Investing in real estate investment trust (REIT) stocks can offer steady income and the potential for long-term growth. One REIT that stands out is Realty Income (O -1.54%), which has experienced a rebound in recent years. While there are other options available, Realty Income offers compelling reasons why investors should consider buying their stock without hesitation.

1. Historical High Dividend Yield

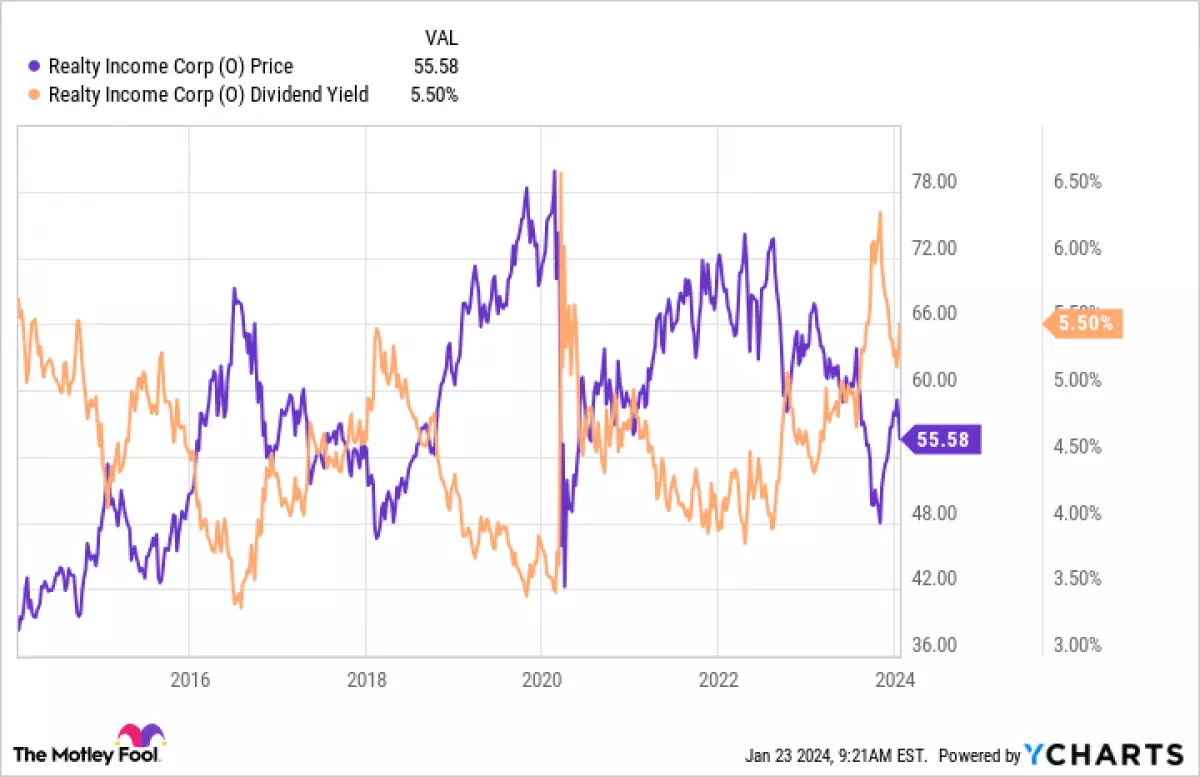

Realty Income currently boasts a dividend yield of 5.5%, which is near historical highs. This means that even though the stock has recovered from its low point in 2023, it still offers an attractive yield for income-focused investors. While a high yield alone shouldn't be the sole reason for investing, it does indicate that the stock is undervalued and worthy of further investigation.

Image: Realty Income's dividend yield over time.

Image: Realty Income's dividend yield over time.

2. Leading Position in the Net Lease REIT Market

Realty Income is the largest net lease REIT, towering over its competitors in terms of size and scale. With over 15,000 properties in its portfolio, Realty Income has the advantage of a diversified tenant base. This mitigates the risk associated with single-tenant properties, making Realty Income a more stable investment option. Moreover, its large size enables Realty Income to pursue bigger deals and act as an industry consolidator, resulting in greater access to capital.

Image: Realty Income's market cap over time.

Image: Realty Income's market cap over time.

3. Cost Advantage and Access to Capital

The real estate industry heavily relies on access to capital, and Realty Income has a significant advantage in this regard. With an investment-grade balance sheet, Realty Income enjoys lower costs of capital, allowing them to acquire properties at more favorable prices compared to their peers. This cost advantage contributes to their long-term growth potential.

4. Steady and Reliable Growth

As the saying goes, slow and steady wins the race. Realty Income may not experience explosive growth, but it has a track record of consistent and reliable performance. Over the past 29 years, the company has achieved a compound annual dividend growth rate of 4.3%, outpacing inflation. These higher yields and dependable businesses make Realty Income a solid investment option, especially for those seeking a reliable source of income.

Image: Realty Income's dividend growth over time.

Image: Realty Income's dividend growth over time.

5. Exceptional Dividend History

Realty Income's dividend track record is outstanding. With 104 consecutive quarters of dividend increases, including 29 years of annual dividend growth, investors can rely on a consistent and predictable income stream. Furthermore, Realty Income pays dividends on a monthly basis, providing investors with an opportunity to replace a regular paycheck.

6. Diversified Growth Opportunities

Realty Income's management team is focused on expanding the REIT's growth potential. They have successfully expanded into Europe, ventured into new areas such as lending and casino assets, and diversified their retail focus to include emerging businesses like retail healthcare. With a wide range of growth levers at their disposal, Realty Income is well-positioned to capitalize on future opportunities and continue its steady growth trajectory.

In conclusion, Realty Income offers a compelling investment opportunity for investors seeking steady income and long-term growth. While it may not be suitable for every investor, the combination of historical high dividend yields, leading market position, cost advantage, reliable growth, exceptional dividend history, and diversified growth opportunities make Realty Income a stock worth considering. Take advantage of the current attractive valuation and consider adding Realty Income to your portfolio.