change. While this indicates a potential adjustment, it doesn't necessarily mean a crash. Real estate markets fluctuate based on various factors, and a moderate adjustment should be expected.

Is Now a Good Time to Buy a House in Austin?

Given the decrease in home prices and the balanced market conditions, now could be a good time for prospective buyers to explore the housing market. The availability of inventory, coupled with the forecasted adjustments, presents opportunities for those considering a home purchase. However, it's essential to work closely with a real estate professional to assess individual circumstances and make informed decisions.

Image Source: Zillow

Image Source: Zillow

Is the Austin Housing Market Overpriced?

The question of whether the Austin housing market is overpriced is subjective and depends on several factors. While home prices in Austin have seen a significant increase over the past few years, it's important to compare them to other major cities. Although the median home price in Austin is high compared to historical norms, it is still lower than in cities like San Francisco, New York, or Los Angeles. Additionally, Austin's cost of living is generally lower than in other major cities, making homeownership more feasible for some buyers. However, recent research suggests that homebuyers in Austin are paying almost 51% more than what is expected for homes, indicating that the market may be overvalued compared to other areas.

Is Austin a Good Place for Real Estate Investment?

Austin's rapidly expanding economy and population growth make it an attractive destination for real estate investors. The city's robust and diverse economy, along with its job market strength, contributes to its appeal. Companies like Google, Tesla, and Oracle have chosen to relocate operations to Austin, attracting more people and boosting the demand for housing. The city's livability, top-tier educational institutions, and infrastructure improvements further enhance its appeal. Real estate investors can take advantage of Austin's growing and diverse market by exploring various types of properties and rental strategies.

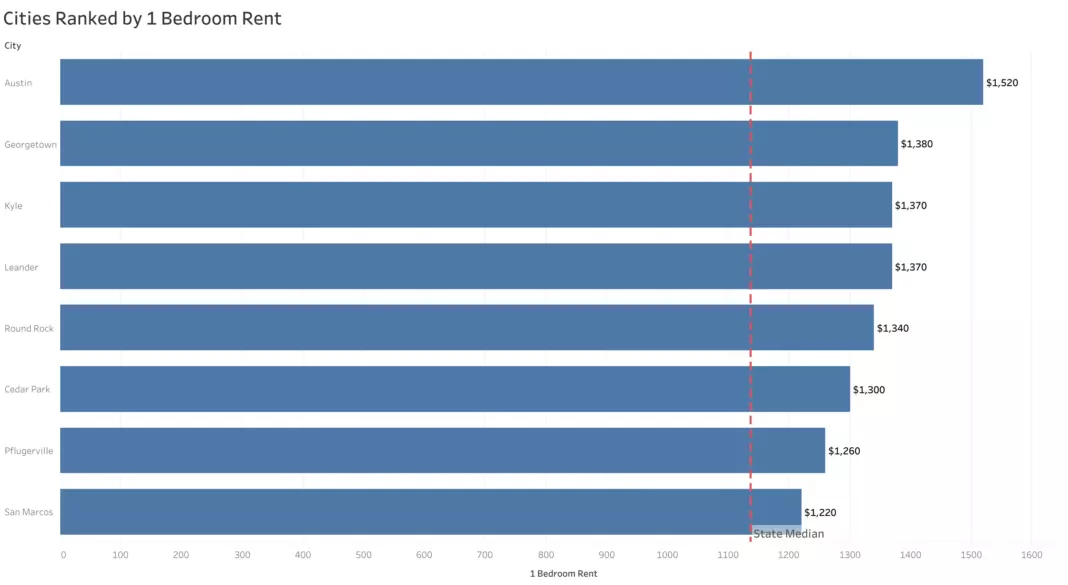

Austin Rental Property Market Size and Growth

Austin's rental property market is substantial and continues to grow. The city offers a wide range of rental properties, catering to a diverse tenant population. The dynamic job market and population growth in Austin make it an ideal location for rental property investment. Various cities in the Austin Metro Area offer opportunities for investors, with different pricing ranges and rental growth potential. However, it's important for investors to conduct thorough market research and consider the unique supply-demand dynamics and neighborhood characteristics of each area.

Image Source: Zumper

Image Source: Zumper

Other Factors Related to Real Estate Investing

Austin's investor-friendly environment, tax benefits, market resilience, and opportunities for diversification make it an appealing choice for real estate investment. With a strong property rights regime, a well-regulated market, and no state income tax, Austin provides an attractive framework for real estate investors. The city's ability to weather economic fluctuations and maintain its growth trajectory adds to its appeal. Investors can explore various types of real estate, capitalize on the city's population growth and job market strength, and benefit from a thriving rental property market.

Conclusion

While discussions and predictions about the Austin housing market forecast for 2024 continue, it's important to approach the subject with a comprehensive understanding of the market's current state and future outlook. The Austin housing market is a dynamic landscape that presents opportunities and challenges for both buyers and sellers. With careful consideration, monitoring of market trends, and guidance from real estate professionals, potential homebuyers and investors can make informed decisions to navigate the ever-evolving Austin real estate landscape.

References: